Question: 5. Palloca Abc QUESTION 4 (12 MARKS) Bb A AaB Bright Future Fund set up a new portfolio by buying 450 X shares for 83

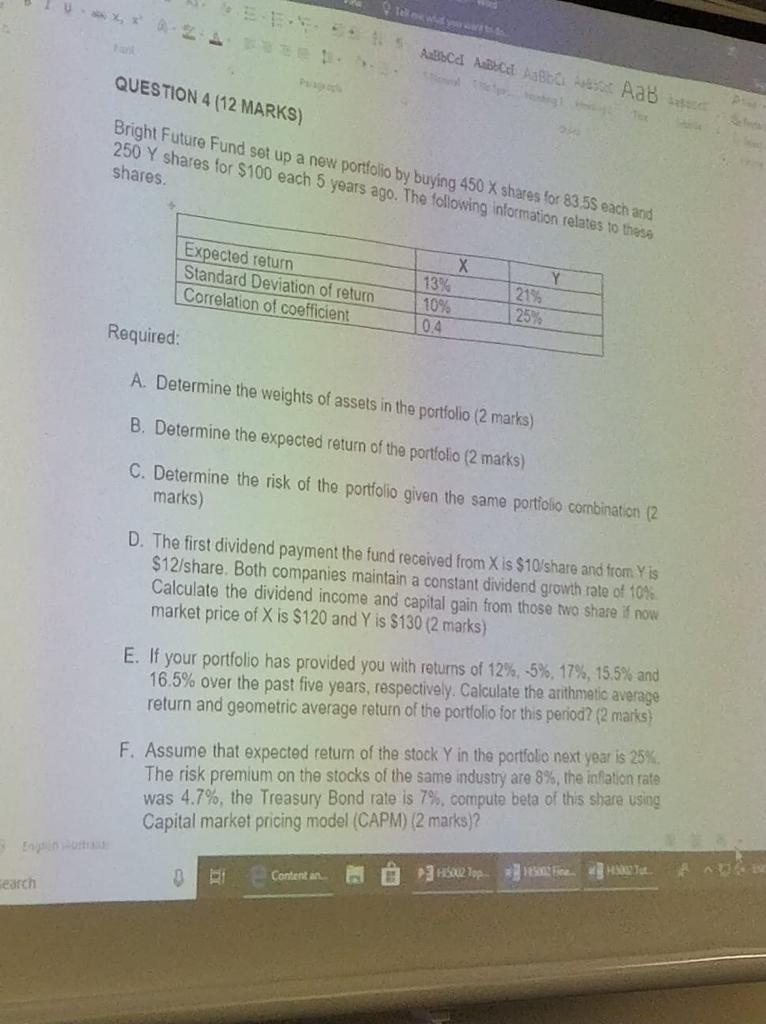

5. Palloca Abc QUESTION 4 (12 MARKS) Bb A AaB Bright Future Fund set up a new portfolio by buying 450 X shares for 83 5S each and 250 Y shares for $100 each 5 years ago. The following information relates to these shares. Expected return Standard Deviation of return Correlation of coefficient Required: A. Determine the weights of assets in the portfolio (2 marks) B. Determine the expected return of the portfolio (2 marks) C. Determine the risk of the portfolio given the same portfolio combination (2 marks) D. The first dividend payment the fund received from X is $10/share and from Yis $12/share. Both companies maintain a constant dividend growth rate of 10% Calculate the dividend income and capital gain from those two share if now market price of X is $120 and Y is $130 (2 marks) E. If your portfolio has provided you with returns of 12%, -5%, 17%, 15.5% and 16.5% over the past five years, respectively. Calculate the arithmetic average return and geometric average return of the portfolio for this period? (2 marks) F. Assume that expected return of the stock Y in the portfolio next year is 25% The risk premium on the stocks of the same industry are 8%, the inflation rate was 4.7%, the Treasury Bond rate is 7%, compute beta of this share using Capital market pricing model (CAPM) (2 marks)? earch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts