Question: 5. Karou is considering different options for financing the $15,000 balance on her planned new car purchase. The cheapest advertised rate among the local banks

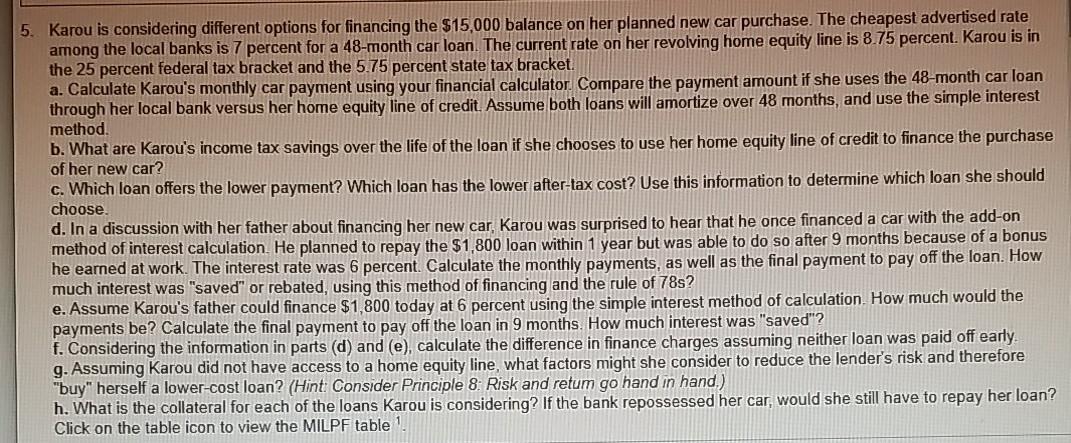

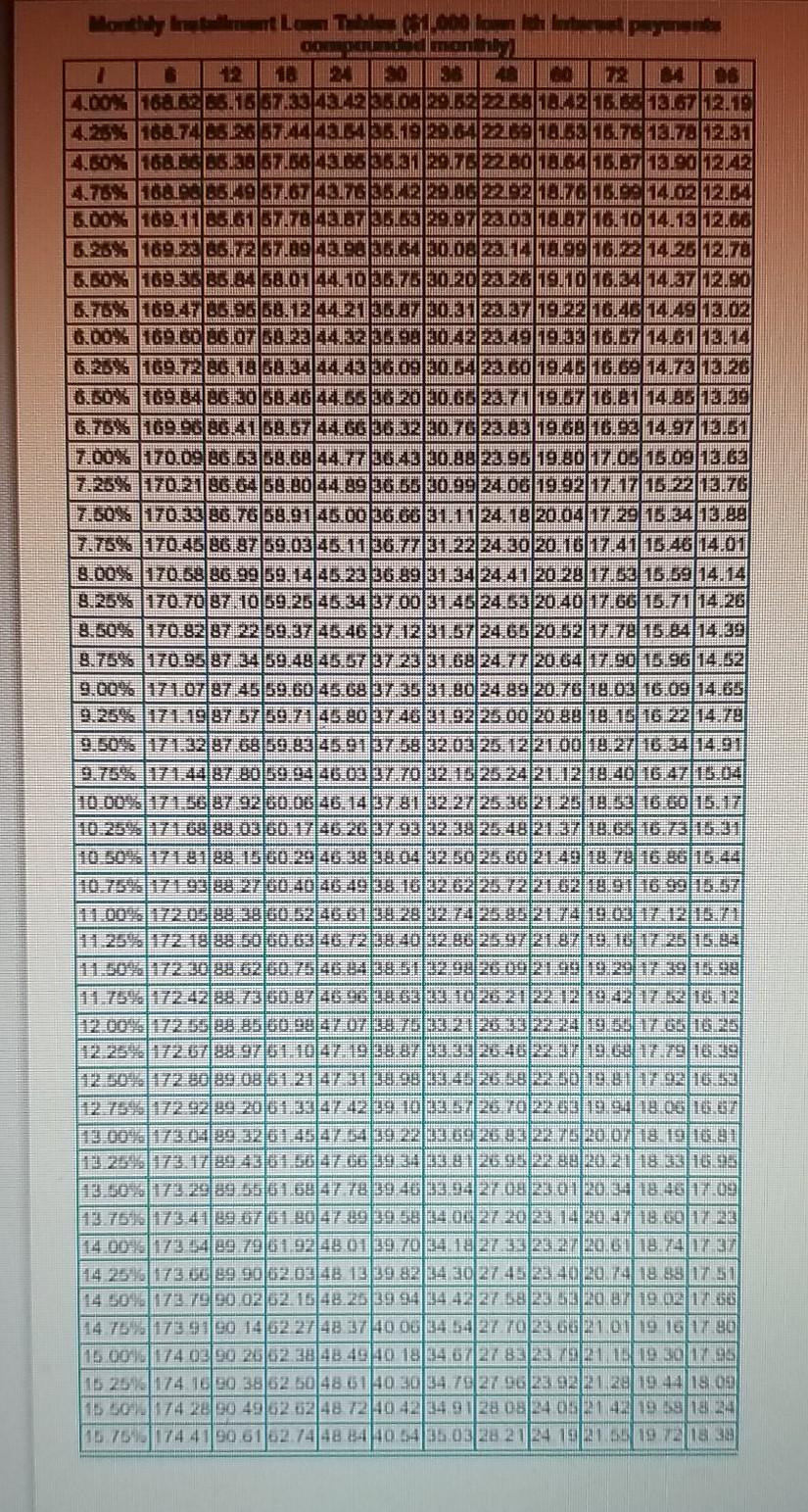

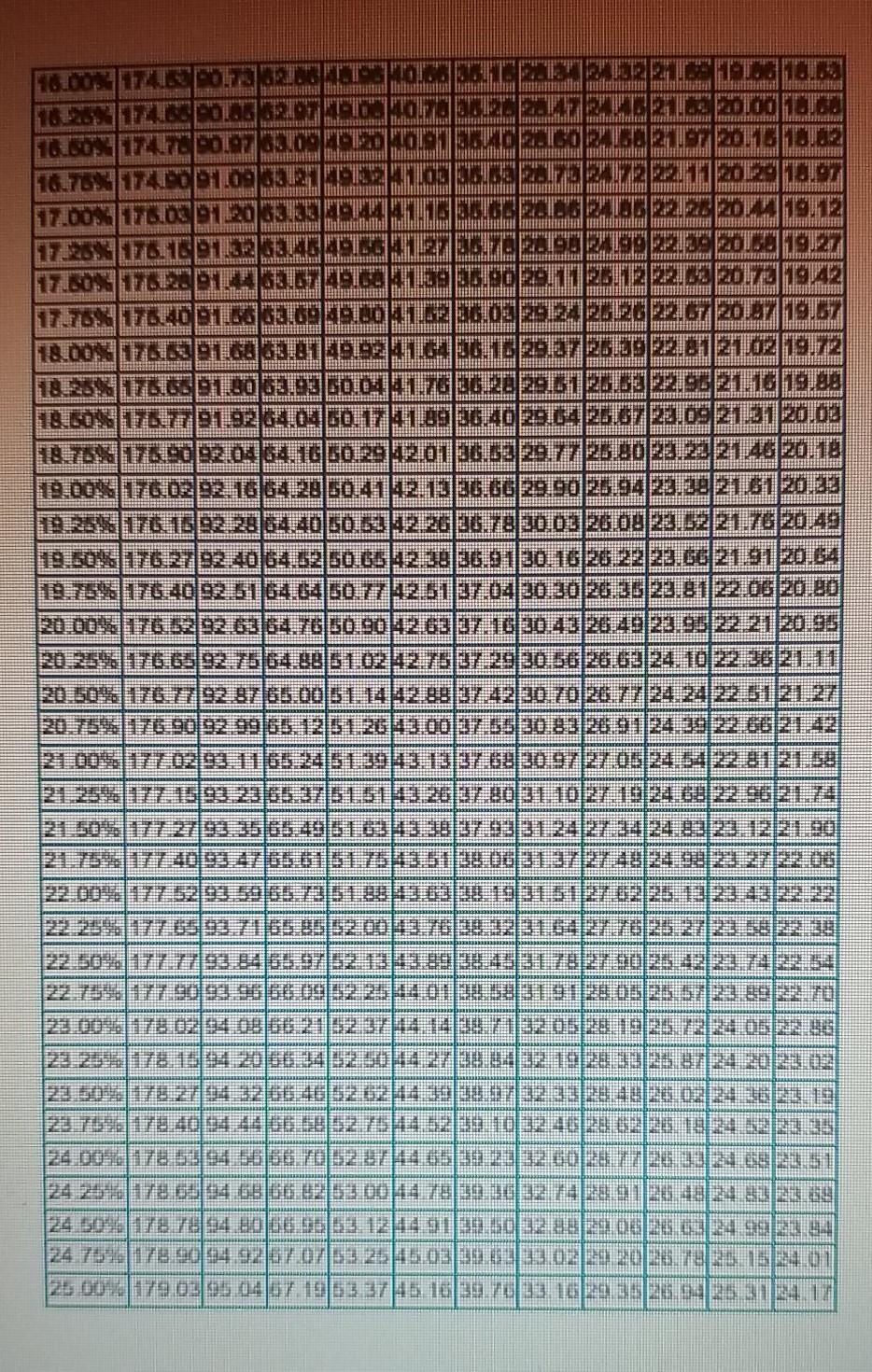

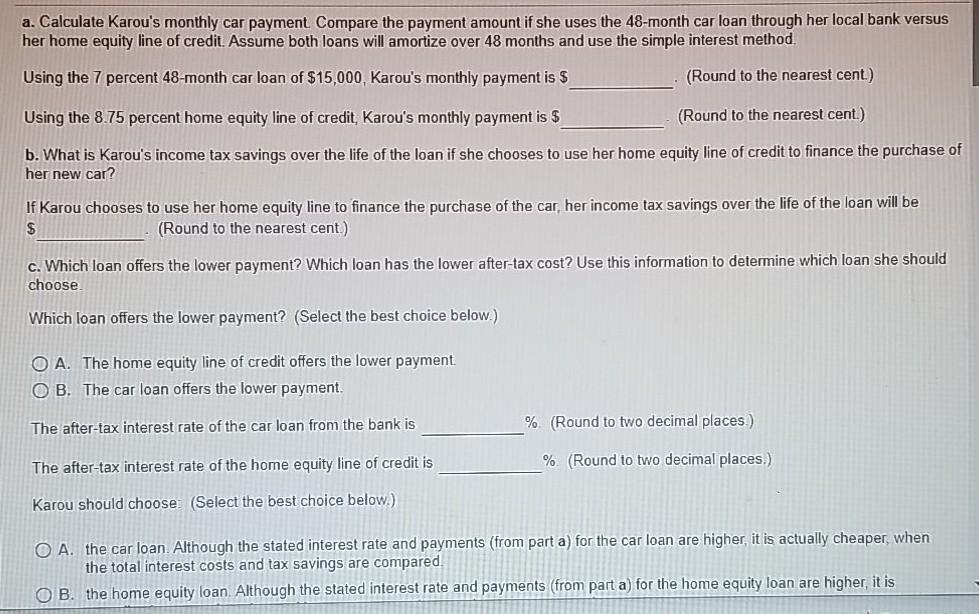

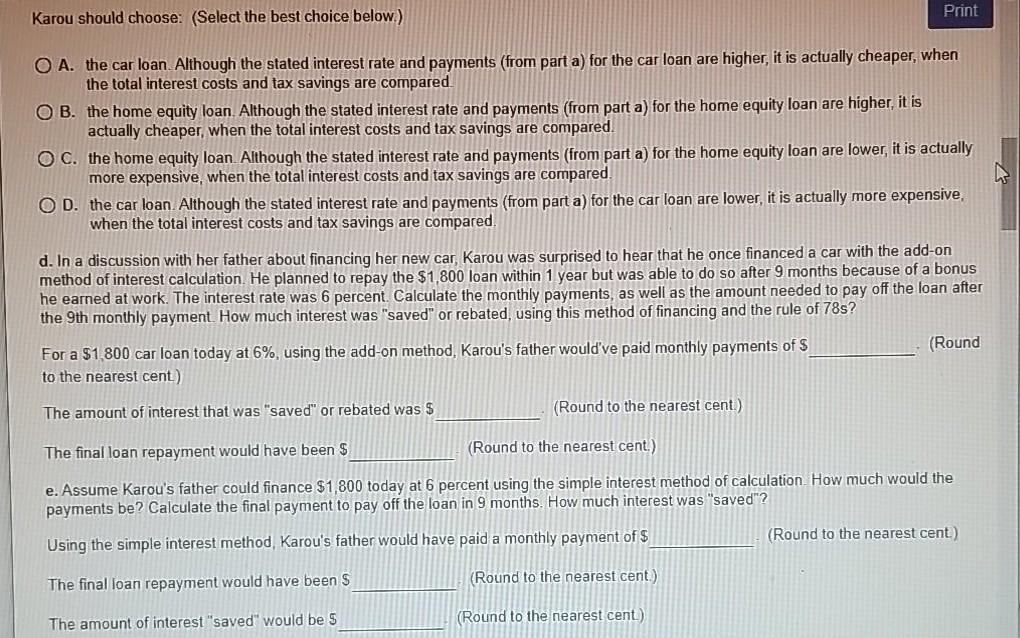

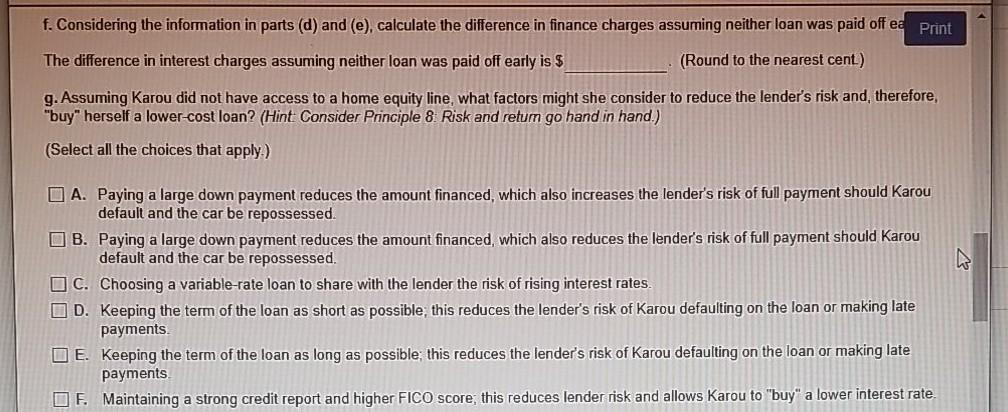

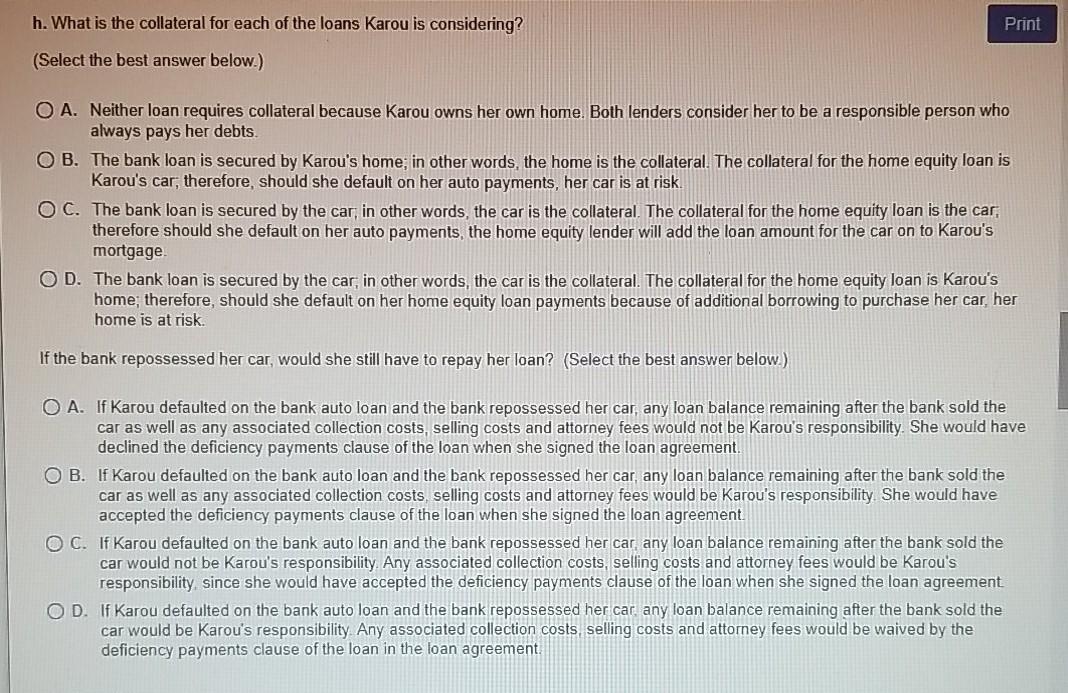

5. Karou is considering different options for financing the $15,000 balance on her planned new car purchase. The cheapest advertised rate among the local banks is 7 percent for a 48-month car loan. The current rate on her revolving home equity line is 8.75 percent. Karou is in the 25 percent federal tax bracket and the 5.75 percent state tax bracket. a. Calculate Karou's monthly car payment using your financial calculator Compare the payment amount if she uses the 48-month car loan through her local bank versus her home equity line of credit. Assume both loans will amortize over 48 months, and use the simple interest method. b. What are Karou's income tax savings over the life of the loan if she chooses to use her home equity line of credit to finance the purchase of her new car? c. Which loan offers the lower payment? Which loan has the lower after-tax cost? Use this information to determine which loan she should choose. d. In a discussion with her father about financing her new car Karou was surprised to hear that he once financed a car with the add-on method of interest calculation. He planned to repay the $1,800 loan within 1 year but was able to do so after 9 months because of a bonus he earned at work. The interest rate was 6 percent. Calculate the monthly payments, as well as the final payment to pay off the loan. How much interest was "saved" or rebated, using this method of financing and the rule of 78s? e. Assume Karou's father could finance $1,800 today at 6 percent using the simple interest method of calculation. How much would the payments be? Calculate the final payment to pay off the loan in 9 months. How much interest was "saved"? f. Considering the information in parts (d) and (e), calculate the difference in finance charges assuming neither loan was paid off early g. Assuming Karou did not have access to a home equity line, what factors might she consider to reduce the lender's risk and therefore "buy" herself a lower-cost loan? (Hint: Consider Principle 8: Risk and retum go hand in hand) h. What is the collateral for each of the loans Karou is considering? If the bank repossessed her car, would she still have to repay her loan? Click on the table icon to view the MILPF table Peyn punde mon 7 13 NO 2 DS 4.00% 1681695.16873343120 2.6222561 216.58 12.67 12.19 4.2% 12TA12444435.19 29.642691030 Gus 13.70 20 A.COX GODSIDA BTK 3700 ST2976280TISATBT: 13190 PUZ 4.76% 1881 59 ST26742.73354229.00 292 13.766.99 14.02 12.6 6.00% 16911126161 57.76 42.67 25.80 29.27 23.03 1907 16.10 14.13 12.00 3.28% 16912 052 1.89 090 25.8.1 30.08 22.11.1999 1 14.25 12.70 6.00% 169.36 25.84 38.01 441036 TS 302022619.10 16.34 14.27 12.30 8.75% 169.47 BSLAG 58.1244213687 30.212.27 192 16.45 14.49 127.02 6.00% 169.00 B6.07 68.23 44.22 26.90 30.42 23.49 19.03 16.57 14.61 13.14 6.25% 169.72 86.18 58.34 44.43 36 09 30.5422.60 1946 16.69 14.73 1226 6.60% 189.84 2620 58.46 44.65 36 20 30.65 21.71 19.67 16.81 14 35 13.39 6.75% 169.90 86.41 58.57 44.66 36.22 20.76 23.83 19.68 16.92 14.97 13.51 7.00% 170.00 86.53 58.68 44.77 36 43 30.88 23.95 19.80 17.03 15 09 13.62 7.25% 170.21 86.64 58.80 44.8926.65 30.99 24.06|19.92 17.17 15 22 13.76 7.50% 170.3386.76 58.91 45.00 36.6G 31.1124.18 20.04 17.29 15.34 13.89 7.75% 17045 86 87 59.03 45.11 36.77 31.22 24.30 20.16 17.41 16.46 14.01 8.00% 1170.68 86.99 59.14 45 23 36.89 21.34 24.41 20 28 17.53 16.59 14.14 8.25% 170.70 87.10 59.25 45 34 37 00 21.45 24.5320 40|17.66 15.71 14 26 8.50% 170.82 87 22 59.37 45.4637 12 31.57 24.65 20:52 17.78 15.84 14.39 8.75% 170.95 37:34 59.4845 57 37 23 31.68 24 77 20764 17.90 15,96 14.52 9.009 17107 87 45 59.6045 68 27-3521 80 24,8920.76|18.03 16.0914.65 9.25 11.1987 57 59.7745.8027 4631.9225.00 20 88 18.15 16 22 14.79 9.5017932187 68159.8345.91 27258 02.03 25 1212100 18:27 16:34 12.911 9.75% 7142 87 B0 59.94 46.03 27.70 92 1525 2421.12 18.40 16.47|15.04 10.00% 07:56|87 92 60.06 46. 14 37 81 32 27.25 1621-25 12:53 16.60 15.17 10.25971.68 800360 1766 26272933239 254821 37 10.6516.7315 31 2003188 1560:2946382004427 502500229 18:23 16 30 15 10.7581719388 27160:4046 49 38. 1622 6225221 6212:91 169 16:57 100%|17205883960.5246810832912274253512174003122521 0125917218885060.63 46.723840 32 9025.9721 87|19. 10 17 25 15 34 11.5041723028.6260.75/46.249851229826092199 19 29 12 39 15.99 11.75*1724788.7360.87469638.63 1026 2122-12 19:42 1752|18. 12 12.00 12.55 38 85.60.984707275232120 22 24 1965 17 65 18 25 2.25*17673397161 1042 19 327122.3326,462 32 1931.79 16.39 1250172 089 0861 247 31398 13.4526 582250 19.01 17 92 16 53 12.755317292199 20 61.1347 42 39 19 1357 26 10 22 62 19.94 1805 16.67 13.00400730329 32 61 45 47 54 39 22 12 69 26 83 22 75/20 07 18. 1918. 21 13 25.9. 173. 17189 43 61 5607 6639.3423 812695 22 88 20:21 18 33 16.95 13. 5041 29 29 5561.6847 1839.463.94270821.01.2013 18.46 17.09 13.76373 4139.67 61 30 47 29 29.58 14 00 27 20 23 14 20.4718.60 17 23 4 004 1735499 7961 93 48 01 29.70 34 18 27.332327|20.61 18.74 1737 14.256173 00 99 90 52.03 48 13 39 82 14 3027 482040 20.74 18 880751 7450417379 00 02 62 1543 2539 94 14 42 27 18 23 5320 07 19 02 11 50 114 7648 17399190 1462 2748 1740 0614 5427 1023 662101 19 18 17 90 15.000 17403 90 20 52.38 48 4940 18 44 67 27 83 23 7921 19 30/17 95 15 2546 174 10 20 38 52 50 48 0140 30 34 7027 9623.02 21 20 19 44 18.08 15 Ba||174 20 90 4962 52 4872 10142 34.9128 08 24 052 42 19 18 1814 6 76017441 90.6102.7448 440 54150328 2024 1921 1920 Hal THI En hall Han ham 116.00% POLIANTTON OTETTIRETATTOOITE 16 DODOT DRITT IEELDEL2100TOIDU 10.SOSTIAC POZIT ECUTED 2002 16 COB 100 TODORE DULELGEDEON 117.259 176. LP12 GODADE 1999 2000 1997 7.SOSI TORBICULT 09001095.902112271279912 17.78 TOUOBUS GIGA120 26.02 292 EGG 20.7.1997 TBLOONIESIOG GODET720721921021972 18.259 1956.91 00 63.93 60.0241.76 26 28 29,5125.5322.98 21.16 19.99 18.30 TTT 197264.0450.17 41.8926.40 29.64 26 GT 22.0921 21 20.02 18.769 176 9092.04 64.16 50.29 422.01 36.52 29.77 25.80 22.2021,45 20:18 1.009: 1760292 16 64.28 50,41,42,13 26.GG 29.90 25.94 23.38 216120.22 PRS: 176 1592.28 64 40501532264.78 20:00 26.082.221.76 20.49 19.01.16 2792 40164 52 50 65 42 19 26 01 230 16 26 73222.CC 21.90120.14 159. 176 40 92 51 64.6450.74261 21.04.20.30126.35 22.8122 06 20.00 200096 6292 63 64.76.50.90426301 1630.4326 4923.95 22 21 20.95 20355. 176.65 93 75 64.885 1.02 42.75 37 2930.56 26.63 24. 10223621.11 20:50 176 92 97 65.0015014428827-4230 7026,77124.2422 5121 27 30.5176 9009299165 125 126 12:00131 55130.83120 924 39226232 300500293, 1165341503943.133 6830.97 27 05124-54292153 2355121593 235515151126203110210246839621 3032565959133122332122130 209765BB250GBB2822200 20057333965253102112122132 202176393.7155 251520763223162625272 82 225019331332025 27 09396 091225201230125932 2005.03 029408662323410321320528.1925.722 0523 56 228 159 206634525042322 1923125 72 2023 276 23 32 66 4652621439232332826 0 19 ZETO. 176.409 450 252 253 5239 103216225102 522135 26 OO. 178 5394 5666, 7052 37465323 3250277125.232 68 2,51 24 25.170.24 GB 6GB2152 0014782030374291 024 5.2104 24 BOB 24 HO 06 20/52. 12414913950220200001499219. 74 759 176 90 94 97 07 Ora 2015.03 21.02 203 204 205101 a. Calculate Karou's monthly car payment Compare the payment amount if she uses the 48-month car loan through her local bank versus her home equity line of credit. Assume both loans will amortize over 48 months and use the simple interest method. Using the 7 percent 48-month car loan of $15,000, Karou's monthly payment is $ (Round to the nearest cent) Using the 8.75 percent home equity line of credit, Karou's monthly payment is $ (Round to the nearest cent.) b. What is Karou's income tax savings over the life of the loan if she chooses to use her home equity line of credit to finance the purchase of her new car? If Karou chooses to use her home equity line to finance the purchase of the car, her income tax savings over the life of the loan will be $ (Round to the nearest cent.) c. Which loan offers the lower payment? Which loan has the lower after-tax cost? Use this information to determine which loan she should choose Which loan offers the lower payment? (Select the best choice below.) O A. The home equity line of credit offers the lower payment OB. The car loan offers the lower payment The after-tax interest rate of the car loan from the bank is % (Round to two decimal places.) The after-tax interest rate of the home equity line credit is %. (Round to two decimal places.) Karou should choose (Select the best choice below.) O A. the car loan. Although the stated interest rate and payments (from part a) for the car loan are higher it is actually cheaper, when the total interest costs and tax savings are compared OB. the home equity loan. Although the stated interest rate and payments (from part a) for the home equity loan are higher, it is Karou should choose: (Select the best choice below.) Print O A. the car loan. Although the stated interest rate and payments (from part a) for the car loan are higher, it is actually cheaper, when the total interest costs and tax savings are compared OB. the home equity loan. Although the stated interest rate and payments (from part a) for the home equity loan are higher, it is actually cheaper, when the total interest costs and tax savings are compared. O C. the home equity loan. Although the stated interest rate and payments (from part a) for the home equity loan are lower, it is actually more expensive, when the total interest costs and tax savings are compared. O D. the car loan. Although the stated interest rate and payments (from part a) for the car loan are lower, it is actually more expensive, when the total interest costs and tax savings are compared. d. In a discussion with her father about financing her new car Karou was surprised to hear that he once financed a car with the add-on method of interest calculation. He planned to repay the $1,800 loan within 1 year but was able to do so after 9 months because of a bonus he earned at work. The interest rate was 6 percent. Calculate the monthly payments, as well as the amount needed to pay off the loan after the 9th monthly payment. How much interest was "saved" or rebated, using this method of financing and the rule of 78s? (Round For a $1,800 car loan today at 6%, using the add-on method, Karou's father would've paid monthly payments of $ to the nearest cent) The amount of interest that was "saved" or rebated was $ (Round to the nearest cent) (Round to the nearest cent.) The final loan repayment would have been $ e. Assume Karou's father could finance $1,800 today at 6 percent using the simple interest method of calculation. How much would the payments be? Calculate the final payment to pay off the loan in 9 months. How much interest was "saved"? (Round to the nearest cent) Using the simple interest method, Karou's father would have paid a monthly payment of $ The final loan repayment would have been $ (Round to the nearest cent) The amount of interest "saved" would be 5 (Round to the nearest cent) f. Considering the information in parts (d) and (e), calculate the difference in finance charges assuming neither loan was paid off ea Print The difference in interest charges assuming neither loan was paid off early is $ (Round to the nearest cent) g. Assuming Karou did not have access to a home equity line, what factors might she consider to reduce the lender's risk and therefore, "buy" herself a lower-cost loan? (Hint Consider Principle 8. Risk and return go hand in hand.) (Select all the choices that apply.) A. Paying a large down payment reduces the amount financed, which also increases the lender's risk of full payment should Karou default and the car be repossessed B. Paying a large down payment reduces the amount financed, which also reduces the lender's risk of full payment should Karou default and the car be repossessed. C. Choosing a variable-rate loan to share with the lender the risk of rising interest rates D. Keeping the term of the loan as short as possible, this reduces the lender's risk of Karou defaulting on the loan or making late payments E. Keeping the term of the loan as long as possible; this reduces the lender's risk of Karou defaulting on the loan or making late payments OF. Maintaining a strong credit report and higher FICO score; this reduces lender risk and allows Karou to "buy" a lower interest rate h. What is the collateral for each of the loans Karou is considering? Print (Select the best answer below.) O A. Neither loan requires collateral because Karou owns her own home. Both lenders consider her to be a responsible person who always pays her debts. OB. The bank loan is secured by Karou's home; in other words, the home is the collateral. The collateral for the home equity loan is Karou's car, therefore, should she default on her auto payments, her car is at risk. O C. The bank loan is secured by the car, in other words, the car is the collateral. The collateral for the home equity loan is the car, therefore should she default on her auto payments, the home equity lender will add the loan amount for the car on to Karou's mortgage OD. The bank loan is secured by the car, in other words, the car is the collateral. The collateral for the home equity loan is Karou's home, therefore, should she default on her home equity loan payments because of additional borrowing to purchase her car, her home is at risk. If the bank repossessed her car, would she still have to repay her loan? (Select the best answer below.) O A. If Karou defaulted on the bank auto loan and the bank repossessed her car, any loan balance remaining after the bank sold the car as well as any associated collection costs, selling costs and attorney fees would not be Karou's responsibility. She would have declined the deficiency payments clause of the loan when she signed the loan agreement OB. If Karou defaulted on the bank auto loan and the bank repossessed her car, any loan balance remaining after the bank sold the car as well as any associated collection costs selling costs and attorney fees would be Karou's responsibility She would have accepted the deficiency payments clause of the loan when she signed the loan agreement O C. If Karou defaulted on the bank auto loan and the bank repossessed her car, any loan balance remaining after the bank sold the car would not be Karou's responsibility. Any associated collection costs, selling costs and attorney fees would be Karou's responsibility, since she would have accepted the deficiency payments clause of the loan when she signed the loan agreement OD. If Karou defaulted on the bank auto loan and the bank repossessed her car any loan balance remaining after the bank sold the car would be Karou's responsibility. Any associated collection costs, selling costs and attorney fees would be waived by the deficiency payments clause of the loan in the loan agreement 5. Karou is considering different options for financing the $15,000 balance on her planned new car purchase. The cheapest advertised rate among the local banks is 7 percent for a 48-month car loan. The current rate on her revolving home equity line is 8.75 percent. Karou is in the 25 percent federal tax bracket and the 5.75 percent state tax bracket. a. Calculate Karou's monthly car payment using your financial calculator Compare the payment amount if she uses the 48-month car loan through her local bank versus her home equity line of credit. Assume both loans will amortize over 48 months, and use the simple interest method. b. What are Karou's income tax savings over the life of the loan if she chooses to use her home equity line of credit to finance the purchase of her new car? c. Which loan offers the lower payment? Which loan has the lower after-tax cost? Use this information to determine which loan she should choose. d. In a discussion with her father about financing her new car Karou was surprised to hear that he once financed a car with the add-on method of interest calculation. He planned to repay the $1,800 loan within 1 year but was able to do so after 9 months because of a bonus he earned at work. The interest rate was 6 percent. Calculate the monthly payments, as well as the final payment to pay off the loan. How much interest was "saved" or rebated, using this method of financing and the rule of 78s? e. Assume Karou's father could finance $1,800 today at 6 percent using the simple interest method of calculation. How much would the payments be? Calculate the final payment to pay off the loan in 9 months. How much interest was "saved"? f. Considering the information in parts (d) and (e), calculate the difference in finance charges assuming neither loan was paid off early g. Assuming Karou did not have access to a home equity line, what factors might she consider to reduce the lender's risk and therefore "buy" herself a lower-cost loan? (Hint: Consider Principle 8: Risk and retum go hand in hand) h. What is the collateral for each of the loans Karou is considering? If the bank repossessed her car, would she still have to repay her loan? Click on the table icon to view the MILPF table Peyn punde mon 7 13 NO 2 DS 4.00% 1681695.16873343120 2.6222561 216.58 12.67 12.19 4.2% 12TA12444435.19 29.642691030 Gus 13.70 20 A.COX GODSIDA BTK 3700 ST2976280TISATBT: 13190 PUZ 4.76% 1881 59 ST26742.73354229.00 292 13.766.99 14.02 12.6 6.00% 16911126161 57.76 42.67 25.80 29.27 23.03 1907 16.10 14.13 12.00 3.28% 16912 052 1.89 090 25.8.1 30.08 22.11.1999 1 14.25 12.70 6.00% 169.36 25.84 38.01 441036 TS 302022619.10 16.34 14.27 12.30 8.75% 169.47 BSLAG 58.1244213687 30.212.27 192 16.45 14.49 127.02 6.00% 169.00 B6.07 68.23 44.22 26.90 30.42 23.49 19.03 16.57 14.61 13.14 6.25% 169.72 86.18 58.34 44.43 36 09 30.5422.60 1946 16.69 14.73 1226 6.60% 189.84 2620 58.46 44.65 36 20 30.65 21.71 19.67 16.81 14 35 13.39 6.75% 169.90 86.41 58.57 44.66 36.22 20.76 23.83 19.68 16.92 14.97 13.51 7.00% 170.00 86.53 58.68 44.77 36 43 30.88 23.95 19.80 17.03 15 09 13.62 7.25% 170.21 86.64 58.80 44.8926.65 30.99 24.06|19.92 17.17 15 22 13.76 7.50% 170.3386.76 58.91 45.00 36.6G 31.1124.18 20.04 17.29 15.34 13.89 7.75% 17045 86 87 59.03 45.11 36.77 31.22 24.30 20.16 17.41 16.46 14.01 8.00% 1170.68 86.99 59.14 45 23 36.89 21.34 24.41 20 28 17.53 16.59 14.14 8.25% 170.70 87.10 59.25 45 34 37 00 21.45 24.5320 40|17.66 15.71 14 26 8.50% 170.82 87 22 59.37 45.4637 12 31.57 24.65 20:52 17.78 15.84 14.39 8.75% 170.95 37:34 59.4845 57 37 23 31.68 24 77 20764 17.90 15,96 14.52 9.009 17107 87 45 59.6045 68 27-3521 80 24,8920.76|18.03 16.0914.65 9.25 11.1987 57 59.7745.8027 4631.9225.00 20 88 18.15 16 22 14.79 9.5017932187 68159.8345.91 27258 02.03 25 1212100 18:27 16:34 12.911 9.75% 7142 87 B0 59.94 46.03 27.70 92 1525 2421.12 18.40 16.47|15.04 10.00% 07:56|87 92 60.06 46. 14 37 81 32 27.25 1621-25 12:53 16.60 15.17 10.25971.68 800360 1766 26272933239 254821 37 10.6516.7315 31 2003188 1560:2946382004427 502500229 18:23 16 30 15 10.7581719388 27160:4046 49 38. 1622 6225221 6212:91 169 16:57 100%|17205883960.5246810832912274253512174003122521 0125917218885060.63 46.723840 32 9025.9721 87|19. 10 17 25 15 34 11.5041723028.6260.75/46.249851229826092199 19 29 12 39 15.99 11.75*1724788.7360.87469638.63 1026 2122-12 19:42 1752|18. 12 12.00 12.55 38 85.60.984707275232120 22 24 1965 17 65 18 25 2.25*17673397161 1042 19 327122.3326,462 32 1931.79 16.39 1250172 089 0861 247 31398 13.4526 582250 19.01 17 92 16 53 12.755317292199 20 61.1347 42 39 19 1357 26 10 22 62 19.94 1805 16.67 13.00400730329 32 61 45 47 54 39 22 12 69 26 83 22 75/20 07 18. 1918. 21 13 25.9. 173. 17189 43 61 5607 6639.3423 812695 22 88 20:21 18 33 16.95 13. 5041 29 29 5561.6847 1839.463.94270821.01.2013 18.46 17.09 13.76373 4139.67 61 30 47 29 29.58 14 00 27 20 23 14 20.4718.60 17 23 4 004 1735499 7961 93 48 01 29.70 34 18 27.332327|20.61 18.74 1737 14.256173 00 99 90 52.03 48 13 39 82 14 3027 482040 20.74 18 880751 7450417379 00 02 62 1543 2539 94 14 42 27 18 23 5320 07 19 02 11 50 114 7648 17399190 1462 2748 1740 0614 5427 1023 662101 19 18 17 90 15.000 17403 90 20 52.38 48 4940 18 44 67 27 83 23 7921 19 30/17 95 15 2546 174 10 20 38 52 50 48 0140 30 34 7027 9623.02 21 20 19 44 18.08 15 Ba||174 20 90 4962 52 4872 10142 34.9128 08 24 052 42 19 18 1814 6 76017441 90.6102.7448 440 54150328 2024 1921 1920 Hal THI En hall Han ham 116.00% POLIANTTON OTETTIRETATTOOITE 16 DODOT DRITT IEELDEL2100TOIDU 10.SOSTIAC POZIT ECUTED 2002 16 COB 100 TODORE DULELGEDEON 117.259 176. LP12 GODADE 1999 2000 1997 7.SOSI TORBICULT 09001095.902112271279912 17.78 TOUOBUS GIGA120 26.02 292 EGG 20.7.1997 TBLOONIESIOG GODET720721921021972 18.259 1956.91 00 63.93 60.0241.76 26 28 29,5125.5322.98 21.16 19.99 18.30 TTT 197264.0450.17 41.8926.40 29.64 26 GT 22.0921 21 20.02 18.769 176 9092.04 64.16 50.29 422.01 36.52 29.77 25.80 22.2021,45 20:18 1.009: 1760292 16 64.28 50,41,42,13 26.GG 29.90 25.94 23.38 216120.22 PRS: 176 1592.28 64 40501532264.78 20:00 26.082.221.76 20.49 19.01.16 2792 40164 52 50 65 42 19 26 01 230 16 26 73222.CC 21.90120.14 159. 176 40 92 51 64.6450.74261 21.04.20.30126.35 22.8122 06 20.00 200096 6292 63 64.76.50.90426301 1630.4326 4923.95 22 21 20.95 20355. 176.65 93 75 64.885 1.02 42.75 37 2930.56 26.63 24. 10223621.11 20:50 176 92 97 65.0015014428827-4230 7026,77124.2422 5121 27 30.5176 9009299165 125 126 12:00131 55130.83120 924 39226232 300500293, 1165341503943.133 6830.97 27 05124-54292153 2355121593 235515151126203110210246839621 3032565959133122332122130 209765BB250GBB2822200 20057333965253102112122132 202176393.7155 251520763223162625272 82 225019331332025 27 09396 091225201230125932 2005.03 029408662323410321320528.1925.722 0523 56 228 159 206634525042322 1923125 72 2023 276 23 32 66 4652621439232332826 0 19 ZETO. 176.409 450 252 253 5239 103216225102 522135 26 OO. 178 5394 5666, 7052 37465323 3250277125.232 68 2,51 24 25.170.24 GB 6GB2152 0014782030374291 024 5.2104 24 BOB 24 HO 06 20/52. 12414913950220200001499219. 74 759 176 90 94 97 07 Ora 2015.03 21.02 203 204 205101 a. Calculate Karou's monthly car payment Compare the payment amount if she uses the 48-month car loan through her local bank versus her home equity line of credit. Assume both loans will amortize over 48 months and use the simple interest method. Using the 7 percent 48-month car loan of $15,000, Karou's monthly payment is $ (Round to the nearest cent) Using the 8.75 percent home equity line of credit, Karou's monthly payment is $ (Round to the nearest cent.) b. What is Karou's income tax savings over the life of the loan if she chooses to use her home equity line of credit to finance the purchase of her new car? If Karou chooses to use her home equity line to finance the purchase of the car, her income tax savings over the life of the loan will be $ (Round to the nearest cent.) c. Which loan offers the lower payment? Which loan has the lower after-tax cost? Use this information to determine which loan she should choose Which loan offers the lower payment? (Select the best choice below.) O A. The home equity line of credit offers the lower payment OB. The car loan offers the lower payment The after-tax interest rate of the car loan from the bank is % (Round to two decimal places.) The after-tax interest rate of the home equity line credit is %. (Round to two decimal places.) Karou should choose (Select the best choice below.) O A. the car loan. Although the stated interest rate and payments (from part a) for the car loan are higher it is actually cheaper, when the total interest costs and tax savings are compared OB. the home equity loan. Although the stated interest rate and payments (from part a) for the home equity loan are higher, it is Karou should choose: (Select the best choice below.) Print O A. the car loan. Although the stated interest rate and payments (from part a) for the car loan are higher, it is actually cheaper, when the total interest costs and tax savings are compared OB. the home equity loan. Although the stated interest rate and payments (from part a) for the home equity loan are higher, it is actually cheaper, when the total interest costs and tax savings are compared. O C. the home equity loan. Although the stated interest rate and payments (from part a) for the home equity loan are lower, it is actually more expensive, when the total interest costs and tax savings are compared. O D. the car loan. Although the stated interest rate and payments (from part a) for the car loan are lower, it is actually more expensive, when the total interest costs and tax savings are compared. d. In a discussion with her father about financing her new car Karou was surprised to hear that he once financed a car with the add-on method of interest calculation. He planned to repay the $1,800 loan within 1 year but was able to do so after 9 months because of a bonus he earned at work. The interest rate was 6 percent. Calculate the monthly payments, as well as the amount needed to pay off the loan after the 9th monthly payment. How much interest was "saved" or rebated, using this method of financing and the rule of 78s? (Round For a $1,800 car loan today at 6%, using the add-on method, Karou's father would've paid monthly payments of $ to the nearest cent) The amount of interest that was "saved" or rebated was $ (Round to the nearest cent) (Round to the nearest cent.) The final loan repayment would have been $ e. Assume Karou's father could finance $1,800 today at 6 percent using the simple interest method of calculation. How much would the payments be? Calculate the final payment to pay off the loan in 9 months. How much interest was "saved"? (Round to the nearest cent) Using the simple interest method, Karou's father would have paid a monthly payment of $ The final loan repayment would have been $ (Round to the nearest cent) The amount of interest "saved" would be 5 (Round to the nearest cent) f. Considering the information in parts (d) and (e), calculate the difference in finance charges assuming neither loan was paid off ea Print The difference in interest charges assuming neither loan was paid off early is $ (Round to the nearest cent) g. Assuming Karou did not have access to a home equity line, what factors might she consider to reduce the lender's risk and therefore, "buy" herself a lower-cost loan? (Hint Consider Principle 8. Risk and return go hand in hand.) (Select all the choices that apply.) A. Paying a large down payment reduces the amount financed, which also increases the lender's risk of full payment should Karou default and the car be repossessed B. Paying a large down payment reduces the amount financed, which also reduces the lender's risk of full payment should Karou default and the car be repossessed. C. Choosing a variable-rate loan to share with the lender the risk of rising interest rates D. Keeping the term of the loan as short as possible, this reduces the lender's risk of Karou defaulting on the loan or making late payments E. Keeping the term of the loan as long as possible; this reduces the lender's risk of Karou defaulting on the loan or making late payments OF. Maintaining a strong credit report and higher FICO score; this reduces lender risk and allows Karou to "buy" a lower interest rate h. What is the collateral for each of the loans Karou is considering? Print (Select the best answer below.) O A. Neither loan requires collateral because Karou owns her own home. Both lenders consider her to be a responsible person who always pays her debts. OB. The bank loan is secured by Karou's home; in other words, the home is the collateral. The collateral for the home equity loan is Karou's car, therefore, should she default on her auto payments, her car is at risk. O C. The bank loan is secured by the car, in other words, the car is the collateral. The collateral for the home equity loan is the car, therefore should she default on her auto payments, the home equity lender will add the loan amount for the car on to Karou's mortgage OD. The bank loan is secured by the car, in other words, the car is the collateral. The collateral for the home equity loan is Karou's home, therefore, should she default on her home equity loan payments because of additional borrowing to purchase her car, her home is at risk. If the bank repossessed her car, would she still have to repay her loan? (Select the best answer below.) O A. If Karou defaulted on the bank auto loan and the bank repossessed her car, any loan balance remaining after the bank sold the car as well as any associated collection costs, selling costs and attorney fees would not be Karou's responsibility. She would have declined the deficiency payments clause of the loan when she signed the loan agreement OB. If Karou defaulted on the bank auto loan and the bank repossessed her car, any loan balance remaining after the bank sold the car as well as any associated collection costs selling costs and attorney fees would be Karou's responsibility She would have accepted the deficiency payments clause of the loan when she signed the loan agreement O C. If Karou defaulted on the bank auto loan and the bank repossessed her car, any loan balance remaining after the bank sold the car would not be Karou's responsibility. Any associated collection costs, selling costs and attorney fees would be Karou's responsibility, since she would have accepted the deficiency payments clause of the loan when she signed the loan agreement OD. If Karou defaulted on the bank auto loan and the bank repossessed her car any loan balance remaining after the bank sold the car would be Karou's responsibility. Any associated collection costs, selling costs and attorney fees would be waived by the deficiency payments clause of the loan in the loan agreement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts