Question: 5. John is the manager of a $50 million investment fund. The fund consists of five stocks with the following investments and betas: Stock Investment

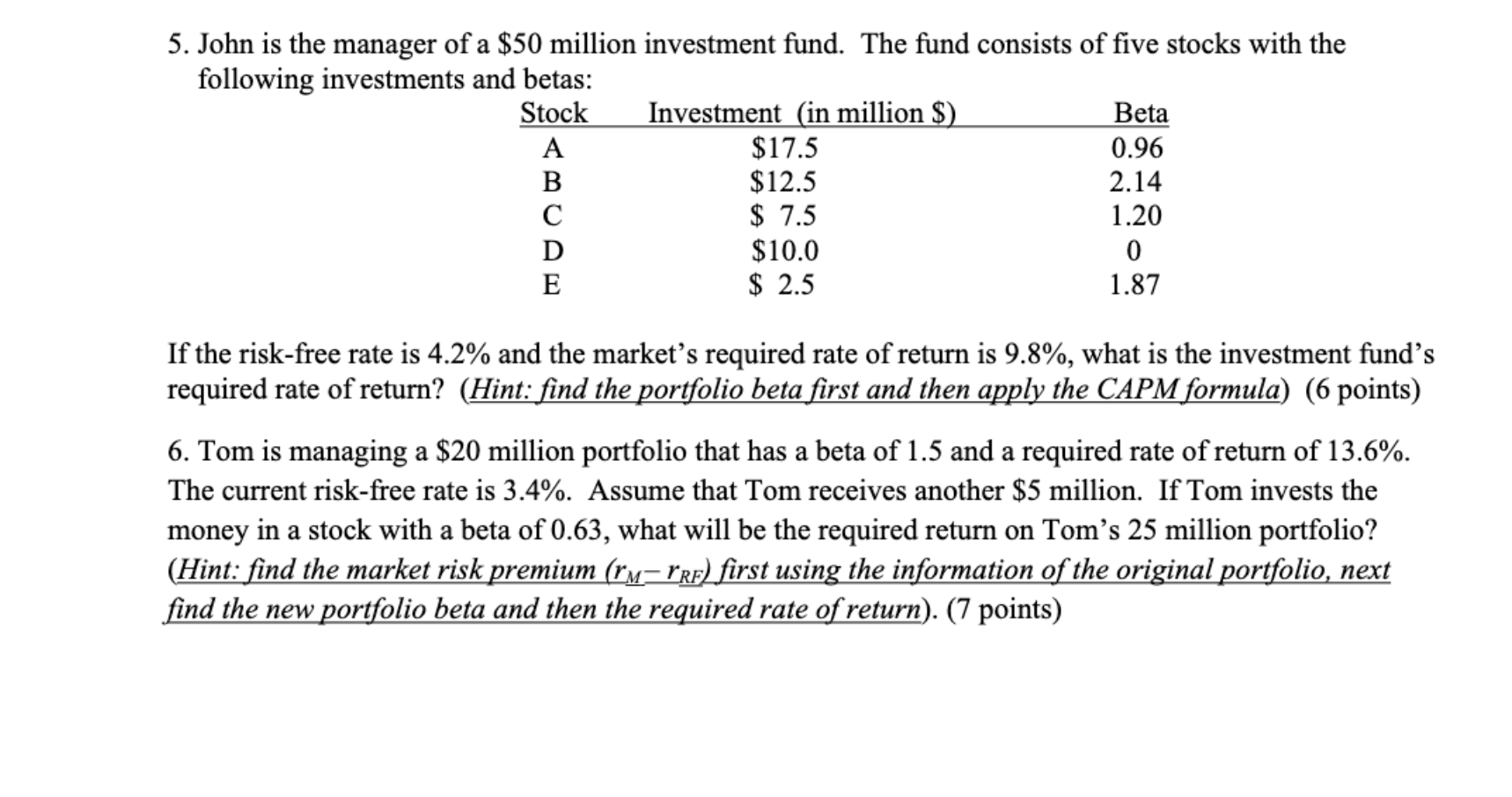

5. John is the manager of a $50 million investment fund. The fund consists of five stocks with the following investments and betas: Stock Investment (in million $). Beta A $17.5 0.96 B $12.5 2.14 $ 7.5 1.20 D $10.0 0 E $ 2.5 1.87 COA If the risk-free rate is 4.2% and the market's required rate of return is 9.8%, what is the investment fund's required rate of return? (Hint: find the portfolio beta first and then apply the CAPM formula) (6 points) 6. Tom is managing a $20 million portfolio that has a beta of 1.5 and a required rate of return of 13.6%. The current risk-free rate is 3.4%. Assume that Tom receives another $5 million. If Tom invests the money in a stock with a beta of 0.63, what will be the required return on Tom's 25 million portfolio? (Hint: find the market risk premium (rm-PRF) first using the information of the original portfolio, next find the new portfolio beta and then the required rate of return). (7 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts