Question: 5. Key performance measures Measuring Stock Performance An informed and prudent investor uses a variety of measures such as financial rations, book value, earnings per

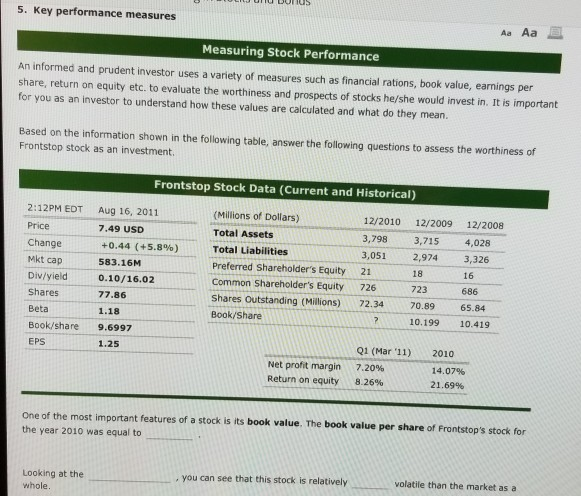

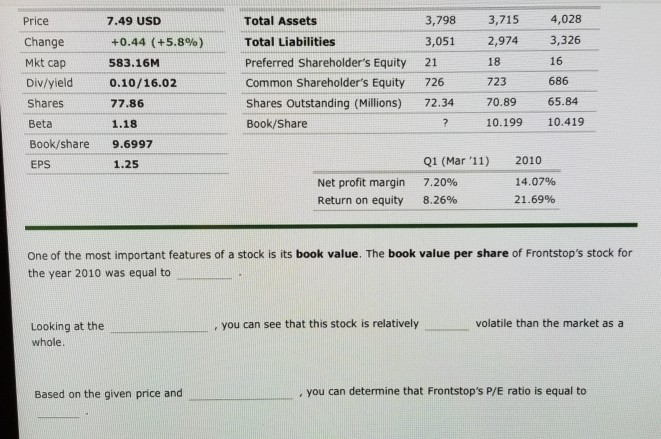

5. Key performance measures Measuring Stock Performance An informed and prudent investor uses a variety of measures such as financial rations, book value, earnings per share, return on equity etc. to evaluate the worthiness and prospects of stocks he/she would invest in. It is important for you as an investor to understand how these values are calculated and what do they mean. Based on the information shown in the following table, answer the following questions to assess the worthiness of Frontstop stock as an investment Frontstop Stock Data (Current and Historical) 2:12PM EDT Price Change Mkt cap Div/yield Shares Beta Book/share EPS Aug 16, 2011 7.49 USD +0.44 (+5.890) 583.16M 0.10/16.02 77.86 1.18 9.6997 1.25 (Millions of Dollars) Total Assets Total Liabilities Preferred Shareholder's Equity 21 Common Shareholder's Equity 726 Shares Outstanding (Millions)72.3470.89 Book/Share 12/2010 12/2009 12/2008 3,798 3,715 4,028 3,051 2,974 3,326 18 16 686 65.84 723 10.199 10.419 Net profit margin Return on equity Q1 (Mar 11) 2010 7.20% 8.26% 14.07% 21.69% One of the most important features of a stock is its book value. The book value per share of Frontstop's stock for the year 2010 was equal to , you can see that this stock is relatively volatile than the market as a Looking at the whole Price Change Mkt cap Div/yield 0.10/16.02 Shares Beta Book/share 9.6997 EPS Total Assets Total Liabilities Preferred Shareholder's Equity Common Shareholder's Equity Shares Outstanding (Millions) Book/Share 3,798 3,715 4,028 3,051 2,974 3,326 21 726 72.34 7.49 USD +0.44 (+5.890) 583.16M 18 723 70.89 16 686 65.84 77.86 1.18 10.199 10.419 Q1 (Mar 11) 2010 7.20% 8.26% 1.25 Net profit margin Return on equity 14.07% 21 .69% One of the most important features of a stock is its book value. The book value per share of Frontstop's stock for the year 2010 was equal to , you can see that this stock is relatively volatile than the market as a Looking at the whole. Based on the given price and , you can determine that Frontstop's P/E ratio is equal to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts