Question: 5. LeCompte Learning Solutions is considering making a change to its capital structure in hopes of increasing its value. The company's capital structure consists of

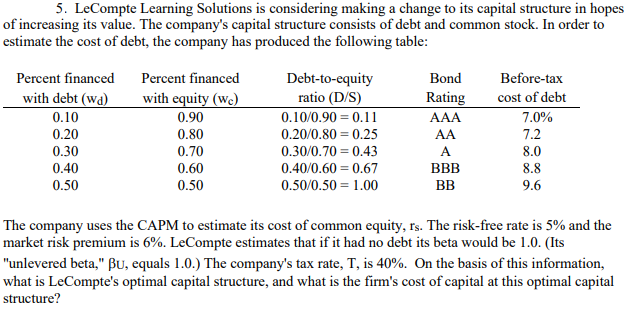

5. LeCompte Learning Solutions is considering making a change to its capital structure in hopes of increasing its value. The company's capital structure consists of debt and common stock. In order to estimate the cost of debt, the company has produced the following table: Percent financed with debt (wd) 0.10 0.20 0.30 0.40 0.50 Percent financed with equity (we) 0.90 0.80 0.70 0.60 0.50 Debt-to-equity ratio (D/S) 0.10/0.90 = 0.11 0.20/0.80 = 0.25 0.30/0.70 = 0.43 0.40/0.60 = 0.67 0.50/0.50 = 1.00 Bond Rating AAA AA A BBB Before-tax cost of debt 7.0% 7.2 8.0 8.8 9.6 BB The company uses the CAPM to estimate its cost of common equity, rs. The risk-free rate is 5% and the market risk premium is 6%. LeCompte estimates that if it had no debt its beta would be 1.0. (Its "unlevered beta," Bu, equals 1.0.) The company's tax rate, T, is 40%. On the basis of this information, what is LeCompte's optimal capital structure, and what is the firm's cost of capital at this optimal capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts