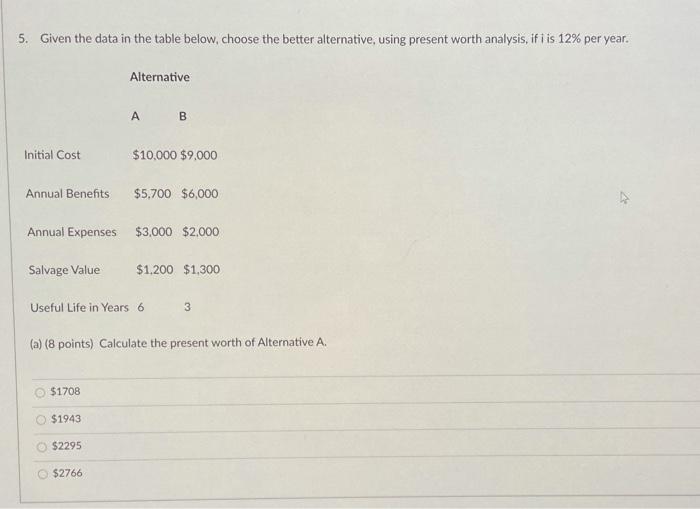

Question: 5. Given the data in the table below, choose the better alternative, using present worth analysis, ifi is 12% per year. Alternative B Initial Cost

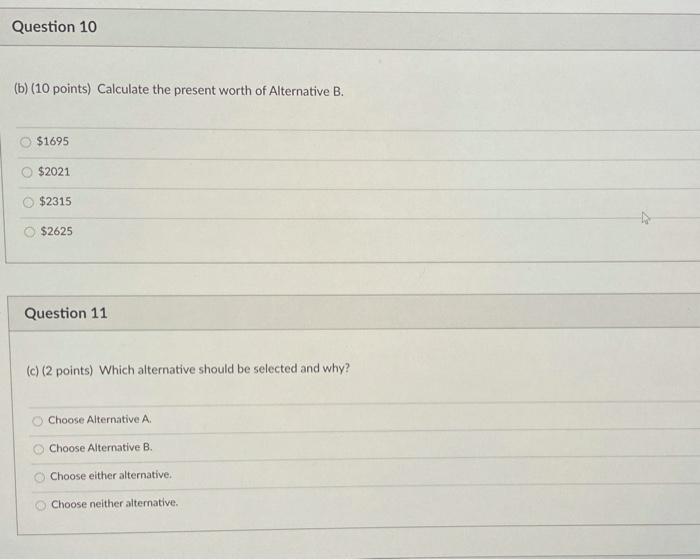

5. Given the data in the table below, choose the better alternative, using present worth analysis, ifi is 12% per year. Alternative B Initial Cost $10,000 $9,000 Annual Benefits $5,700 $6,000 Annual Expenses $3,000 $2,000 Salvage Value $1,200 $1,300 Useful Life in Years 6 3 (a) (8 points) Calculate the present worth of Alternative A. $1708 $1943 $2295 $2766 Question 10 (b) (10 points) Calculate the present worth of Alternative B. $1695 $2021 $2315 $2625 Question 11 (c) (2 points) Which alternative should be selected and why? Choose Alternative A Choose Alternative B. Choose either alternative. Choose neither alternative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts