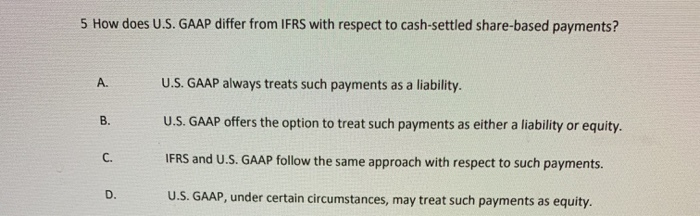

Question: 5 How does U.S. GAAP differ from IFRS with respect to cash-settled share-based payments? U.S. GAAP always treats such payments as a liability. U.S. GAAP

5 How does U.S. GAAP differ from IFRS with respect to cash-settled share-based payments? U.S. GAAP always treats such payments as a liability. U.S. GAAP offers the option to treat such payments as either a liability or equity. IFRS and U.S. GAAP follow the same approach with respect to such payments. U.S. GAAP, under certain circumstances, may treat such payments as equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts