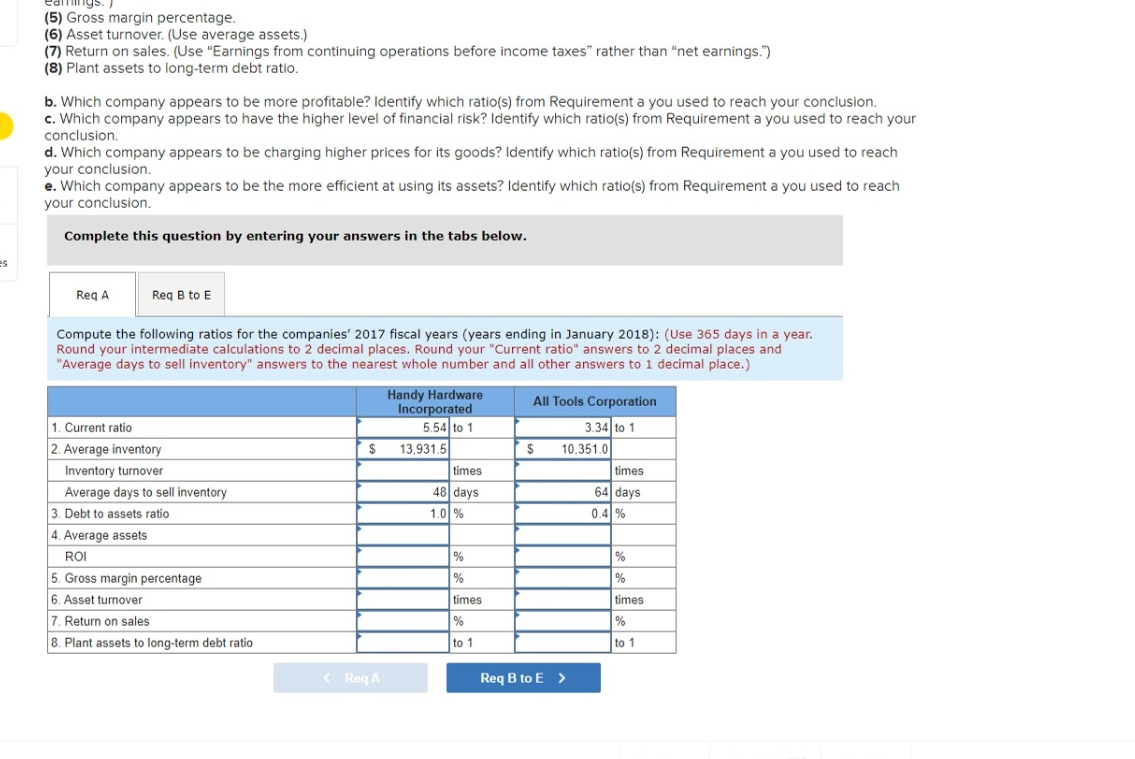

Question: ( 5 ) Gross margin percentage. ( 6 ) Asset turnover. ( Use average assets. ) ( 7 ) Return on sales. ( Use Earnings

Gross margin percentage.

Asset turnover. Use average assets.

Return on sales. Use Earnings from continuing operations before income taxes rather than net earnings.

Plant assets to longterm debt ratio.

b Which company appears to be more profitable? I The following information relates to Handy Hardware Incorporated, and All Tools Corporation for their and fiscal years.

Requireddentify which ratios from Requirement a you used to reach your conclusion.

c Which company appears to have the higher level of financial risk? Identify which ratios from Requirement a you used to reach your conclusion.

d Which company appears to be charging higher prices for its goods? Identify which ratios from Requirement a you used to reach your conclusion.

e Which company appears to be the more efficient at using its assets? Identify which ratios from Requirement a you used to reach your conclusion. Gross margin percentage.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock