Question: 5. Merger analysis - Adjusted present value (APV) approach Wisget Corp, which is considering the acqulsition of Global Sateilte Corp. (GSC), estimates that acquiring GSC

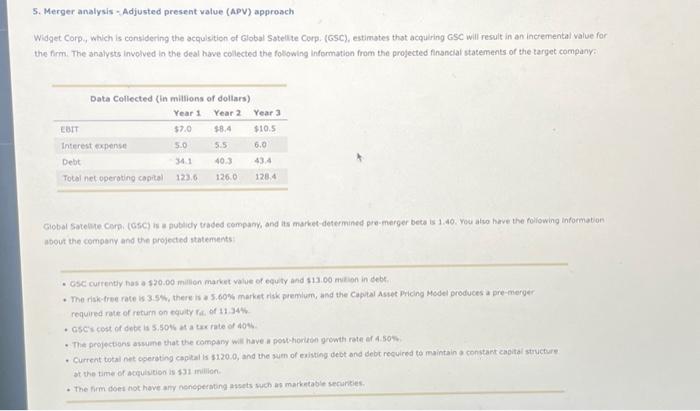

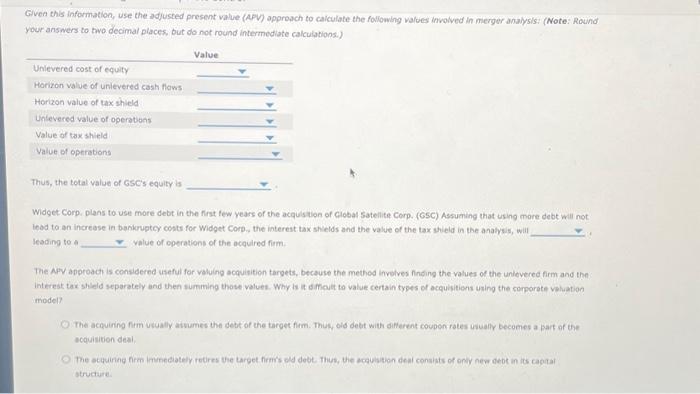

5. Merger analysis - Adjusted present value (APV) approach Wisget Corp, which is considering the acqulsition of Global Sateilte Corp. (GSC), estimates that acquiring GSC will result in an incremental value for the firm. The analysts inveived in the deal have collected the following information from the projected financiat statements of the target company: Giobal Sateme Corp. (GSC) is a publidy thaded cempank, and its market-determined pre-merger beca is 1.40 . You atso have the foliowing information woout the comeenv and the projected statements - Csc currenty has a 520.00 millon market value of equity and 813.00 mution in sebe - The risk-tree rate w 3.5\%, there is a 5.60% markat risk premlum, and the Cappal Asset Pricing Model produces a pre-merger require rate of return on equity fac of 11344 - 05crs cost of dete ia 5.5046 at a tux rate of 404. - The peojectans assume that the company wil have a poubhoruten growth rete ar 4.505 - Current total net cperating cepial is 1120.0 , and the sum of esivting debt ond debt recuired to maintain a constart eabital structure ot the time of actulution is 131 inillion- - The firm doet not hove any nonoperating avsets wion as marketable secuncies. Given this information, use the adjusted present value (APV) approwch to calculate the following valoes involved in mierger anablsis: (Note: Round your answers to two decimal places, but do not round intermodiate calculations.) Thus, the total value of Gse's equity is Widget Corp. plans to use more debt in the first few years of the acqulstion of clobal Satelite Corp. (GSC) Assuching that using more debt will not. lead to an increase in bankruptcy costs for Widget Core. the interest tax shelds and the value of the tax shield in the analysis, wiil lesding to 10 value of operations of the acquired firm. The AFy appreach is considered useful for valuing acquisition targets, because the method involves finding the values of the unlovered firm and the interest tax shleld separately and then summing those values. Why is it diment to value certain types of acquasitions using the corporate valuation imodel? The achuiring fim viually aivames the debt of the target fimm. Thik, old debt with diflerent cocponrates unually becomes a kart of the scouistion deal. atructuati. 5. Merger analysis - Adjusted present value (APV) approach Wisget Corp, which is considering the acqulsition of Global Sateilte Corp. (GSC), estimates that acquiring GSC will result in an incremental value for the firm. The analysts inveived in the deal have collected the following information from the projected financiat statements of the target company: Giobal Sateme Corp. (GSC) is a publidy thaded cempank, and its market-determined pre-merger beca is 1.40 . You atso have the foliowing information woout the comeenv and the projected statements - Csc currenty has a 520.00 millon market value of equity and 813.00 mution in sebe - The risk-tree rate w 3.5\%, there is a 5.60% markat risk premlum, and the Cappal Asset Pricing Model produces a pre-merger require rate of return on equity fac of 11344 - 05crs cost of dete ia 5.5046 at a tux rate of 404. - The peojectans assume that the company wil have a poubhoruten growth rete ar 4.505 - Current total net cperating cepial is 1120.0 , and the sum of esivting debt ond debt recuired to maintain a constart eabital structure ot the time of actulution is 131 inillion- - The firm doet not hove any nonoperating avsets wion as marketable secuncies. Given this information, use the adjusted present value (APV) approwch to calculate the following valoes involved in mierger anablsis: (Note: Round your answers to two decimal places, but do not round intermodiate calculations.) Thus, the total value of Gse's equity is Widget Corp. plans to use more debt in the first few years of the acqulstion of clobal Satelite Corp. (GSC) Assuching that using more debt will not. lead to an increase in bankruptcy costs for Widget Core. the interest tax shelds and the value of the tax shield in the analysis, wiil lesding to 10 value of operations of the acquired firm. The AFy appreach is considered useful for valuing acquisition targets, because the method involves finding the values of the unlovered firm and the interest tax shleld separately and then summing those values. Why is it diment to value certain types of acquasitions using the corporate valuation imodel? The achuiring fim viually aivames the debt of the target fimm. Thik, old debt with diflerent cocponrates unually becomes a kart of the scouistion deal. atructuati

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts