Question: 5 Malling Review View Tell me A 3 E > AL Aalbodde Aanbodde EMER AaBbc Dc , Normal No Spacing Heading 1 5 4 Q5.

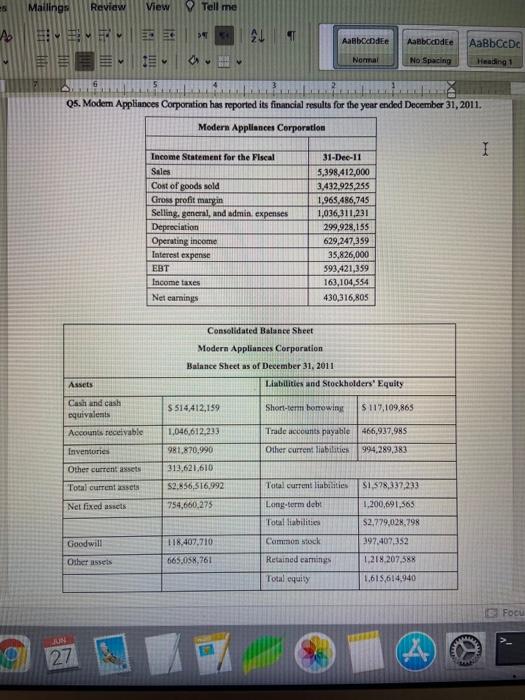

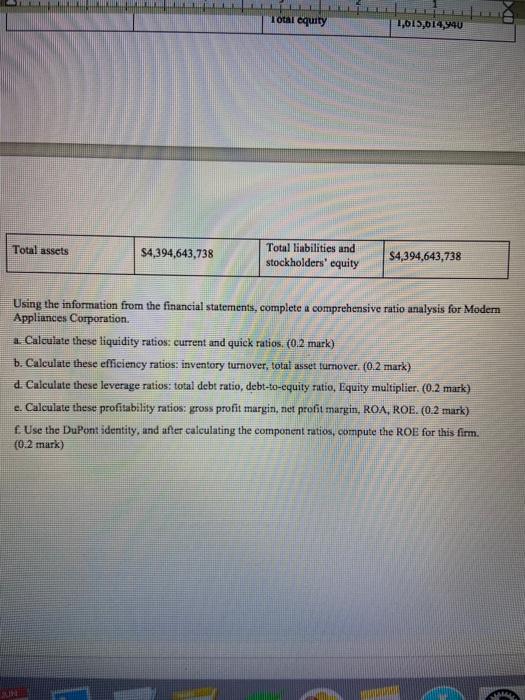

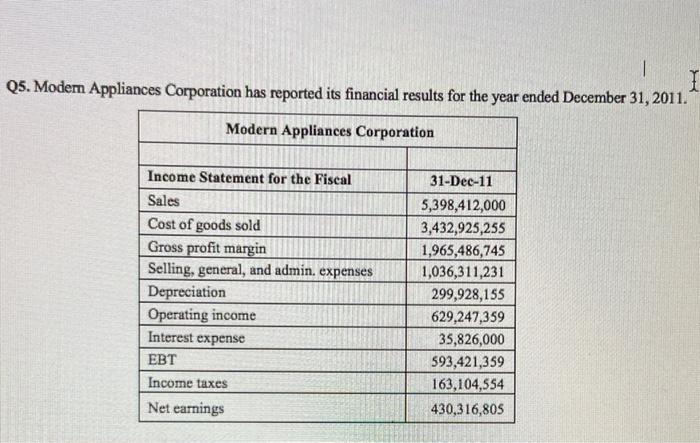

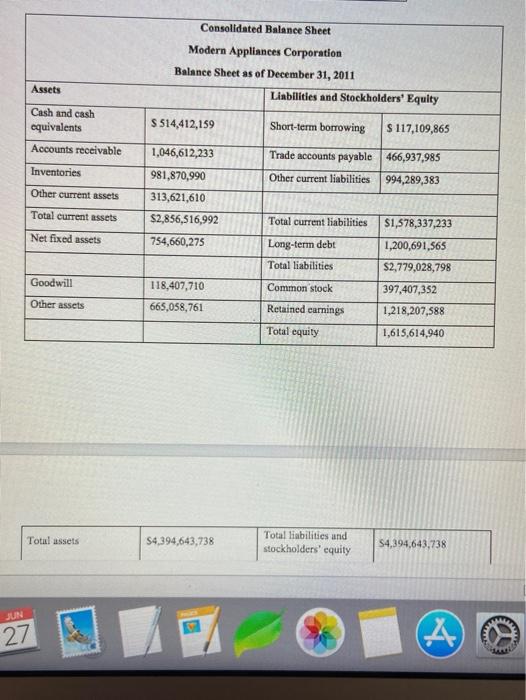

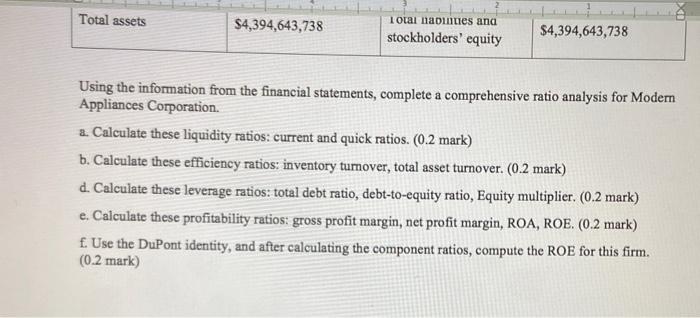

5 Malling Review View Tell me A 3 E > AL Aalbodde Aanbodde EMER AaBbc Dc , Normal No Spacing Heading 1 5 4 Q5. Modem Appliances Corporation has reported its financial results for the year ended December 31, 2011. Modern Appliances Corporation I Income Statement for the Fiscal 31-Dec-11 Sales 5,398,412,000 Cost of goods sold 3.432.925,255 Gross profit margin 1.965,486,745 Selling, general, and admin. expenses 1,036,311,231 Depreciation 299,928,155 Operating income 629,247,359 35,826,000 EBT 593.421,359 Income taxes 163,104,554 Net earnings 430,316,80S Interest expense Consolidated Balance Sheet Modern Appliances Corporation Balance Sheet as of December 31, 2011 Liabilities and Stockholders' Equity Assets $ 514,412,159 Short-term borrowing $117,109,863 Cast and cash equivalents Accounts receivable Trade accounts payable 466.937.985 1,046,612,233 981.870.990 Inventories Other current liabilities 994,289,383 Other current assets 312.621.610 S2.856,516,992 Total current asset Total current liabilities Net fixed assets 754,660,275 Long-term debt Total liabilities S1.578,337,233 1,200,691,565 $2.779,028,798 Goodwill Cammon stock 118,407,710 665,058,761 397.407.352 1.218 207,388 Other sets Retained earnings Total equity 1.615,614,940 Focu UN 27 2. Total equity 1,615,014,740 Total assets $4,394,643,738 Total liabilities and stockholders' equity $4,394,643,738 Using the information from the financial statements, complete a comprehensive ratio analysis for Modem Appliances Corporation. 1. Calculate these liquidity rutios: current and quick ratios (0.2 mark) b. Calculate these efficiency ratios: inventory turnover, total asset turnover. (0.2 mark) d. Calculate these leverage ratios: total debt ratio, debt-to-equity ratio, Equity multiplier. (0.2 mark) e. Calculate these profitability ratios: gross profit margin. niet profit margin, ROA, ROE. (0.2 mark) f Use the DuPont identity, and after calculating the component ratios, compute the ROE for this firm. (0.2 mark) UH I Q5. Modem Appliances Corporation has reported its financial results for the year ended December 31, 2011. Modern Appliances Corporation Income Statement for the Fiscal Sales Cost of goods sold Gross profit margin Selling, general, and admin. expenses Depreciation Operating income Interest expense EBT Income taxes Net earnings 31-Dec-11 5,398,412,000 3,432,925,255 1,965,486,745 1,036,311,231 299,928,155 629.247,359 35,826,000 593,421,359 163,104,554 430,316,805 Consolidated Balance Sheet Modern Appliances Corporation Balance Sheet as of December 31, 2011 Liabilities and Stockholders' Equity Assets Cash and cash equivalents Accounts receivable $ 514,412,159 Short-term borrowing $ 117,109,865 Inventories 1,046,612,233 981,870,990 313,621,610 $2,856,516,992 Trade accounts payable 466,937,985 Other current liabilities 994,289,383 Other current assets Total current assets Total current liabilities Net fixed assets 754,660,275 Long-term debt Total liabilities $1,578,337,233 1,200,691,565 $2,779,028,798 397,407,352 1,218,207,588 Goodwill 118,407,710 Common stock Other assets 665,058,761 Retained earnings Total equity 1,615,614,940 Total assets $4,394,643,738 Total liabilities and stockholders' equity 54,394,643,738 JUN 27 A Total assets $4,394,643,738 1 otai naduties and stockholders' equity $4,394,643,738 Using the information from the financial statements, complete a comprehensive ratio analysis for Modern Appliances Corporation. a. Calculate these liquidity ratios: current and quick ratios. (0.2 mark) b. Calculate these efficiency ratios: inventory turnover, total asset turnover. (0.2 mark) d. Calculate these leverage ratios: total debt ratio, debt-to-equity ratio, Equity multiplier. (0.2 mark) e. Calculate these profitability ratios: gross profit margin, net profit margin, ROA, ROE. (0.2 mark) f. Use the DuPont identity, and after calculating the component ratios, compute the ROE for this firm. (0.2 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts