Question: (5 marks) QUESTION 4 (25 MARKS) (UNIT 2) a) Discuss on how a bond issuer decides on the appropriate coupon rate to set on its

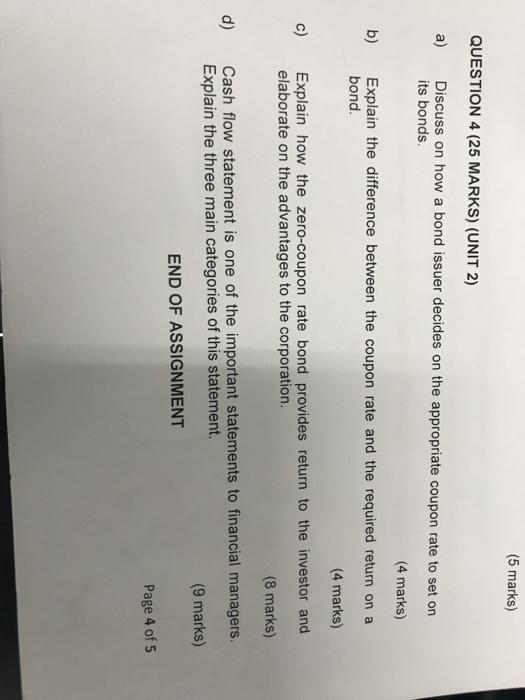

(5 marks) QUESTION 4 (25 MARKS) (UNIT 2) a) Discuss on how a bond issuer decides on the appropriate coupon rate to set on its bonds. (4 marks) b) Explain the difference between the coupon rate and the required return on a bond. (4 marks) c) Explain how the zero-coupon rate bond provides return to the investor and elaborate on the advantages to the corporation (8 marks) d) Cash flow statement is one of the important statements to financial managers. Explain the three main categories of this statement. (9 marks) END OF ASSIGNMENT Page 4 of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts