Question: 5. Determine the average monthly return variance, standard deviation of each stock listed below. Also determine the covariance of stock A with Stock B as

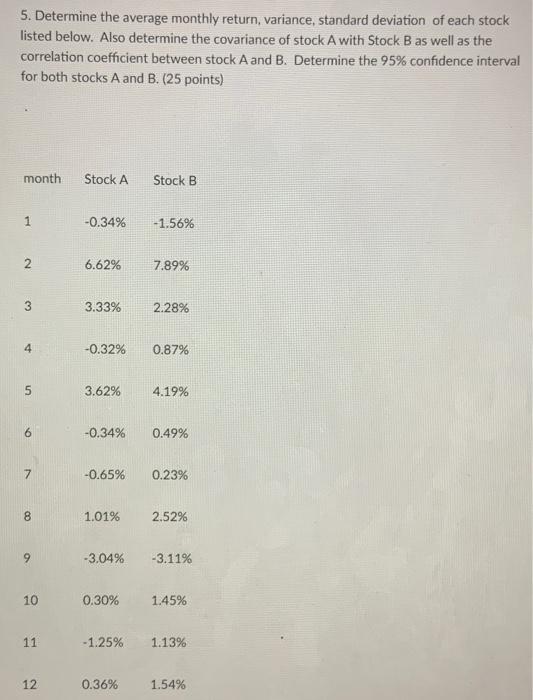

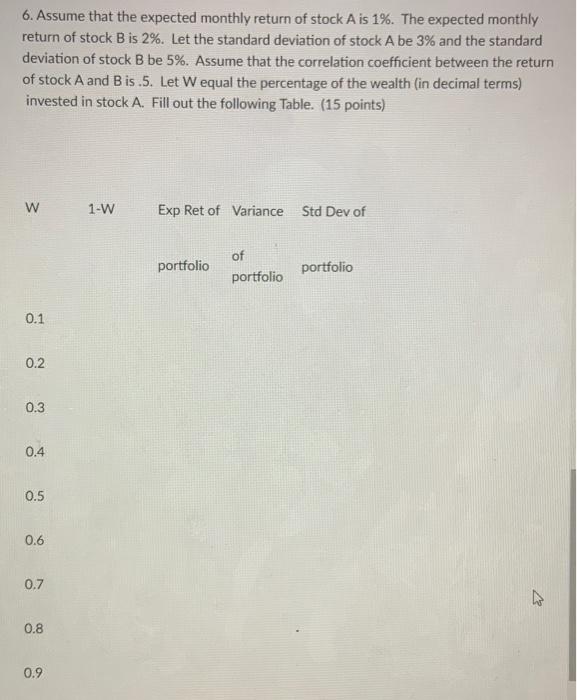

5. Determine the average monthly return variance, standard deviation of each stock listed below. Also determine the covariance of stock A with Stock B as well as the correlation coefficient between stock A and B. Determine the 95% confidence interval for both stocks A and B. (25 points) month Stock A Stock B 1 -0.34% -1.56% 2 6.62% 7.89% 3 3.33% 2.28% 4 -0.32% 0.87% 5 3.62% 4.19% 6 -0.34% 0.49% 7 -0.65% 0.23% 8 1.01% 2.52% 9 -3.04% -3.11% 10 0.30% 1.45% 11 -1.25% 1.13% 12 0.36% 1.54% 6. Assume that the expected monthly return of stock A is 1%. The expected monthly return of stock B is 2%. Let the standard deviation of stock A be 3% and the standard deviation of stock B be 5%. Assume that the correlation coefficient between the return of stock A and B is.5. Let Wequal the percentage of the wealth (in decimal terms) invested in stock A. Fill out the following Table. (15 points) w 1-W Exp Ret of Variance Std Dev of portfolio of portfolio portfolio 0.1 0.2 0.3 0.4 0.5 0.6 0.7 - 0.8 0.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts