Question: 5. Considering project B which one is the best and why.? Project B's results are given on the table below DPBP 3 years NPV

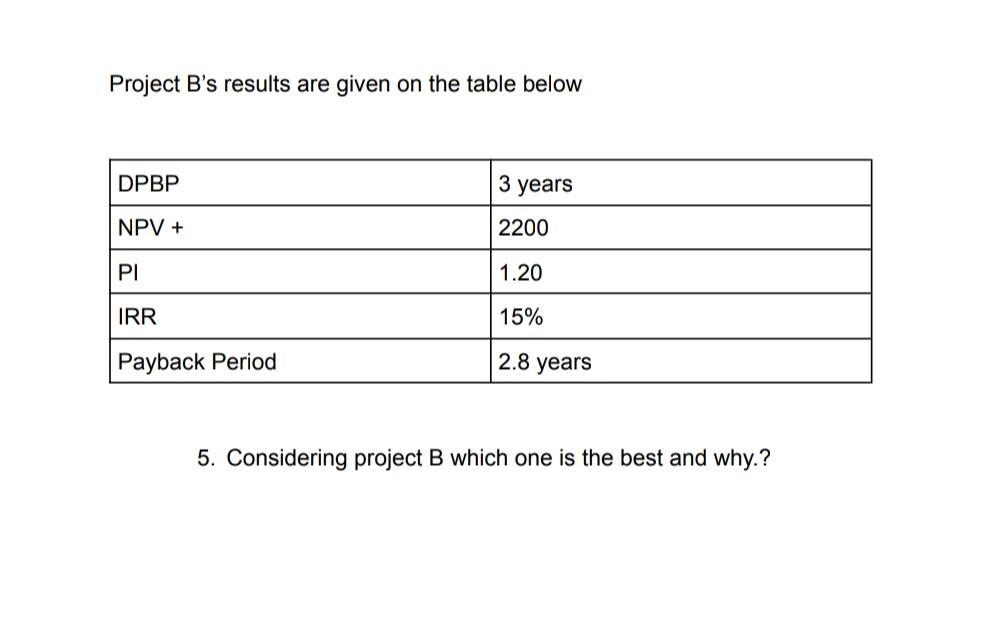

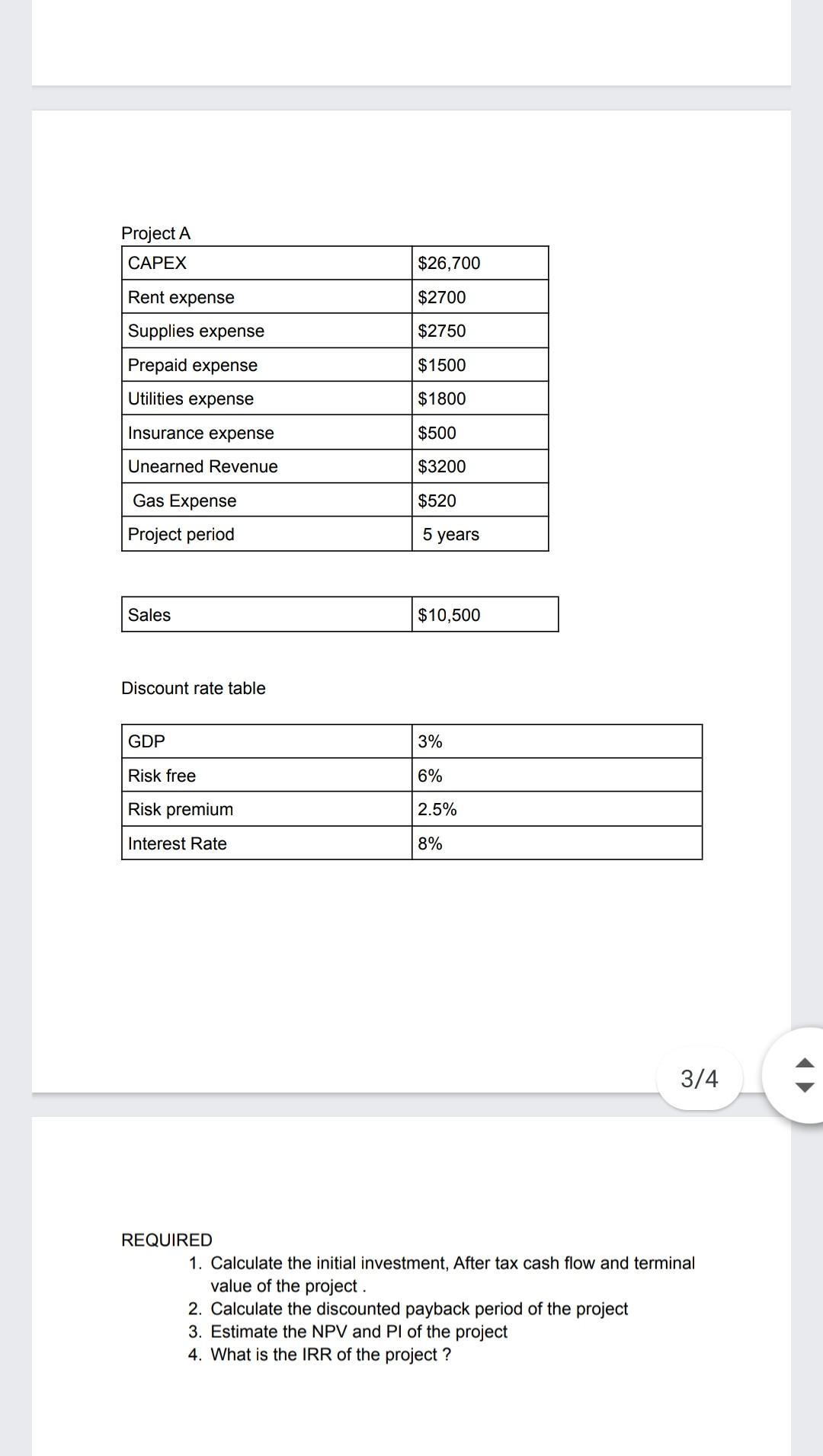

5. Considering project B which one is the best and why.? Project B's results are given on the table below DPBP 3 years NPV + 2200 PI 1.20 IRR 15% Payback Period 2.8 years 5. Considering project B which one is the best and why.? Project A CAPEX $26,700 Rent expense $2700 Supplies expense $2750 Prepaid expense $1500 Utilities expense $1800 Insurance expense $500 Unearned Revenue $3200 Gas Expense $520 Project period 5 years Sales $10,500 Discount rate table GDP 3% Risk free 6% Risk premium 2.5% Interest Rate 8% 3/4 REQUIRED 1. Calculate the initial investment, After tax cash flow and terminal value of the project . 2. Calculate the discounted payback period of the project 3. Estimate the NPV and Pl of the project 4. What is the IRR of the project ?

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Solution In the given case the discount rate to be used is 85 pa which is computed as R... View full answer

Get step-by-step solutions from verified subject matter experts