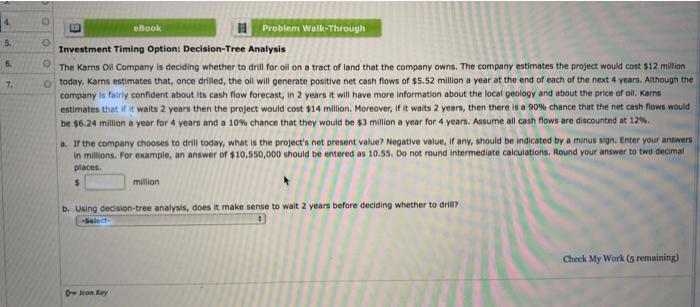

Question: 5 E 5. 6. 7. eBook Problem Walk-Through Investment Timing Option: Decision-Tree Analysis The Karns Of Company is deciding whether to drill for oil on

5 E 5. 6. 7. eBook Problem Walk-Through Investment Timing Option: Decision-Tree Analysis The Karns Of Company is deciding whether to drill for oil on a tract of land that the company owns. The company estimates the project would cost $12 million o today, Karns estimates that, once drilled, the oil will generate positive net cash flows of $5.52 million a year at the end of each of the next 4 years. Although the company is fairly confident about its cash flow forecast, in 2 years it will have more information about the local geology and about the price of oil. Karns estimates that it waits 2 years then the project would cost $14 million. Moreover, if it waits 2 years, then there is a 90% chance that the net cash flows would be $6.24 million a year for 4 years and a 10% chance that they would be $3 million a year for 4 years. Assume all cash flows are discounted at 12% a. If the company chooses to drill today, what is the project's net present value? Negative value, if any, should be indicated by a minus sign. Enter your answers in millions. For example, an answer of $10,550,000 should be entered as 10.55. Do not round Intermediate calculations, Round your answer to two decimal places million 5 b. Using decision-tree analysis, does it make sense to wait 2 years before deciding whether to drill -Select- Check My Works remaining Olon Key

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts