Question: 5. (Loans with collateral value, in Final 2020) Consider the commercial bank's liquidity man- agement problem in a three-period model. At period 0, the bank's

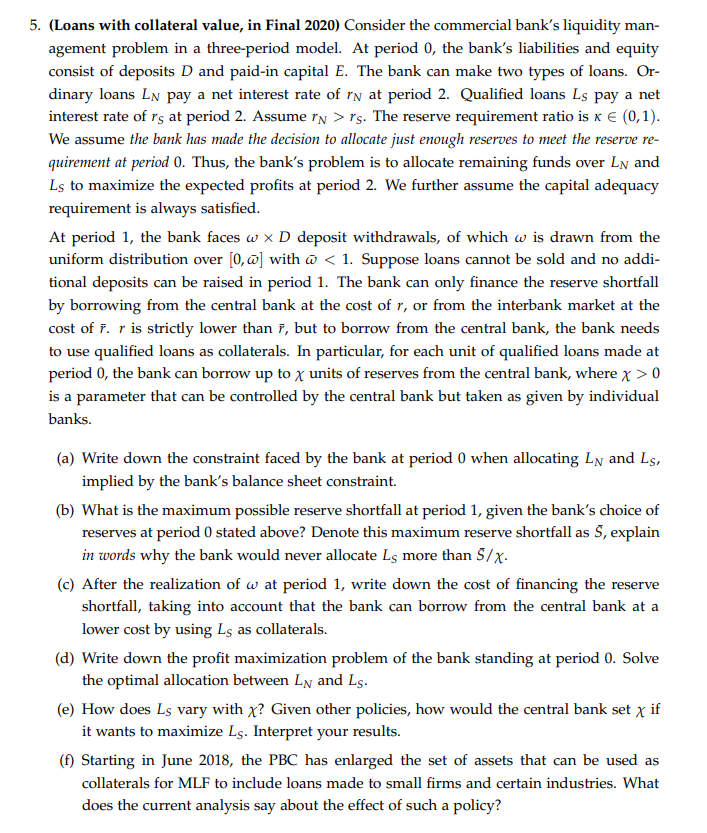

5. (Loans with collateral value, in Final 2020) Consider the commercial bank's liquidity man- agement problem in a three-period model. At period 0, the bank's liabilities and equity consist of deposits D and paid-in capital E. The bank can make two types of loans. Or- dinary loans LN pay a net interest rate of rN at period 2. Qualified loans Ls pay a net interest rate of rs at period 2. Assume rN> rs. The reserve requirement ratio is x (0,1). We assume the bank has made the decision to allocate just enough reserves to meet the reserve re- quirement at period 0. Thus, the bank's problem is to allocate remaining funds over LN and Ls to maximize the expected profits at period 2. We further assume the capital adequacy requirement is always satisfied. At period 1, the bank faces w x D deposit withdrawals, of which w is drawn from the uniform distribution over [0,@] with @ 0 is a parameter that can be controlled by the central bank but taken as given by individual banks. (a) Write down the constraint faced by the bank at period 0 when allocating LN and Ls, implied by the bank's balance sheet constraint. (b) What is the maximum possible reserve shortfall at period 1, given the bank's choice of reserves at period 0 stated above? Denote this maximum reserve shortfall as 5, explain in words why the bank would never allocate Ls more than 5/x. (c) After the realization of w at period 1, write down the cost of financing the reserve shortfall, taking into account that the bank can borrow from the central bank at a lower cost by using Ls as collaterals. (d) Write down the profit maximization problem of the bank standing at period 0. Solve the optimal allocation between LN and Ls. (e) How does Ls vary with x? Given other policies, how would the central bank set x if it wants to maximize Ls. Interpret your results. (f) Starting in June 2018, the PBC has enlarged the set of assets that can be used as collaterals for MLF to include loans made to small firms and certain industries. What does the current analysis say about the effect of such a policy? 5. (Loans with collateral value, in Final 2020) Consider the commercial bank's liquidity man- agement problem in a three-period model. At period 0, the bank's liabilities and equity consist of deposits D and paid-in capital E. The bank can make two types of loans. Or- dinary loans LN pay a net interest rate of rN at period 2. Qualified loans Ls pay a net interest rate of rs at period 2. Assume rN> rs. The reserve requirement ratio is x (0,1). We assume the bank has made the decision to allocate just enough reserves to meet the reserve re- quirement at period 0. Thus, the bank's problem is to allocate remaining funds over LN and Ls to maximize the expected profits at period 2. We further assume the capital adequacy requirement is always satisfied. At period 1, the bank faces w x D deposit withdrawals, of which w is drawn from the uniform distribution over [0,@] with @ 0 is a parameter that can be controlled by the central bank but taken as given by individual banks. (a) Write down the constraint faced by the bank at period 0 when allocating LN and Ls, implied by the bank's balance sheet constraint. (b) What is the maximum possible reserve shortfall at period 1, given the bank's choice of reserves at period 0 stated above? Denote this maximum reserve shortfall as 5, explain in words why the bank would never allocate Ls more than 5/x. (c) After the realization of w at period 1, write down the cost of financing the reserve shortfall, taking into account that the bank can borrow from the central bank at a lower cost by using Ls as collaterals. (d) Write down the profit maximization problem of the bank standing at period 0. Solve the optimal allocation between LN and Ls. (e) How does Ls vary with x? Given other policies, how would the central bank set x if it wants to maximize Ls. Interpret your results. (f) Starting in June 2018, the PBC has enlarged the set of assets that can be used as collaterals for MLF to include loans made to small firms and certain industries. What does the current analysis say about the effect of such a policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts