Question: 5. Now, run the Empirical CAPM model, where the dependent variable ( y-variable) is the NPI (or NAREIT) minus the treasury rate, and where the

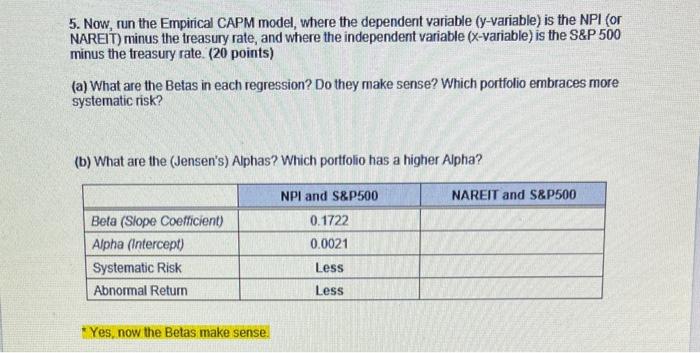

5. Now, run the Empirical CAPM model, where the dependent variable ( y-variable) is the NPI (or NAREIT) minus the treasury rate, and where the independent variable ( x-variable) is the S\&P 500 minus the treasury rate. ( 20 points) (a) What are the Betas in each regression? Do they make sense? Which portfolio embraces more systematic risk? (b) What are the (Jensen's) Alphas? Which portfolio has a higher Alpha? - Yes, now the Betas make sense. 5. Now, run the Empirical CAPM model, where the dependent variable ( y-variable) is the NPI (or NAREIT) minus the treasury rate, and where the independent variable ( x-variable) is the S\&P 500 minus the treasury rate. ( 20 points) (a) What are the Betas in each regression? Do they make sense? Which portfolio embraces more systematic risk? (b) What are the (Jensen's) Alphas? Which portfolio has a higher Alpha? - Yes, now the Betas make sense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts