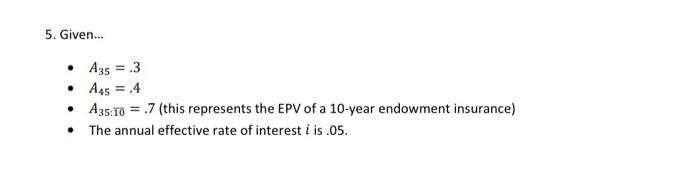

Question: 5. Given... - A35=.3 - A45=.4 - A35:10=.7 (this represents the EPV of a 10-year endowment insurance) - The annual effective rate of interest i

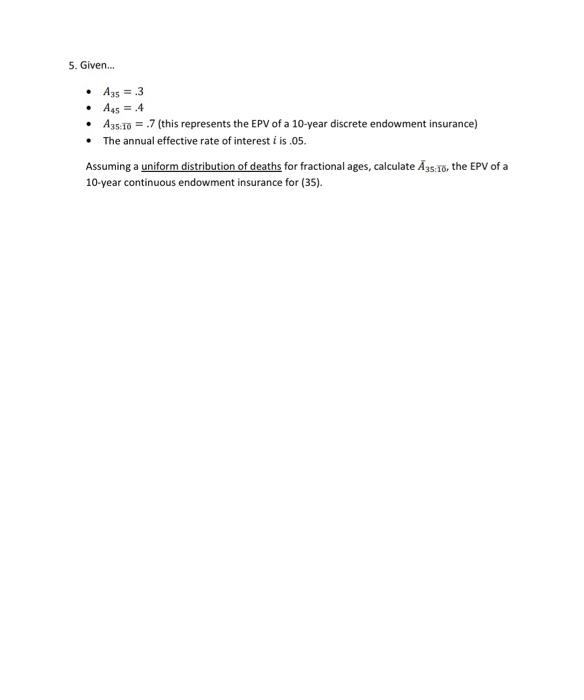

5. Given... - A35=.3 - A45=.4 - A35:10=.7 (this represents the EPV of a 10-year endowment insurance) - The annual effective rate of interest i is .05. 5. Given... - A35=.3 - A45=.4 - A35:10=.7 (this represents the EPV of a 10-year discrete endowment insurance) - The annual effective rate of interest i is .05. Assuming a uniform distribution of deaths for fractional ages, calculate A35:10, the EPV of a 10-year continuous endowment insurance for (35). 5. Given... - A35=.3 - A45=.4 - A35:10=.7 (this represents the EPV of a 10-year endowment insurance) - The annual effective rate of interest i is .05. 5. Given... - A35=.3 - A45=.4 - A35:10=.7 (this represents the EPV of a 10-year discrete endowment insurance) - The annual effective rate of interest i is .05. Assuming a uniform distribution of deaths for fractional ages, calculate A35:10, the EPV of a 10-year continuous endowment insurance for (35)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts