Question: 5. f(b) Use the least squares method to develop the estimated regression equation that can be used to predict itemized deductions (in $1,0005) given the

5.

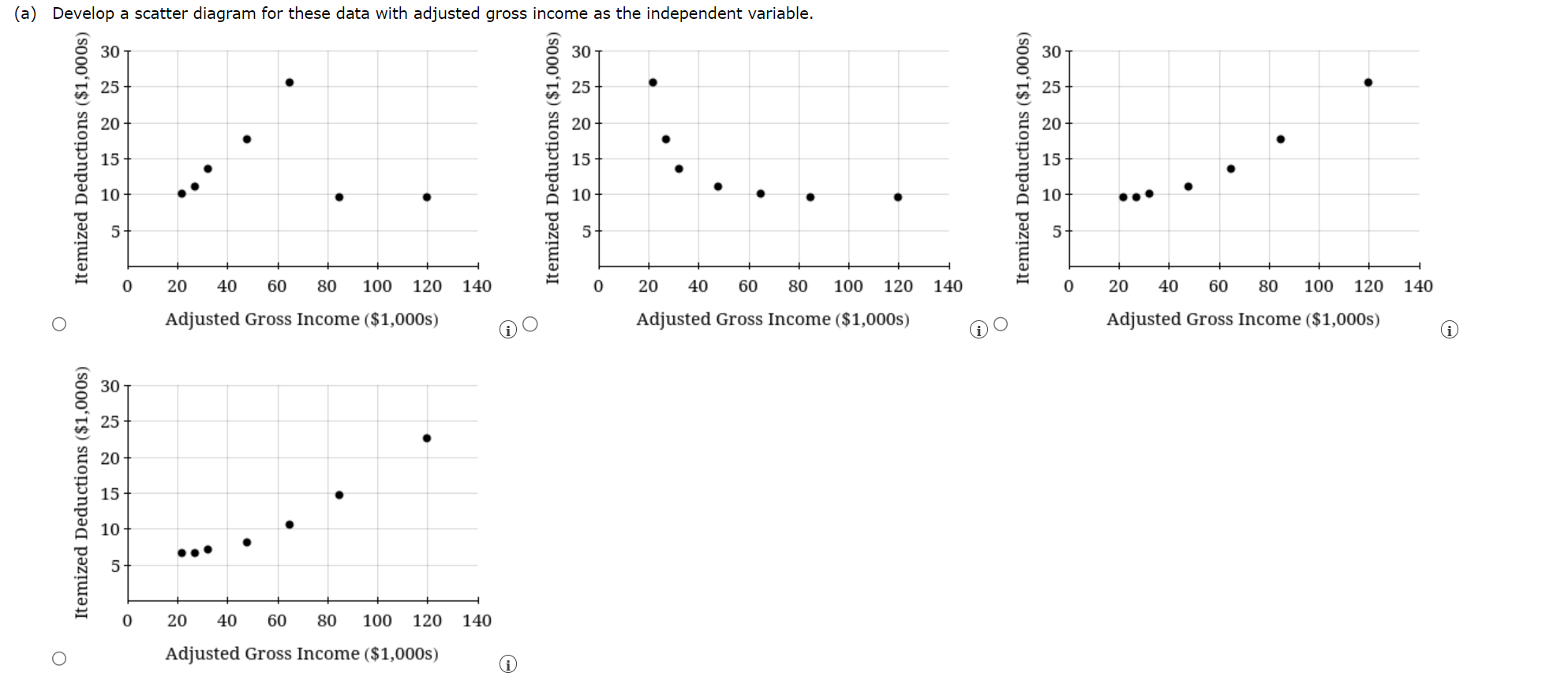

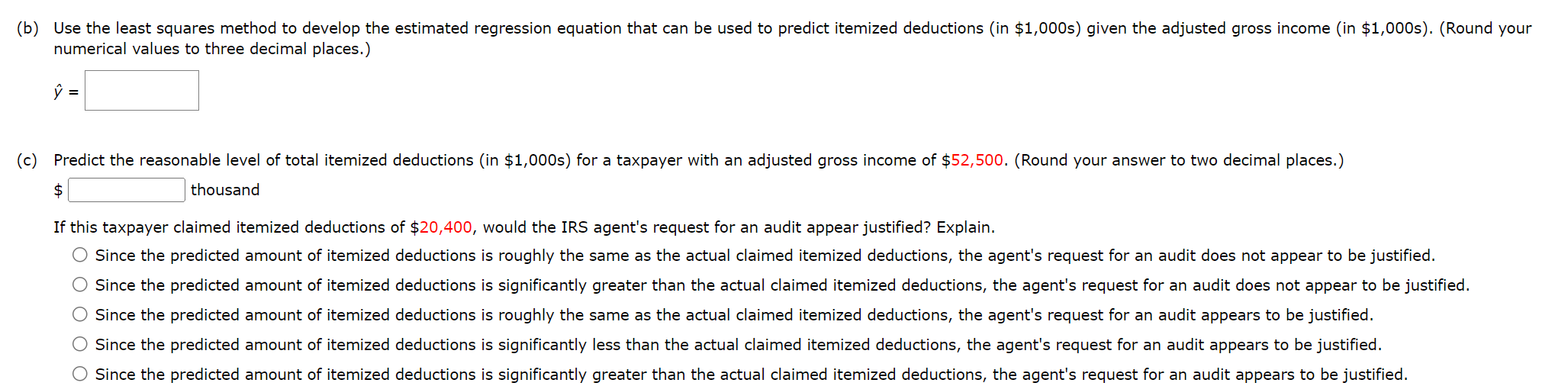

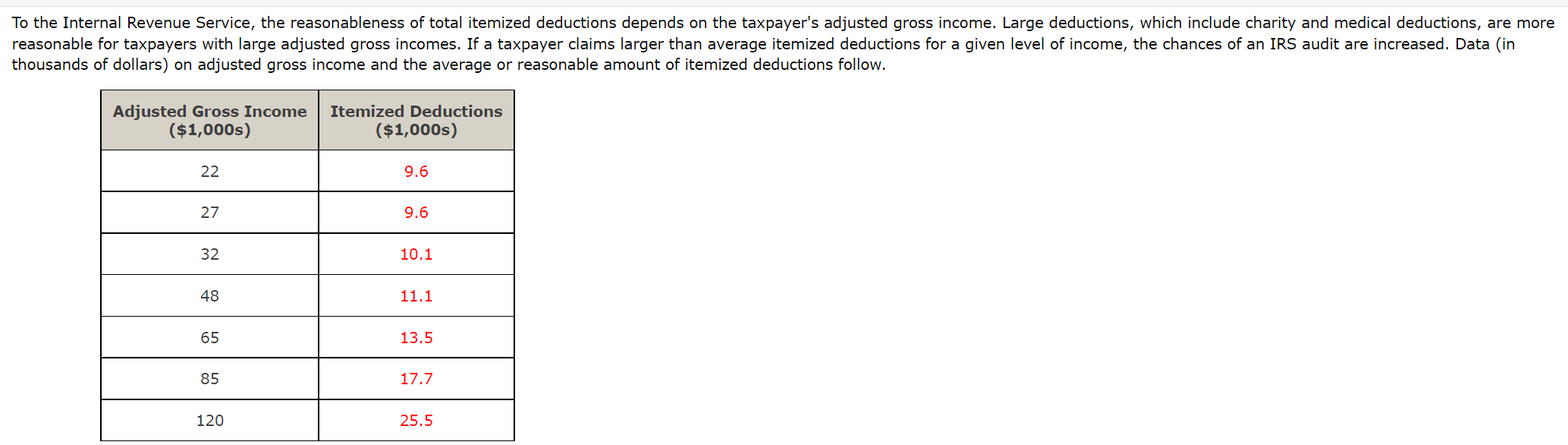

\f(b) Use the least squares method to develop the estimated regression equation that can be used to predict itemized deductions (in $1,0005) given the adjusted gross income (in $1,0005). (Round your numerical values to three decimal places.) f: (c) Precict the reasona Jle level of total itemized deductions (in $1,0005) for a taxpayer with an adjusted gross income of $52,500. (Round your answer to two decimal places.) If this taxpayer claimed itemized deductions of $20,400, would the IRS agent's request for an audit appearjustified? Explain. 0 Since the predicted amount of itemized deductions is roughly the same as the actual claimed itemized deductions, the agent's request for an audit does not appear to be justied. 0 Since the predicted amount of itemized deductions is significantly greater than the actual claimed itemized deductions, the agent's request for an audit does not appear to be justied. 0 Since the predicted amount of itemized deductions is roughly the same as the actual claimed itemized deductions, the agent's request for an audit appears to be justied. 0 Since the predicted amount of itemized deductions is significantly less than the actual claimed itemized deductions, the agent's request for an audit appears to be justied. O Since the predicted amount of itemized deductions is significantly greater than the actual claimed itemized deductions, the agent's request for an audit appears to be justied. To the Internal Revenue Service, the reasonableness of total itemized deductions depends on the taxpayer's adjusted gross income. Large deductions, which include charity and medical deductions, are more reasonable for taxpayers with large adjusted gross incomes. If a taxpayer claims larger than average itemized deductions for a given level of income, the chances of an IRS audit are increased. Data (in thousands of dollars) on adjusted gross income and the average or reasonable amount of itemized deductions follow. Adjusted Gross Income Itemized Deductions ($1,0005) ($1,0005) 22 9.6 27 9.6 32 10.1 48 1 1.1 65 13.5 85 17.7 120 25.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts