Question: 5) Jogging Gear is considering a project with an initial cash requirement of $238,400. The 5 project will yield cash flows of $4,930 monthly for

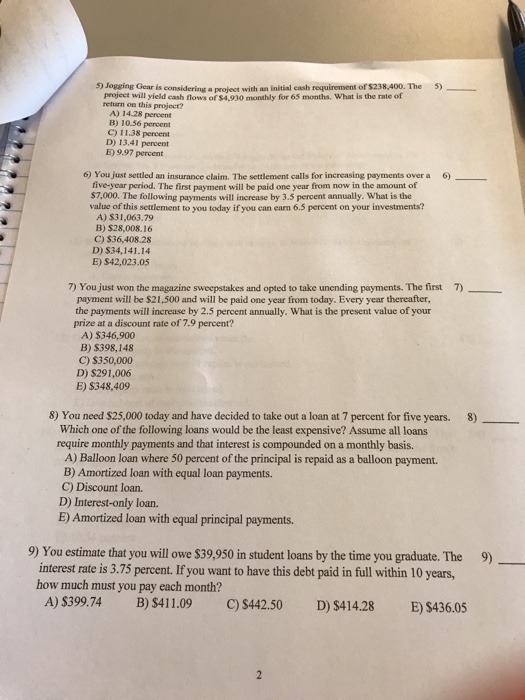

5) Jogging Gear is considering a project with an initial cash requirement of $238,400. The 5 project will yield cash flows of $4,930 monthly for 65 months. What is the rate of return on this project? A) 14.28 percent B) 10.56 percent C) 11.38 percent D) 13.41 percent E) 9.97 percent 6) You just settled an insurance claim. The settlement calls for increasing payments over a 6. five-year period. The first payment will be paid one year fron now in the amount of $7,000. The following payments will increase by 3.5 percent annually. What is the value of this settlement to you today if you can earn 6.5 percent on your investments? A) $31,063.79 B) $28,008.16 C) 536,408.28 D) $34,141.14 E) $42,023.05 7) You just won the magazine sweepstakes and opted to take unending payments. The first 7) payment will be $21,500 and will be paid one year from today. Every year thereafter, the payments will increase by 2.5 percent annually. What is the present value of your prize at a discount rate of 7.9 percent? A) $346,900 B) $398,148 C) $350,000 D) $291,006 E) $348,409 8) You need $25,000 today and have decided to take out a loan at 7 percent for five years. 8) Which one of the following loans would be the least expensive? Assume all loans require monthly payments and that interest is compounded on a monthly basis. A) Balloon loan where 50 percent of the principal is repaid as a balloon payment. B) Amortized loan with equal loan payments. C) Discount loan. D) Interest-only loan. E) Amortized loan with equal principal payments. 9) You estimate that you will owe S39,950 in student loans by the time you graduate. The 9) interest rate is 3.75 percent. If you want to have this debt paid in full within 10 years, how much must you pay each month? A)$39974 B)$411.09 C)$442.50 D)$414.28 E)$436.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts