Question: 5. Crises, Failures, and Current Events (5 points each) (a) Explain why fraud in subprime loans could amplify losses in the values of subprime based

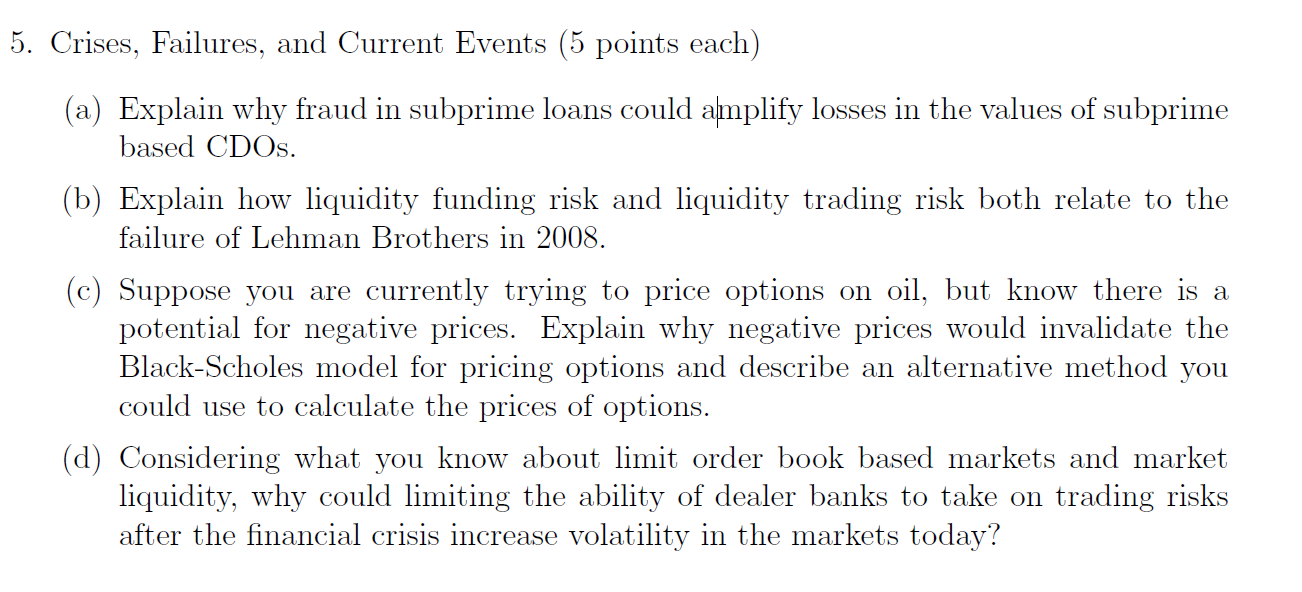

5. Crises, Failures, and Current Events (5 points each) (a) Explain why fraud in subprime loans could amplify losses in the values of subprime based CDOs. (b) Explain how liquidity funding risk and liquidity trading risk both relate to the failure of Lehman Brothers in 2008. (c) Suppose you are currently trying to price options on oil, but know there is a potential for negative prices. Explain why negative prices would invalidate the Black-Scholes model for pricing options and describe an alternative method you could use to calculate the prices of options. (d) Considering what you know about limit order book based markets and market liquidity, why could limiting the ability of dealer banks to take on trading risks after the financial crisis increase volatility in the markets today? 5. Crises, Failures, and Current Events (5 points each) (a) Explain why fraud in subprime loans could amplify losses in the values of subprime based CDOs. (b) Explain how liquidity funding risk and liquidity trading risk both relate to the failure of Lehman Brothers in 2008. (c) Suppose you are currently trying to price options on oil, but know there is a potential for negative prices. Explain why negative prices would invalidate the Black-Scholes model for pricing options and describe an alternative method you could use to calculate the prices of options. (d) Considering what you know about limit order book based markets and market liquidity, why could limiting the ability of dealer banks to take on trading risks after the financial crisis increase volatility in the markets today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts