Question: 5. Fixed costs can be discretionary or committed. Using your judgment based on the discussion in the case, identify which costs are likely to

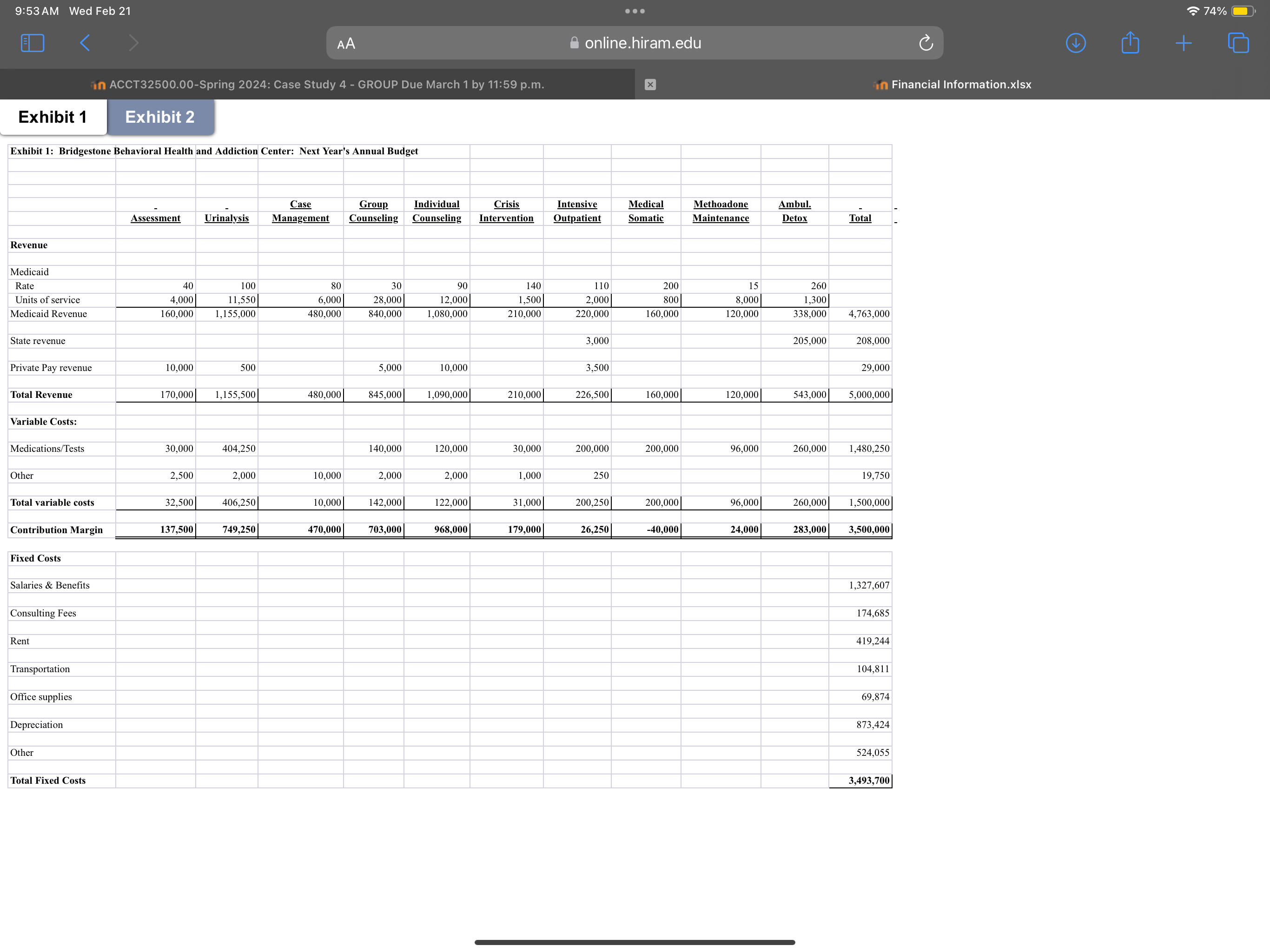

5. Fixed costs can be discretionary or committed. Using your judgment based on the discussion in the case, identify which costs are likely to be discretionary. Assuming that management is able to decrease discretionary fixed costs by 10%, what would be the impact on Bridgestone's break-even point revenues? 6. As Bridgestone operates during the next year, do some services deserve more attention than others? (Hint: What is their relative contribution to the WACM % and to the total contribution margin? Which services?) 7. How can the budgetary weighted average contribution margin (WACM) percentage be used to help control the actual operations of Bridgestone? 8. If a budgetary weighted average contribution margin (WACM) percentage has been developed with an expected level of revenue and a planned fixed cost and the budgetary WACM percentage is in fact achieved in the next (future) time period, could the organization still face losses if the total revenue drops below the budgeted level or total fixed costs increase beyond the budgeted levels? Can you explain how losses still might occur even though the planned WACM percentage is being realized in the future time period? 9:53 AM Wed Feb 21 AA in ACCT32500.00-Spring 2024: Case Study 4 - GROUP Due March 1 by 11:59 p.m. Exhibit 1 Exhibit 2 Exhibit 1: Bridgestone Behavioral Health and Addiction Center: Next Year's Annual Budget online.hiram.edu Case Group Assessment Urinalysis Management Counseling Individual Crisis Counseling Intervention Intensive Outpatient Medical Somatic Methoadone Maintenance Ambul. Detox Total Revenue Medicaid in Financial Information.xlsx Rate Units of service 40 4,000 Medicaid Revenue 160,000 100 11,550 1,155,000 State revenue Private Pay revenue 10,000 500 Total Revenue 170,000 1,155,500 80 6,000 480,000 30 28,000 840,000 90 12,000 1,080,000 140 1,500 210,000 110 2,000 220,000 200 800 160,000 15 8,000 120,000 260 1,300 338,000 4,763,000 3,000 205,000 208,000 5,000 10,000 3,500 29,000 480,000 845,000 1,090,000 210,000 226,500 160,000 120,000 543,000 5,000,000 Variable Costs: Medications/Tests 30,000 404,250 140,000 120,000 30,000 200,000 200,000 96,000 260,000 1,480,250 Other 2,500 2,000 10,000 2,000 2,000 1,000 250 19,750 Total variable costs 32,500 406,250 10,000 142,000 122,000 31,000 200,250 200,000 96,000 260,000 1,500,000 Contribution Margin 137,500 749,250 470,000 703,000 968,000 179,000 26,250 -40,000 24,000 283,000 3,500,000 Fixed Costs Salaries & Benefits Consulting Fees Rent Transportation Office supplies Depreciation Other Total Fixed Costs 1,327,607 174,685 419,244 104,811 69,874 873,424 524,055 3,493,700 + 8.74%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts