Question: (5 marks) The following is a modified/simplified excerpt from the indenture of S year unsecured notes issued by Cequence Energy Inc. (TSX: CQE) in October

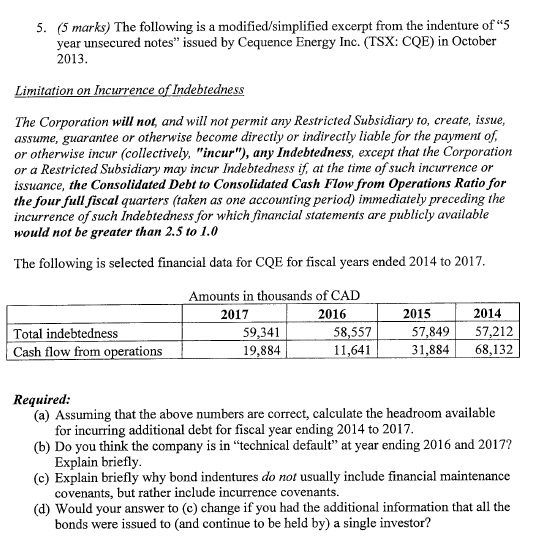

(5 marks) The following is a modified/simplified excerpt from the indenture of "S year unsecured notes" issued by Cequence Energy Inc. (TSX: CQE) in October 2013 5. itation on ence of Indebtedness The Corporation will not, and will not permit any Restricted Subsidiary to, create, issue, assume, guarantee or otherwise become directly or indirectly liable for the payment of or otherwise incur (collectively, "incur"), any Indebtedness, except that the Corporation or a Restricted Subsidiary may incur Indebtedness if, at the time of such incurrence or issuance, the Consolidated Debt to Consolidated Cash Flow from Operations Ratio for the four full fiscal quarters (taken as one accounting period) immediately preceding the incurrence of such Indebtedness for which financial statements are publicly available would not be greater than 2.5 to 1.0 The following is selected financial data for CQE for fiscal years ended 2014 to 2017 Amounts in thousands of CAD 2017 2016 2015 2014 Total indebtedness Cash flow from o 59.341 19.884 58,557 11,641 57,849 57,212 31,88468,132 ons Required: (a) Assuming that the above numbers are correct, calculate the headroom available (b) Do you think the company is in "technical default" at year ending 2016 and 2017? (c) Explain briefly why bond indentures do not usually include financial maintenance (d) Would your answer to (c) change if you had the additional information that all the for incurring additional debt for fiscal year ending 2014 to 2017 Explain briefly covenants, but rather include incurrence covenants. bonds were issued to (and continue to be held by) a single investor? (5 marks) The following is a modified/simplified excerpt from the indenture of "S year unsecured notes" issued by Cequence Energy Inc. (TSX: CQE) in October 2013 5. itation on ence of Indebtedness The Corporation will not, and will not permit any Restricted Subsidiary to, create, issue, assume, guarantee or otherwise become directly or indirectly liable for the payment of or otherwise incur (collectively, "incur"), any Indebtedness, except that the Corporation or a Restricted Subsidiary may incur Indebtedness if, at the time of such incurrence or issuance, the Consolidated Debt to Consolidated Cash Flow from Operations Ratio for the four full fiscal quarters (taken as one accounting period) immediately preceding the incurrence of such Indebtedness for which financial statements are publicly available would not be greater than 2.5 to 1.0 The following is selected financial data for CQE for fiscal years ended 2014 to 2017 Amounts in thousands of CAD 2017 2016 2015 2014 Total indebtedness Cash flow from o 59.341 19.884 58,557 11,641 57,849 57,212 31,88468,132 ons Required: (a) Assuming that the above numbers are correct, calculate the headroom available (b) Do you think the company is in "technical default" at year ending 2016 and 2017? (c) Explain briefly why bond indentures do not usually include financial maintenance (d) Would your answer to (c) change if you had the additional information that all the for incurring additional debt for fiscal year ending 2014 to 2017 Explain briefly covenants, but rather include incurrence covenants. bonds were issued to (and continue to be held by) a single investor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts