Question: 5 Floating vs Fixing [10 points Assume that Burundi has a floating exchange rate but it is thinking about pegging its currency to the U.S.

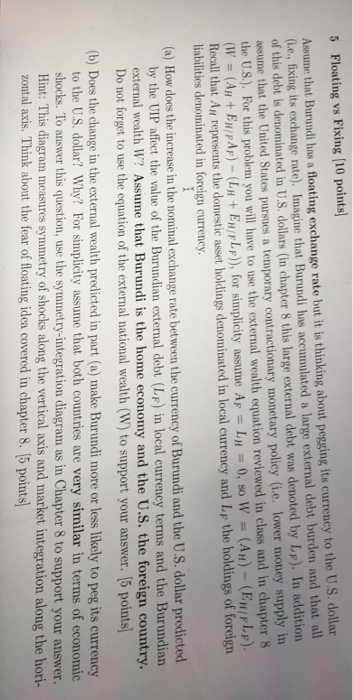

5 Floating vs Fixing [10 points Assume that Burundi has a floating exchange rate but it is thinking about pegging its currency to the U.S. dollar (i.e., fixing its exchange rate). Imagine that Burundi has accumulated a large external debt burden and that all of this debt is denominated in U.S. dollars (in chapter 8 this large external debt was denoted by Lp). In addition assume that the United States pursues a temporary contractionary monetary policy (i.e. lower money supply in the U.S.). For this problem you will have to use the external wealth equation reviewed in class and in chapter 8 (W (AH+ EHpAp) - (LH+EH/pLp)), for simplicity assume Ap LH Recall that AH represents the domestic asset liabilities denominated in foreign currency (AH)- (EH/FLF) t holdings denominated in local currency and Lp the holdings of foreign 0, so W (a) How does the increase in the nominal exchange rate between the currency of Burundi and the U.S. dollar predicted by the UIP affect the value of the Burundian external debt (Lp) in local currency terms and the Burundian external wealth W? Assume that Burundi is the home economy and the U.S. the foreign country. Do not forget to use the equation of the external national wealth (W) to support your answer. (5 points (b) Does the change in the external wealth predicted in part (a) make Burundi more or less likely to peg its currency to the U.S. dollar? Why? For simplicity assume that both countries are very similar in terms of economic shocks. To answer Hint: This diagram measures symmetry of shocks along the vertical axis and market integration along the hori- zontal axis. Think about the fear of floating idea covered in chapter 8. [5 points this question, use the symmetry-integration diagram as in Chapter 8 to support your answer. 5 Floating vs Fixing [10 points Assume that Burundi has a floating exchange rate but it is thinking about pegging its currency to the U.S. dollar (i.e., fixing its exchange rate). Imagine that Burundi has accumulated a large external debt burden and that all of this debt is denominated in U.S. dollars (in chapter 8 this large external debt was denoted by Lp). In addition assume that the United States pursues a temporary contractionary monetary policy (i.e. lower money supply in the U.S.). For this problem you will have to use the external wealth equation reviewed in class and in chapter 8 (W (AH+ EHpAp) - (LH+EH/pLp)), for simplicity assume Ap LH Recall that AH represents the domestic asset liabilities denominated in foreign currency (AH)- (EH/FLF) t holdings denominated in local currency and Lp the holdings of foreign 0, so W (a) How does the increase in the nominal exchange rate between the currency of Burundi and the U.S. dollar predicted by the UIP affect the value of the Burundian external debt (Lp) in local currency terms and the Burundian external wealth W? Assume that Burundi is the home economy and the U.S. the foreign country. Do not forget to use the equation of the external national wealth (W) to support your answer. (5 points (b) Does the change in the external wealth predicted in part (a) make Burundi more or less likely to peg its currency to the U.S. dollar? Why? For simplicity assume that both countries are very similar in terms of economic shocks. To answer Hint: This diagram measures symmetry of shocks along the vertical axis and market integration along the hori- zontal axis. Think about the fear of floating idea covered in chapter 8. [5 points this question, use the symmetry-integration diagram as in Chapter 8 to support your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts