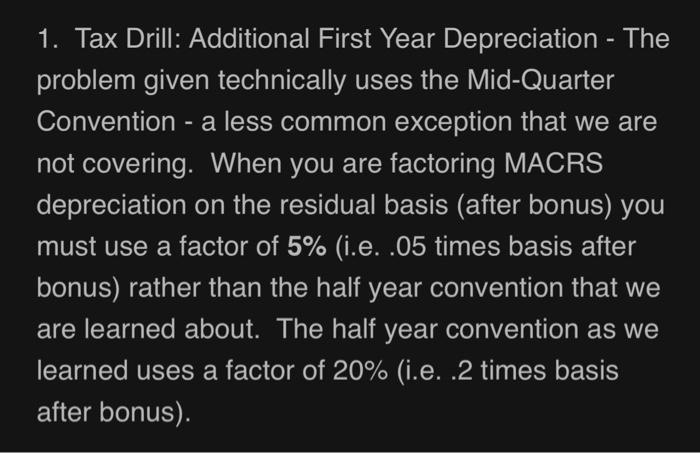

Question: ****** 5% not 20% ******* look at both photos please Tax Drill - Additional First-year Depreciation Diana acquires and places in service a 5 -year

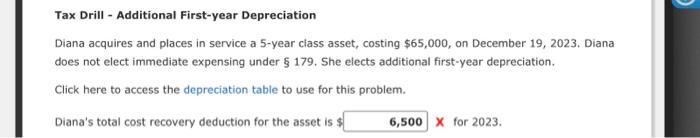

Tax Drill - Additional First-year Depreciation Diana acquires and places in service a 5 -year class asset, costing $65,000, on December 19, 2023. Diana does not elect immediate expensing under $179. She elects additional first-year depreciation. Click here to access the depreciation table to use for this problem. Diana's total cost recovery deduction for the asset is $ X for 2023 . 1. Tax Drill: Additional First Year Depreciation - The problem given technically uses the Mid-Quarter Convention - a less common exception that we are not covering. When you are factoring MACRS depreciation on the residual basis (after bonus) you must use a factor of 5% (i.e. .05 times basis after bonus) rather than the half year convention that we are learned about. The half year convention as we learned uses a factor of 20% (i.e. . 2 times basis after bonus)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts