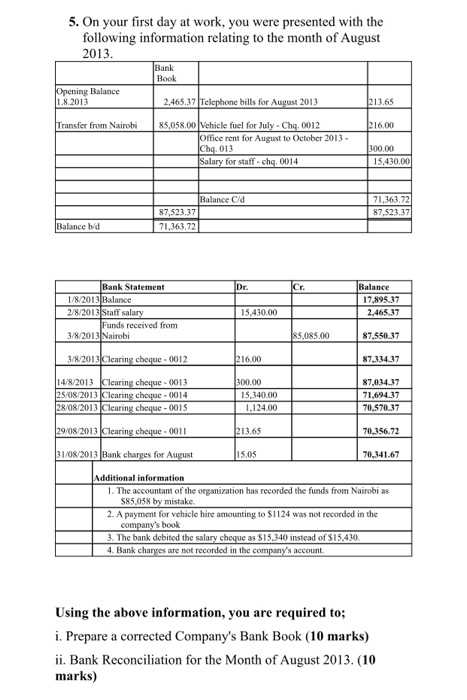

Question: 5. On your first day at work, you were presented with the following information relating to the month of August 2013. Opening Balance 1.8.2013

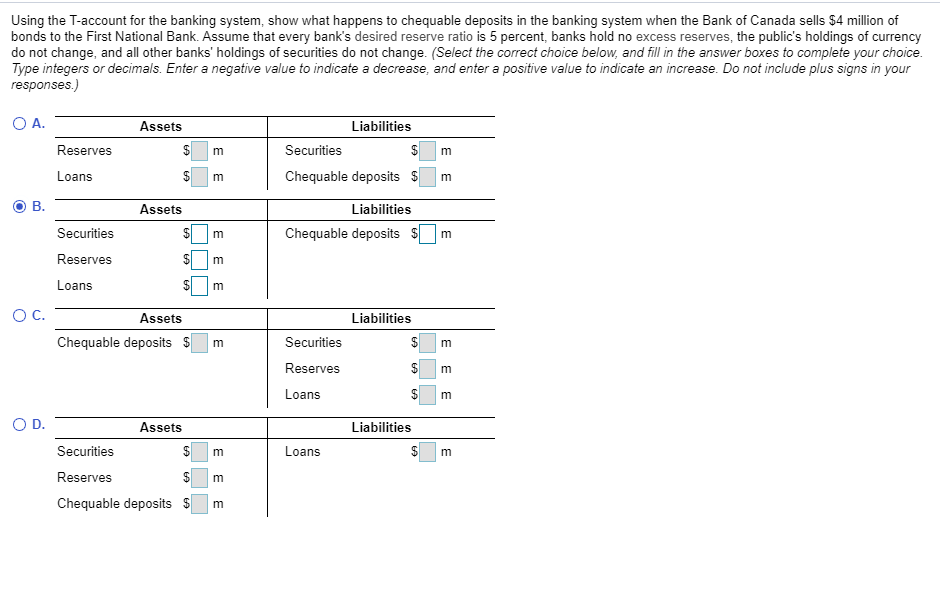

5. On your first day at work, you were presented with the following information relating to the month of August 2013. Opening Balance 1.8.2013 Transfer from Nairobi Balance b/d 1/8/2013 Balance 2/8/2013 Staff salary Bank Book 2,465.37 Telephone bills for August 2013 85,058.00 Vehicle fuel for July - Chq, 0012 Bank Statement 3/8/2013 Nairobi 87,523.37 71,363,72 Funds received from 3/8/2013 Clearing cheque - 0012 14/8/2013 Clearing cheque - 0013 25/08/2013 Clearing cheque - 0014 28/08/2013 Clearing cheque - 0015 29/08/2013 Clearing cheque - 0011 31/08/2013 Bank charges for August Office rent for August to October 2013- Chq. 013 Salary for staff - chq. 0014 Balance C/d Dr. 15,430.00 216.00 300.00 15,340.00 1,124.00 213.65 15.05 Cr. 85,085.00 213.65 216.00 300.00 3. The bank debited the salary cheque as $15,340 instead of $15,430. 4. Bank charges are not recorded in the company's account. 15,430,00 71,363.72 87,523.37 Balance 17,895.37 2,465.37 87,550.37 87,334.37 87,034.37 71,694.37 70,570.37 70,356.72 70,341.67 Additional information 1. The accountant of the organization has recorded the funds from Nairobi as $85,058 by mistake. 2. A payment for vehicle hire amounting to $1124 was not recorded in the company's book Using the above information, you are required to; i. Prepare a corrected Company's Bank Book (10 marks) ii. Bank Reconciliation for the Month of August 2013. (10 marks) Using the T-account for the banking system, show what happens to chequable deposits in the banking system when the Bank of Canada sells $4 million of bonds to the First National Bank. Assume that every bank's desired reserve ratio is 5 percent, banks hold no excess reserves, the public's holdings of currency do not change, and all other banks' holdings of securities do not change. (Select the correct choice below, and fill in the answer boxes to complete your choice. Type integers or decimals. Enter a negative value to indicate a decrease, and enter a positive value to indicate an increase. Do not include plus signs in your responses.) O A. B. O C. O D. Reserves Loans Securities Reserves Loans Assets Assets $ Assets m 69 m $ $ m m Assets Chequable deposits $ m 69 m Securities Reserves Chequable deposits $ m m m $ m Securities Chequable deposits $ m Liabilities Liabilities Chequable deposits $ m Securities Reserves Loans Loans Liabilities 69 Liabilities 69 m m m m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts