Question: 5) Jack has interest in buying Riskee, Inc. stock. His stockbroker informed him that Riskee's beta coefficient is 3.0. He then referred to some

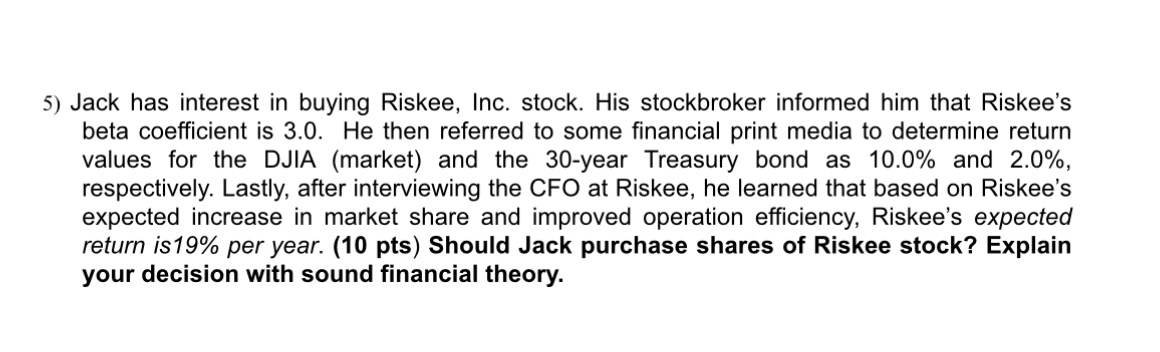

5) Jack has interest in buying Riskee, Inc. stock. His stockbroker informed him that Riskee's beta coefficient is 3.0. He then referred to some financial print media to determine return values for the DJIA (market) and the 30-year Treasury bond as 10.0% and 2.0%, respectively. Lastly, after interviewing the CFO at Riskee, he learned that based on Riskee's expected increase in market share and improved operation efficiency, Riskee's expected return is 19% per year. (10 pts) Should Jack purchase shares of Riskee stock? Explain your decision with sound financial theory.

Step by Step Solution

There are 3 Steps involved in it

To determine whether Jack should purchase shares of Riskee stock we can use the Capital Asset Pricin... View full answer

Get step-by-step solutions from verified subject matter experts