Question: 5 - part d - i . Robert started an accounting firm in Year 1 and organized as a partnership. Performance of services began on

part di

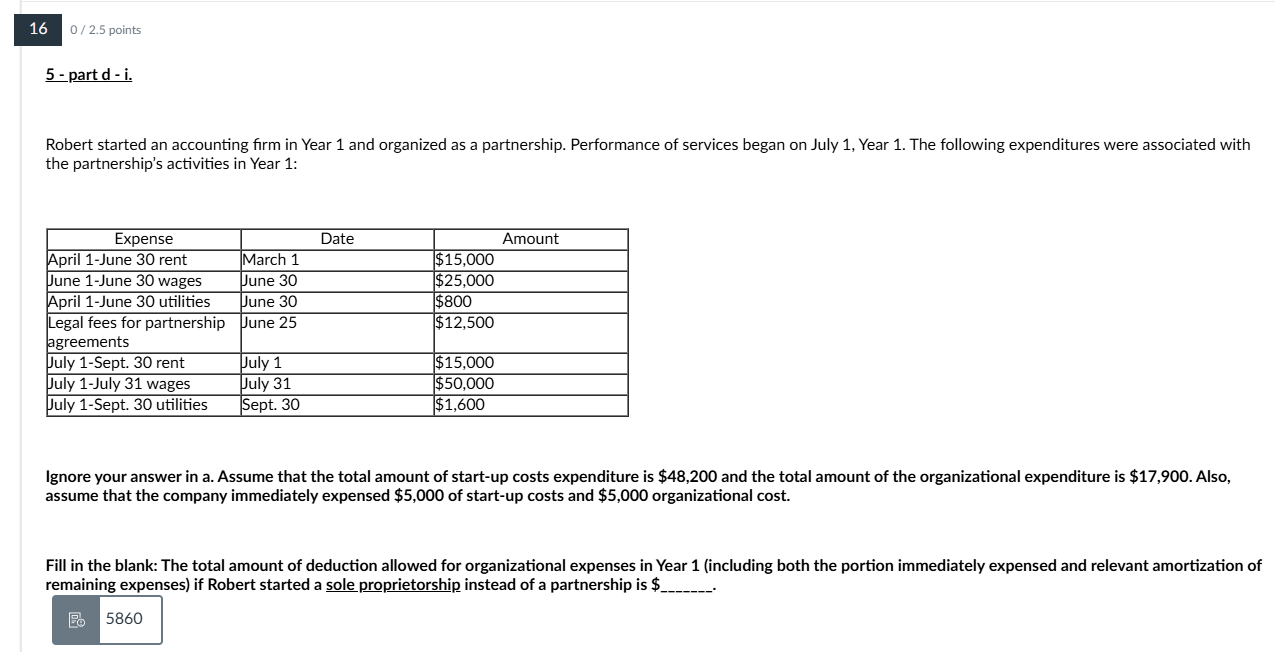

Robert started an accounting firm in Year and organized as a partnership. Performance of services began on July Year The following expenditures were associated with the partnership's activities in Year :Legal fees for partnership agreements

Ignore your answer in a Assume that the total amount of startup costs expenditure is $ and the total amount of the organizational expenditure is $ Also, assume that the company immediately expensed $ of startup costs and $ organizational cost.

Fill in the blank: The total amount of deduction allowed for organizational expenses in Year including both the portion immediately expensed and relevant amortization of remaining expenses if Robert started a sole proprietorship instead of a partnership is $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock