Question: 5. MC Construction Corp. started constructing a commercial building in August 2022 with a contract price of P5,000,000. Total estimated costs amounted to P3,500,000.

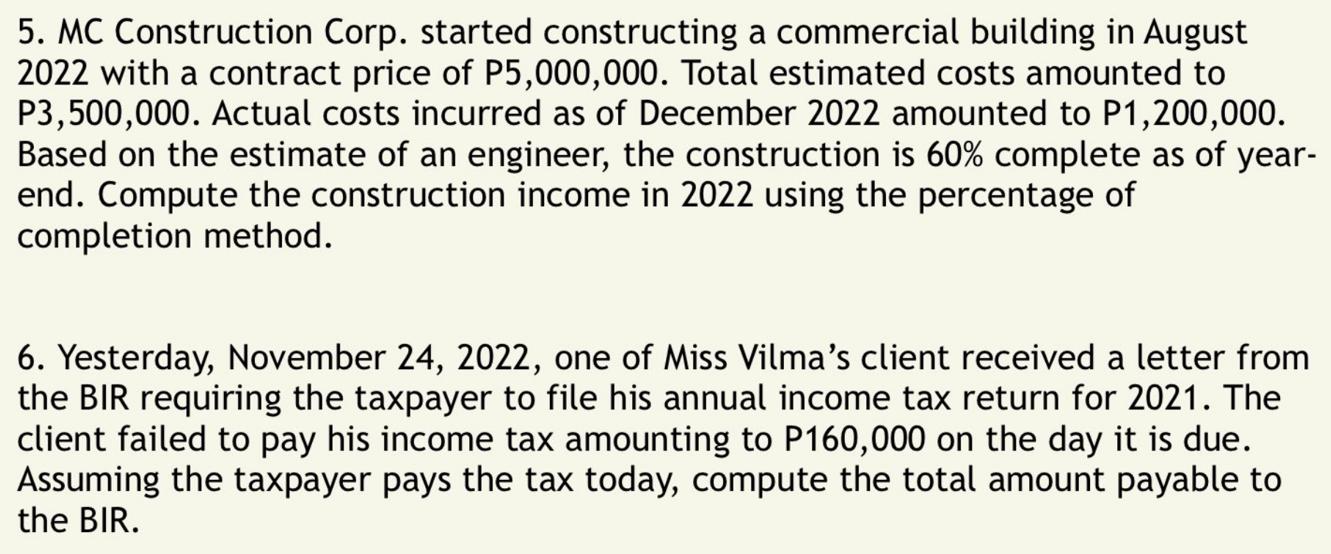

5. MC Construction Corp. started constructing a commercial building in August 2022 with a contract price of P5,000,000. Total estimated costs amounted to P3,500,000. Actual costs incurred as of December 2022 amounted to P1,200,000. Based on the estimate of an engineer, the construction is 60% complete as of year- end. Compute the construction income in 2022 using the percentage of completion method. 6. Yesterday, November 24, 2022, one of Miss Vilma's client received a letter from the BIR requiring the taxpayer to file his annual income tax return for 2021. The client failed to pay his income tax amounting to P160,000 on the day it is due. Assuming the taxpayer pays the tax today, compute the total amount payable to the BIR.

Step by Step Solution

There are 3 Steps involved in it

5 The percentage of completion method uses the percentage of completion of a construction project as ... View full answer

Get step-by-step solutions from verified subject matter experts