Question: 5 Dividends in the Black-Scholes-Merton Model (Black's Approximation) (15 points) Consider an American call option on a stock. The underlying stock has price $150 today,

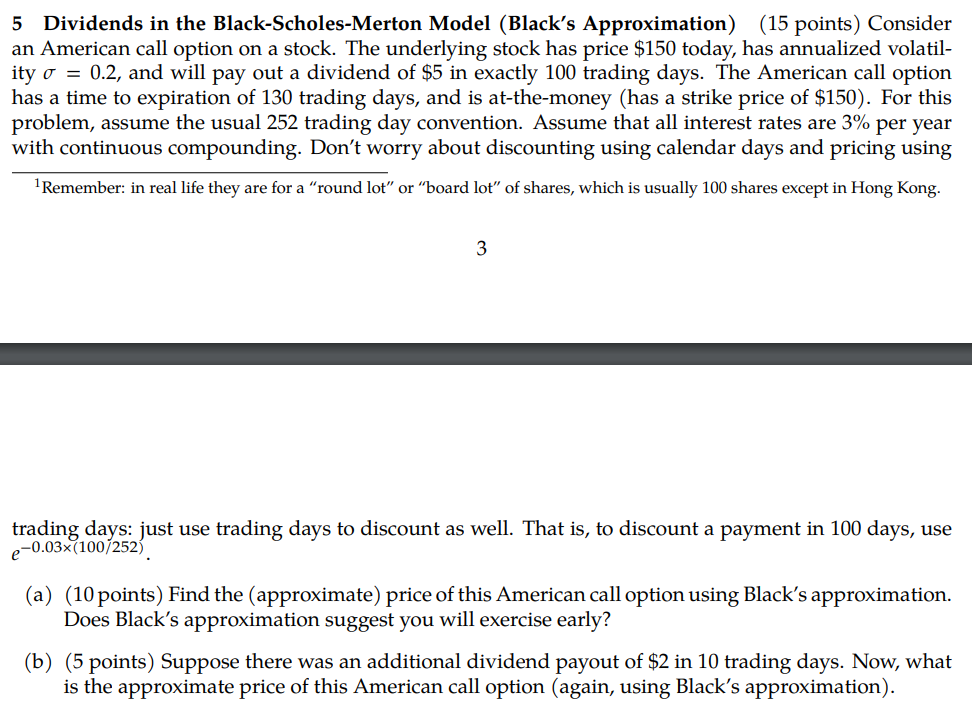

5 Dividends in the Black-Scholes-Merton Model (Black's Approximation) (15 points) Consider an American call option on a stock. The underlying stock has price $150 today, has annualized volatility =0.2, and will pay out a dividend of $5 in exactly 100 trading days. The American call option has a time to expiration of 130 trading days, and is at-the-money (has a strike price of $150 ). For this problem, assume the usual 252 trading day convention. Assume that all interest rates are 3% per year with continuous compounding. Don't worry about discounting using calendar days and pricing using 1 Remember: in real life they are for a "round lot" or "board lot" of shares, which is usually 100 shares except in Hong Kong. 3 trading days: just use trading days to discount as well. That is, to discount a payment in 100 days, use e0.03(100/252). (a) (10 points) Find the (approximate) price of this American call option using Black's approximation. Does Black's approximation suggest you will exercise early? (b) (5 points) Suppose there was an additional dividend payout of $2 in 10 trading days. Now, what is the approximate price of this American call option (again, using Black's approximation). 5 Dividends in the Black-Scholes-Merton Model (Black's Approximation) (15 points) Consider an American call option on a stock. The underlying stock has price $150 today, has annualized volatility =0.2, and will pay out a dividend of $5 in exactly 100 trading days. The American call option has a time to expiration of 130 trading days, and is at-the-money (has a strike price of $150 ). For this problem, assume the usual 252 trading day convention. Assume that all interest rates are 3% per year with continuous compounding. Don't worry about discounting using calendar days and pricing using 1 Remember: in real life they are for a "round lot" or "board lot" of shares, which is usually 100 shares except in Hong Kong. 3 trading days: just use trading days to discount as well. That is, to discount a payment in 100 days, use e0.03(100/252). (a) (10 points) Find the (approximate) price of this American call option using Black's approximation. Does Black's approximation suggest you will exercise early? (b) (5 points) Suppose there was an additional dividend payout of $2 in 10 trading days. Now, what is the approximate price of this American call option (again, using Black's approximation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts