Question: 5. Estimate the project's operating cash flows. (Hint: Again use Table 1 as a guide.) What are the project's NPV, IRR. modified IRR (MIRR), and

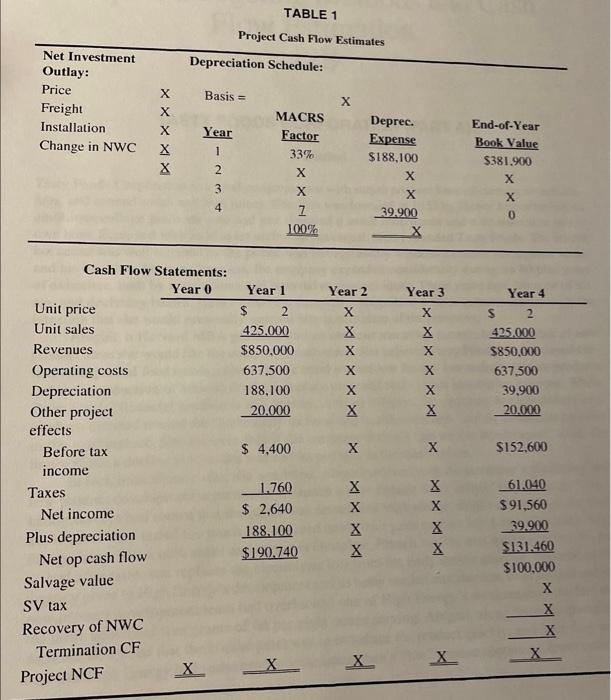

5. Estimate the project's operating cash flows. (Hint: Again use Table 1 as a guide.) What are the project's NPV, IRR. modified IRR (MIRR), and payback? Should the project be undertaken? [Remember: The MIRR is found in three steps: (1) compound all cash inflows forward to the terminal year at the cost of capital, (2) sum the compounded cash inflows to obtain the terminal value of the inflows, and (3) find the discount rate which forces the present value of the terminal value to equal the present value of the net investment outlays. This discount rate is defined as the MIRR.] 6. Now suppose the project had involved replacement rather than expansion of existing facilities. Describe briefly how the analysis would have to be changed to deal with a replacement project. TABLE 1 Project Cash Flow Estimates \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{5}{*}{\begin{tabular}{l} Net Investment \\ Outlay: \\ Price \\ Freight \\ Installation \\ Change in NWC \end{tabular}} & \multicolumn{3}{|c|}{ Depreciation Schedule: } & & \multirow[b]{3}{*}{ End-of-Year } \\ \hline & \multicolumn{2}{|c|}{ Basis =} & \multicolumn{2}{|l|}{x} & \\ \hline & x & MACl & & Deprec. & \\ \hline & Year & Facto & & Expense & Book Value \\ \hline & x & 33% & & $188,100 & $381.900 \\ \hline \multirow{4}{*}{ Change in NWC } & x & x & & x & x \\ \hline & 3 & x & & x & x \\ \hline & \multirow[t]{2}{*}{4} & 7 & & 39,900 & \multirow[t]{2}{*}{0} \\ \hline & & 100 & & x & \\ \hline \multicolumn{6}{|c|}{ Cash Flow Statements: } \\ \hline & Year 0 & Year 1 & Year 2 & Year 3 & Year 4 \\ \hline Unit price & & $ & x & x & 2 \\ \hline Unit sales & & 425.000 & x & x & 425,000 \\ \hline Revenues & & $850,000 & x & x & $850,000 \\ \hline Operating costs & & 637.500 & x & x & 637,500 \\ \hline Depreciation & & 188,100 & x & x & 39,900 \\ \hline \begin{tabular}{l} Other project \\ effects \end{tabular} & & 20.000 & x & x & 20,000 \\ \hline \begin{tabular}{l} Before tax \\ income \end{tabular} & & $4,400 & x & x & $152.600 \\ \hline Taxes & & 1.760 & x & x & 61.040 \\ \hline Net income & & $2,640 & x & x & $91,560 \\ \hline Plus depreciation & & 188.100 & x & x & 39,900 \\ \hline Net op cash flow & & $190.740 & \multirow[t]{2}{*}{x} & x & $131,460 \\ \hline Salvage value & & & & & $100,000 \\ \hlineSVtax & & & & & x \\ \hline Recovery of NWC & & & & & x \\ \hline Termination CF & & & & & x \\ \hline Project NCF & x & x & x & x & x \\ \hline \end{tabular} 5. Estimate the project's operating cash flows. (Hint: Again use Table 1 as a guide.) What are the project's NPV, IRR. modified IRR (MIRR), and payback? Should the project be undertaken? [Remember: The MIRR is found in three steps: (1) compound all cash inflows forward to the terminal year at the cost of capital, (2) sum the compounded cash inflows to obtain the terminal value of the inflows, and (3) find the discount rate which forces the present value of the terminal value to equal the present value of the net investment outlays. This discount rate is defined as the MIRR.] 6. Now suppose the project had involved replacement rather than expansion of existing facilities. Describe briefly how the analysis would have to be changed to deal with a replacement project. TABLE 1 Project Cash Flow Estimates \begin{tabular}{|c|c|c|c|c|c|} \hline \multirow{5}{*}{\begin{tabular}{l} Net Investment \\ Outlay: \\ Price \\ Freight \\ Installation \\ Change in NWC \end{tabular}} & \multicolumn{3}{|c|}{ Depreciation Schedule: } & & \multirow[b]{3}{*}{ End-of-Year } \\ \hline & \multicolumn{2}{|c|}{ Basis =} & \multicolumn{2}{|l|}{x} & \\ \hline & x & MACl & & Deprec. & \\ \hline & Year & Facto & & Expense & Book Value \\ \hline & x & 33% & & $188,100 & $381.900 \\ \hline \multirow{4}{*}{ Change in NWC } & x & x & & x & x \\ \hline & 3 & x & & x & x \\ \hline & \multirow[t]{2}{*}{4} & 7 & & 39,900 & \multirow[t]{2}{*}{0} \\ \hline & & 100 & & x & \\ \hline \multicolumn{6}{|c|}{ Cash Flow Statements: } \\ \hline & Year 0 & Year 1 & Year 2 & Year 3 & Year 4 \\ \hline Unit price & & $ & x & x & 2 \\ \hline Unit sales & & 425.000 & x & x & 425,000 \\ \hline Revenues & & $850,000 & x & x & $850,000 \\ \hline Operating costs & & 637.500 & x & x & 637,500 \\ \hline Depreciation & & 188,100 & x & x & 39,900 \\ \hline \begin{tabular}{l} Other project \\ effects \end{tabular} & & 20.000 & x & x & 20,000 \\ \hline \begin{tabular}{l} Before tax \\ income \end{tabular} & & $4,400 & x & x & $152.600 \\ \hline Taxes & & 1.760 & x & x & 61.040 \\ \hline Net income & & $2,640 & x & x & $91,560 \\ \hline Plus depreciation & & 188.100 & x & x & 39,900 \\ \hline Net op cash flow & & $190.740 & \multirow[t]{2}{*}{x} & x & $131,460 \\ \hline Salvage value & & & & & $100,000 \\ \hlineSVtax & & & & & x \\ \hline Recovery of NWC & & & & & x \\ \hline Termination CF & & & & & x \\ \hline Project NCF & x & x & x & x & x \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts