Question: 5) Jack and Jill, two the risks associated with the accounts receivable of their respective clients. The appropriate audit rnsk auditors who have separate accounting

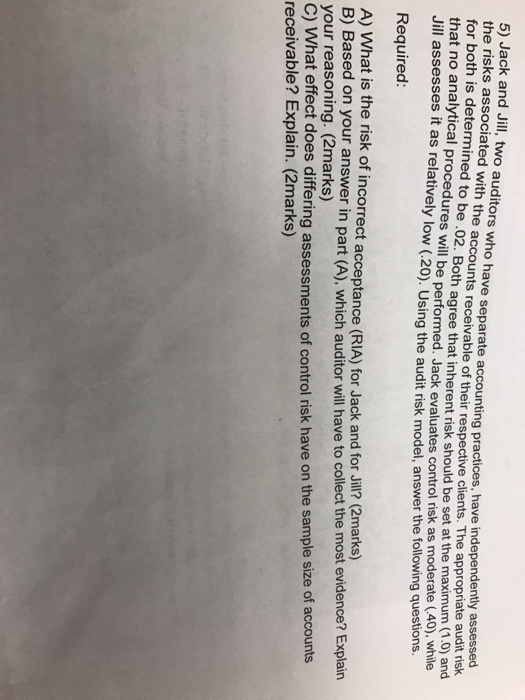

5) Jack and Jill, two the risks associated with the accounts receivable of their respective clients. The appropriate audit rnsk auditors who have separate accounting practices, have independently assessed for both is determined to that no analytical procedures will be performed. Jack evaluates control risk as moderate (40). while Jill assesses it as relatively low (20). Using the audit risk model, answer the following questions. be .02. Both agree that inherent risk should be set at the maximum (1.0) and Required: A) What is the risk of incorrect acceptance (RIA) for Jack and for Jil? (2mar B) Based on your answer in part (A), which auditor will have to collect the most evidence? Explain your reasoning. (2marks) C) What effect does differing assessments of control risk have on the sample size of accounts receivable? Explain. (2marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts