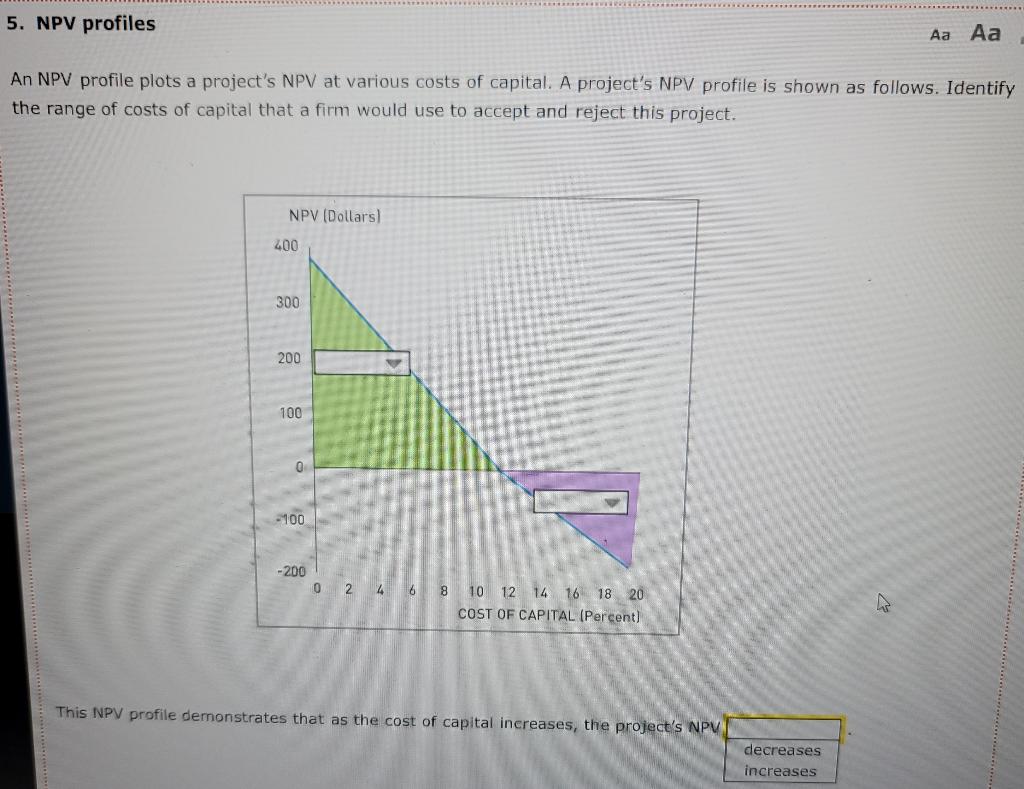

Question: 5. NPV profiles Aa Aa An NPV profile plots a project's NPV at various costs of capital. A project's NPV profile is shown as follows.

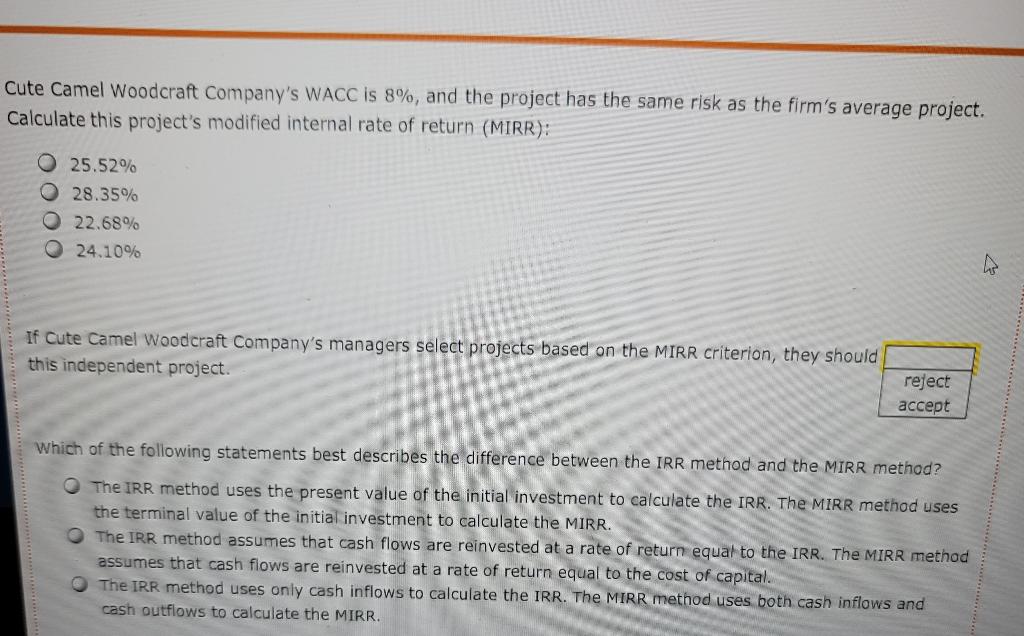

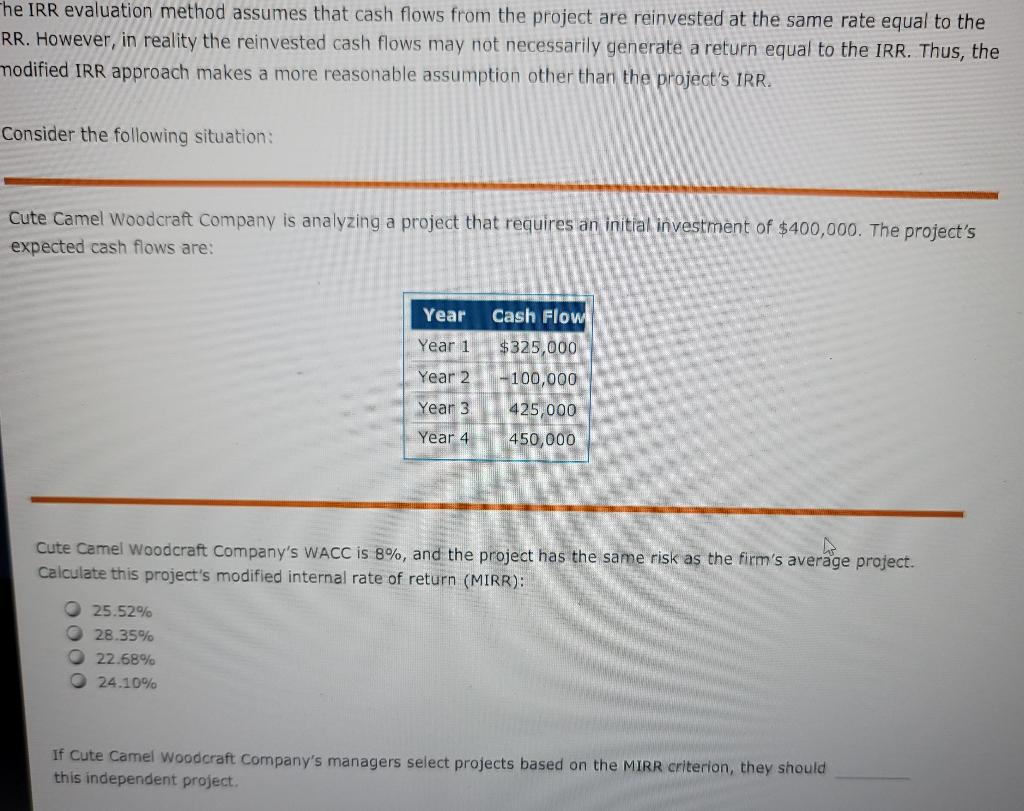

5. NPV profiles Aa Aa An NPV profile plots a project's NPV at various costs of capital. A project's NPV profile is shown as follows. Identify the range of costs of capital that a firm would use to accept and reject this project. NPV (Dollars) 400 300 200 100 0 -100 -200 0 2 4 6 8 10 12 14 16 18 20 COST OF CAPITAL (Percent) This NPV profile demonstrates that as the cost of capital increases, the project's NPVL decreases increases Cute Camel Woodcraft Company's WACC is 8%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): 25.52% 28.35% 22.68% 24.10% 4 If Cute Camel Woodcraft Company's managers select projects based on the MIRR criterion, they should this independent project. reject accept Which of the following statements best describes the difference between the IRR method and the MIRR method? The IRR method uses the present value of the initial investment to calculate the IRR. The MIRR method uses the terminal value of the initial investment to calculate the MIRR. The IRR method assumes that cash flows are reinvested at a rate of return equal to the IRR. The MIRR method assumes that cash flows are reinvested at a rate of return equal to the cost of capital The IRR method uses only cash inflows to calculate the IRR. The MIRR method uses both cash inflows and cash outflows to calculate the MIRR. The IRR evaluation method assumes that cash flows from the project are reinvested at the same rate equal to the RR. However, in reality the reinvested cash flows may not necessarily generate a return equal to the IRR. Thus, the modified IRR approach makes a more reasonable assumption other than the project's IRR. Consider the following situation: Cute Camel woodcraft Company is analyzing a project that requires an initial investment of $400,000. The project's expected cash flows are: Year Year 1 Year 2 Cash Flow $325,000 100,000 Year 3 Year 4 425,000 450,000 Cute Camel Woodcraft Company's WACC is 8%, and the project has the same risk as the firm's average project. Calculate this project's modified internal rate of return (MIRR): 25.52% 28.35% 22.68% 24.10% If Cute Camel Woodcraft Company's managers select projects based on the MIRR criterion, they should this independent project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts