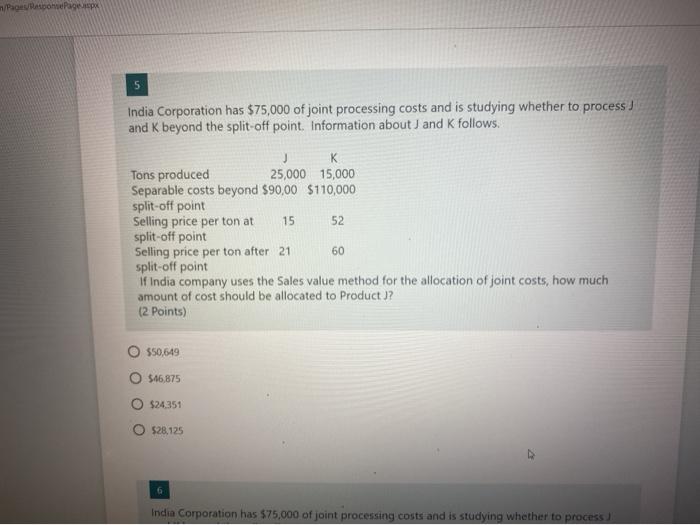

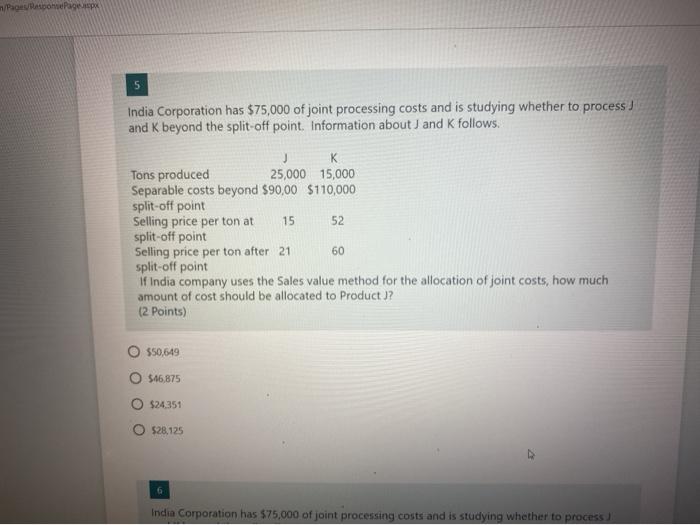

Question: 5 - help magiral or intermediate accouting n/PageRowPage 5 India Corporation has $75,000 of joint processing costs and is studying whether to process and K

5 - help magiral or intermediate accouting

n/PageRowPage 5 India Corporation has $75,000 of joint processing costs and is studying whether to process and K beyond the split-off point. Information about J and K follows. K Tons produced 25,000 15,000 Separable costs beyond $90,00 $110,000 split-off point Selling price per ton at 15 52 split-off point Selling price per ton after 21 60 split-off point if India company uses the Sales value method for the allocation of joint costs, how much amount of cost should be allocated to Product ? (2 points) $50,649 O $16,875 $24351 $28,125 6 India Corporation has $75,000 of joint processing costs and is studying whether to process

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock