Question: 5) Hedging is useful when faced with A) idiosyncratic risk. B) systemic risk. C) systematic risk. D) Both A) & C) are correct. 6) Reducing

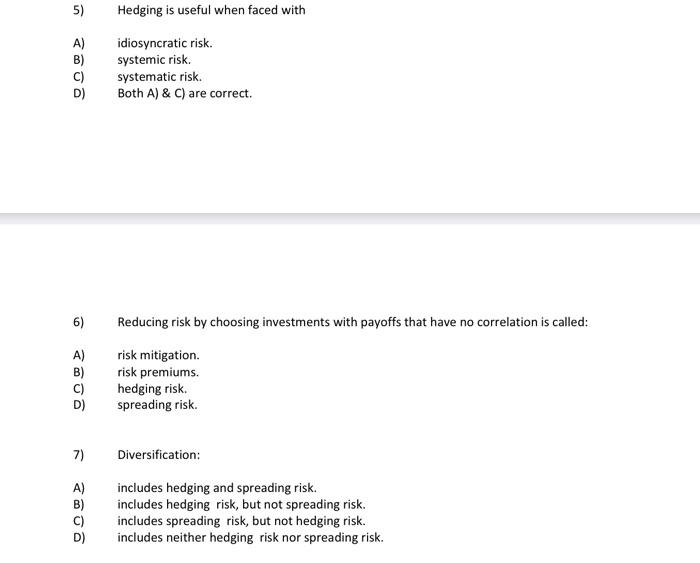

5) Hedging is useful when faced with A) idiosyncratic risk. B) systemic risk. C) systematic risk. D) Both A) \& C) are correct. 6) Reducing risk by choosing investments with payoffs that have no correlation is called: A) risk mitigation. B) risk premiums. C) hedging risk. D) spreading risk. 7) Diversification: A) includes hedging and spreading risk. B) includes hedging risk, but not spreading risk. C) includes spreading risk, but not hedging risk. D) includes neither hedging risk nor spreading risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts