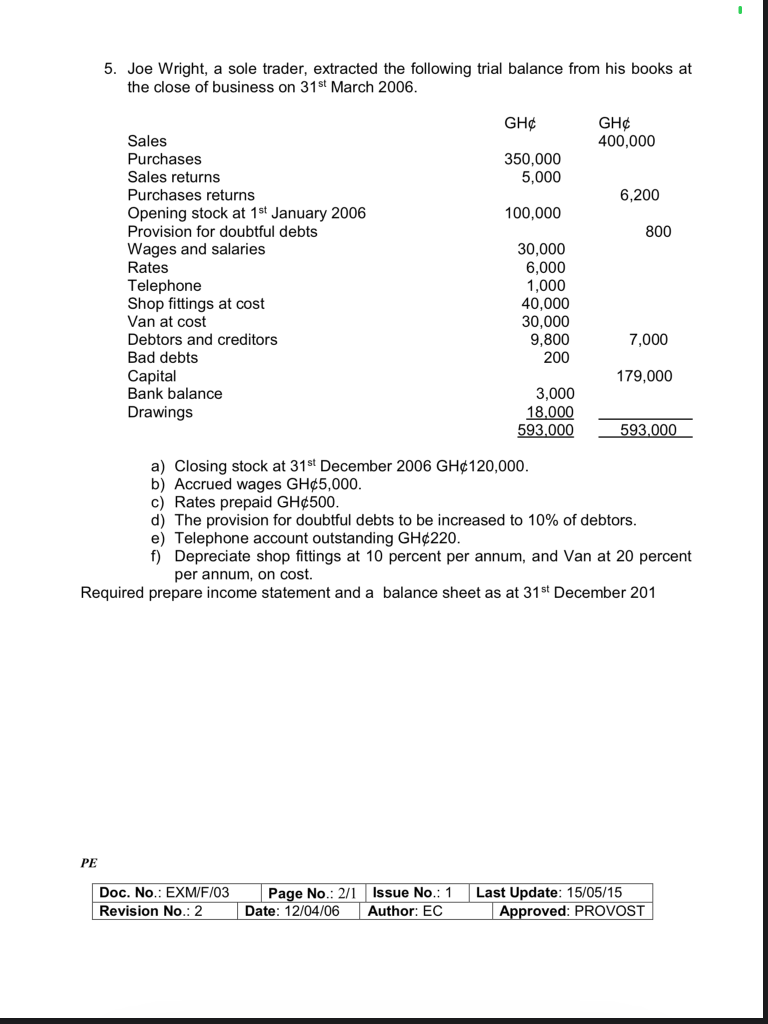

Question: 5. Joe Wright, a sole trader, extracted the following trial balance from his books at the close of business on 31st March 2006. GH GH

5. Joe Wright, a sole trader, extracted the following trial balance from his books at the close of business on 31st March 2006. GH GH 400,000 350,000 5,000 6,200 100,000 800 Sales Purchases Sales returns Purchases returns Opening stock at 1st January 2006 Provision for doubtful debts Wages and salaries Rates Telephone Shop fittings at cost Van at cost Debtors and creditors Bad debts Capital Bank balance Drawings 30,000 6,000 1,000 40,000 30,000 9,800 200 7,000 179,000 3,000 18,000 593,000 593,000 a) Closing stock at 31st December 2006 GH120,000. b) Accrued wages GH5,000. c) Rates prepaid GH500. d) The provision for doubtful debts to be increased to 10% of debtors. e) Telephone account outstanding GH220. f) Depreciate shop fittings at 10 percent per annum, and Van at 20 percent per annum, on cost. Required prepare income statement and a balance sheet as at 31st December 201 PE Doc. No.: EXM/F/03 Revision No.: 2 Page No.: 2/1 Issue No.: 1 Date: 12/04/06 Author: EC Last Update: 15/05/15 Approved: PROVOST

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts