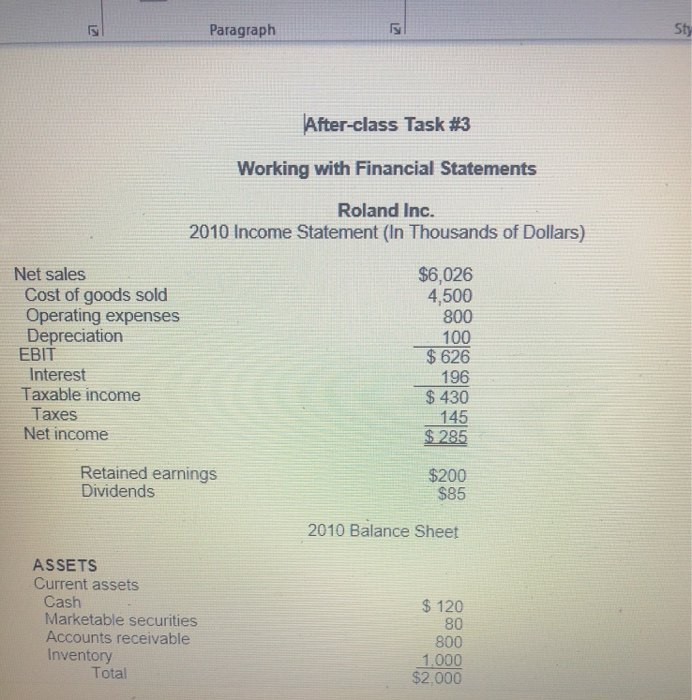

Question: 5 Paragraph 5 Sty After-class Task #3 Working with Financial Statements Roland Inc. 2010 Income Statement (In Thousands of Dollars) Net sales Cost of goods

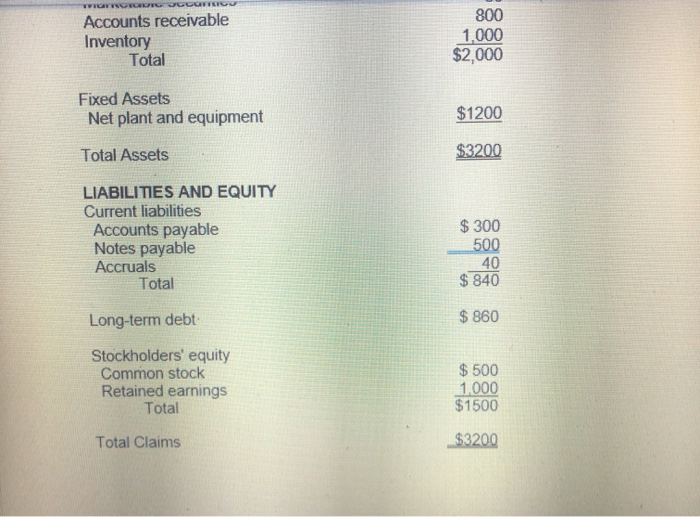

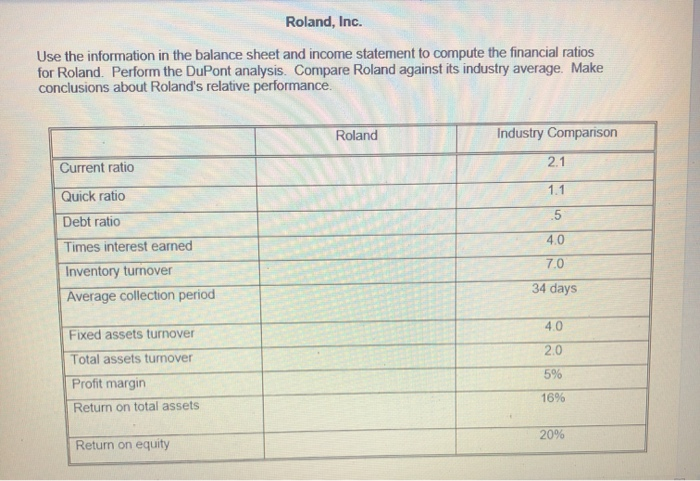

5 Paragraph 5 Sty After-class Task #3 Working with Financial Statements Roland Inc. 2010 Income Statement (In Thousands of Dollars) Net sales Cost of goods sold Operating expenses Depreciation EBIT Interest Taxable income Taxes Net income $6,026 4,500 800 100 $ 626 196 $ 430 145 $ 285 Retained earnings Dividends $200 $85 2010 Balance Sheet ASSETS Current assets Cash Marketable securities Accounts receivable Inventory Total $ 120 80 800 1.000 $2,000 WILDL Accounts receivable Inventory Total 800 1,000 $2,000 Fixed Assets Net plant and equipment $1200 Total Assets $3200 LIABILITIES AND EQUITY Current liabilities Accounts payable Notes payable Accruals Total $ 300 500 40 $ 840 Long-term debt $ 860 Stockholders' equity Common stock Retained earnings Total $ 500 1.000 $1500 Total Claims $3200 Roland, Inc. Use the information in the balance sheet and income statement to compute the financial ratios for Roland. Perform the DuPont analysis. Compare Roland against its industry average. Make conclusions about Roland's relative performance. Roland Industry Comparison Current ratio 2.1 1.1 Quick ratio .5 Debt ratio 4.0 70 Times interest earned Inventory turnover Average collection period 34 days 4.0 Fixed assets turnover 2.0 Total assets tumover 5% Profit margin 16% Return on total assets 20% Return on equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts