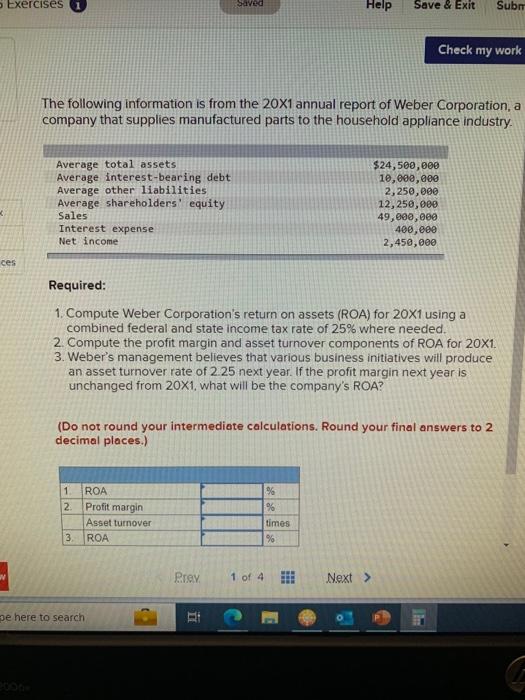

Question: 5 Exercises 1 3 w 2006x Average total assets Average interest-bearing debt Average other liabilities Average shareholders' equity Sales Interest expense Net income Required: The

The following information is from the 201 annual report of Weber Corporation, a company that supplies manufactured parts to the household appliance industry. Required: 1. Compute Weber Corporation's return on assets (ROA) for 201 using a combined federal and state income tax rate of 25% where needed. 2. Compute the profit margin and asset turnover components of ROA for 201. 3. Weber's management believes that various business initiatives will produce an asset turnover rate of 2.25 next year. If the profit margin next year is unchanged from 201, what will be the company's ROA? (Do not round your intermediate calculations. Round your final answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts