Question: 5. Local Waterville bakery Universal Bread Bakers (UBB) has asked you, the JanPlan intern, to evaluate an expansion proposal. UBB wants to borrow $1 million

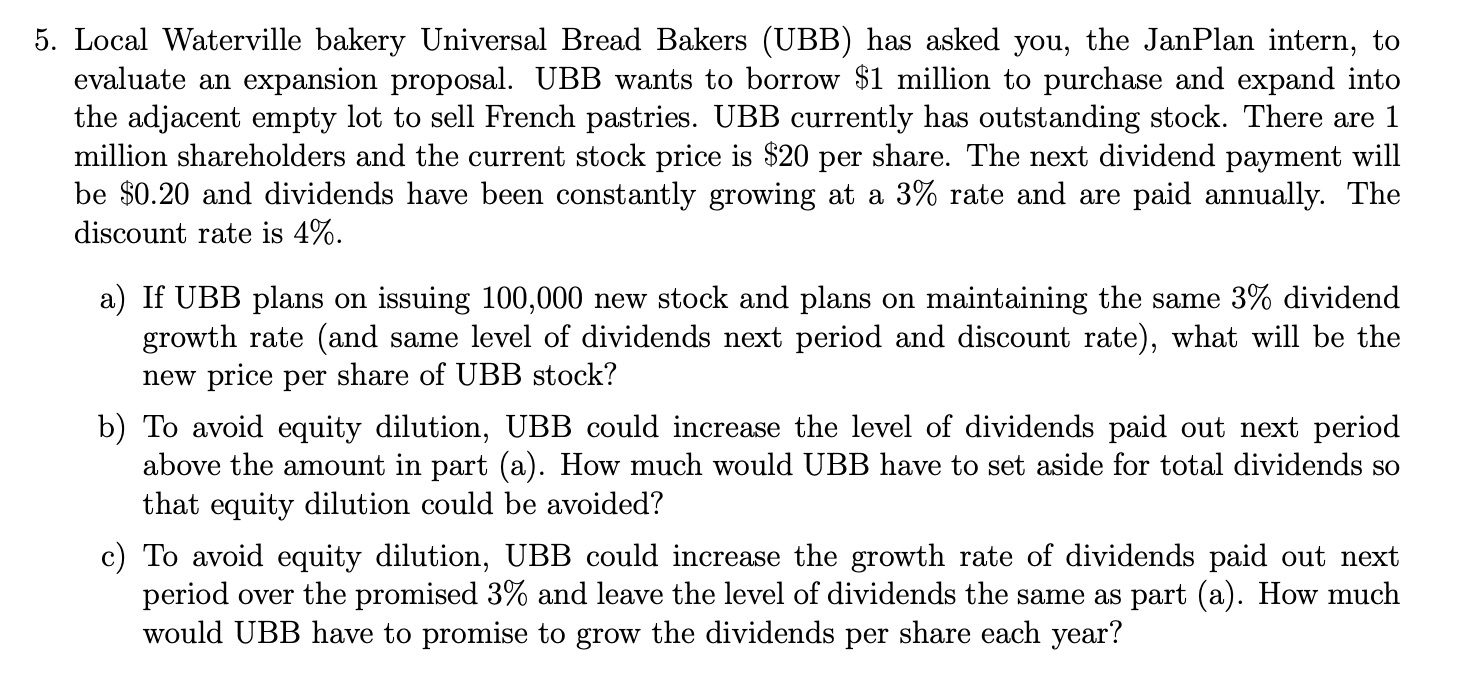

5. Local Waterville bakery Universal Bread Bakers (UBB) has asked you, the JanPlan intern, to evaluate an expansion proposal. UBB wants to borrow $1 million to purchase and expand into the adjacent empty lot to sell French pastries. UBB currently has outstanding stock. There are 1 million shareholders and the current stock price is $20 per share. The next dividend payment will be $0.20 and dividends have been constantly growing at a 3% rate and are paid annually. The discount rate is 4%. a) If UBB plans on issuing 100,000 new stock and plans on maintaining the same 3% dividend growth rate (and same level of dividends next period and discount rate), what will be the new price per share of UBB stock? b) To avoid equity dilution, UBB could increase the level of dividends paid out next period above the amount in part (a). How much would UBB have to set aside for total dividends so that equity dilution could be avoided? c) To avoid equity dilution, UBB could increase the growth rate of dividends paid out next period over the promised 3% and leave the level of dividends the same as part (a). How much would UBB have to promise to grow the dividends per share each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts