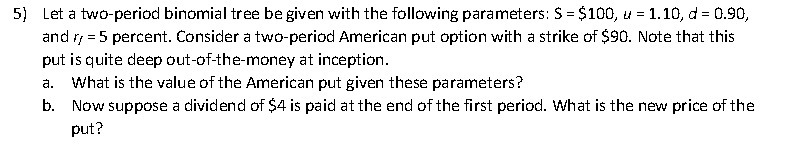

Question: 5) Let a two-period binomial tree be given with the following parameters: S = $100, u = 1.10, d= = 0.90, and ry =

5) Let a two-period binomial tree be given with the following parameters: S = $100, u = 1.10, d= = 0.90, and ry = 5 percent. Consider a two-period American put option with a strike of $90. Note that this put is quite deep out-of-the-money at inception. a. What is the value of the American put given these parameters? b. Now suppose a dividend of $4 is paid at the end of the first period. What is the new price of the put?

Step by Step Solution

There are 3 Steps involved in it

a To value the American put option using the twoperiod binomial tree model we can first calculate th... View full answer

Get step-by-step solutions from verified subject matter experts