Question: 5. (Part 1) Using the formula for Put Call Parity, what combination can you make of options positions and the underlying to replicate a short

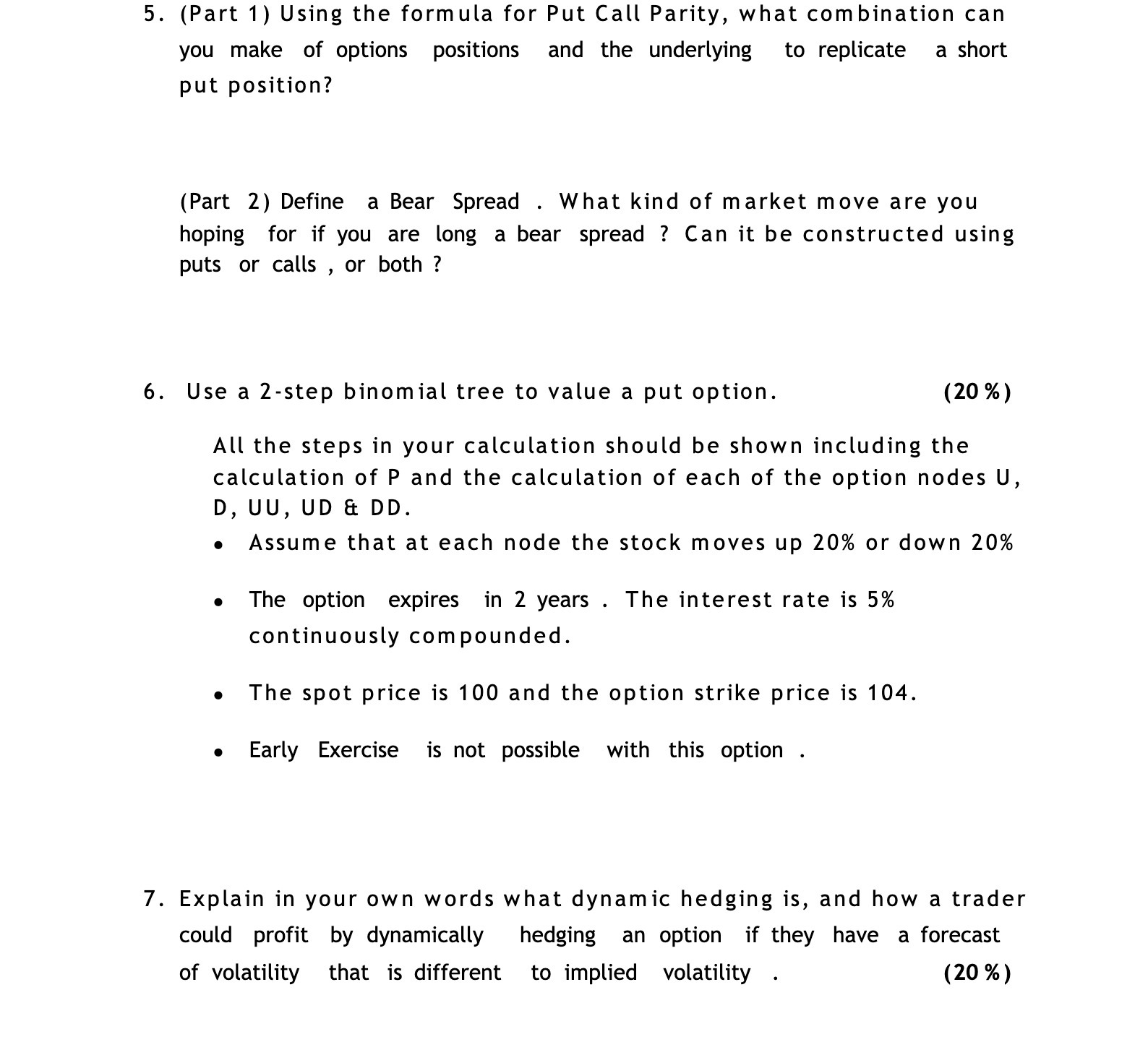

5. (Part 1) Using the formula for Put Call Parity, what combination can you make of options positions and the underlying to replicate a short put position? (Part 2) Define a Bear Spread . What kind of market move are you hoping for if you are long a bear spread ? Can it be constructed using puts or calls , or both ? 6. Use a 2-step binomial tree to value a put option. (20%) All the steps in your calculation should be shown including the calculation of P and the calculation of each of the option nodes U, D, UU, UD & DD. Assume that at each node the stock moves up 20% or down 20% The option expires in 2 years . The interest rate is 5% continuously compounded. The spot price is 100 and the option strike price is 104. Early Exercise is not possible with this option . 7. Explain in your own words what dynamic hedging is, and how a trader could profit by dynamically hedging an option if they have a forecast of volatility that is different to implied volatility . (20%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts