Question: 5 Pearson ACT - Sole Proprietorship - Google Chrome 0 X X A https://act.pearsoncmg.com/activity/1/4/1 Pea Accounting Cycle Tutorial Step 1: Account Balances OOO.OOO > AS

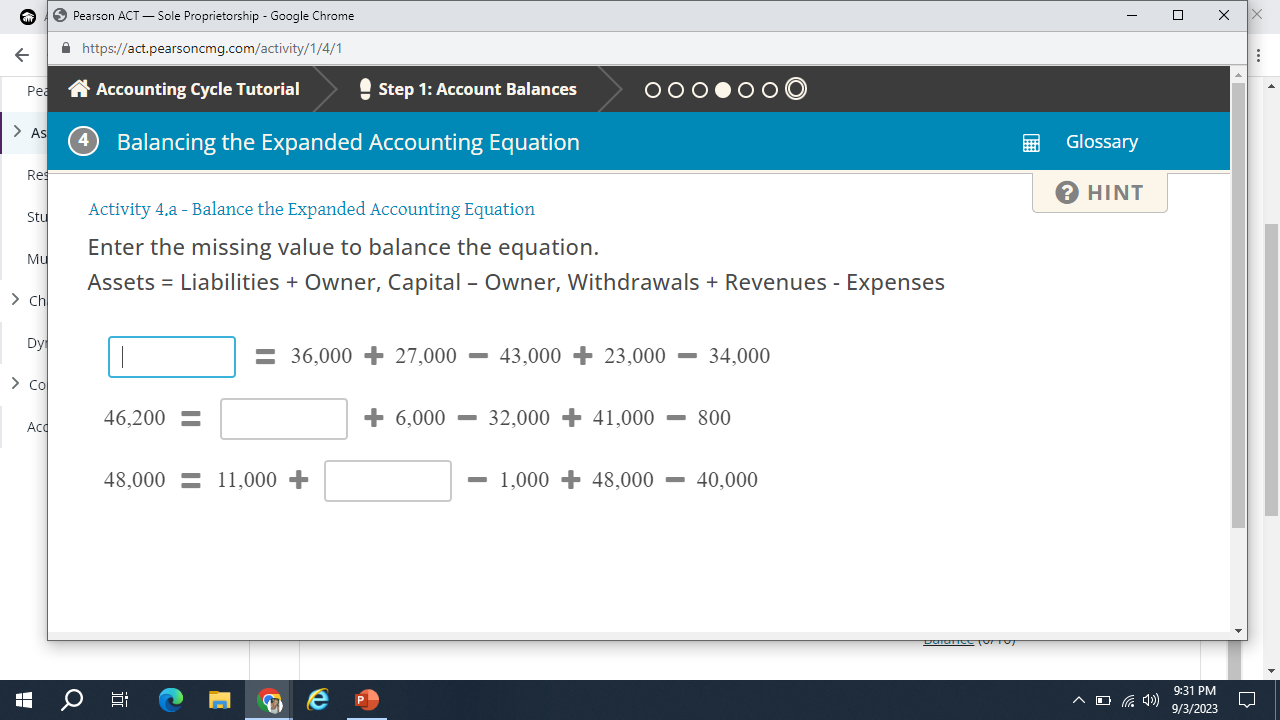

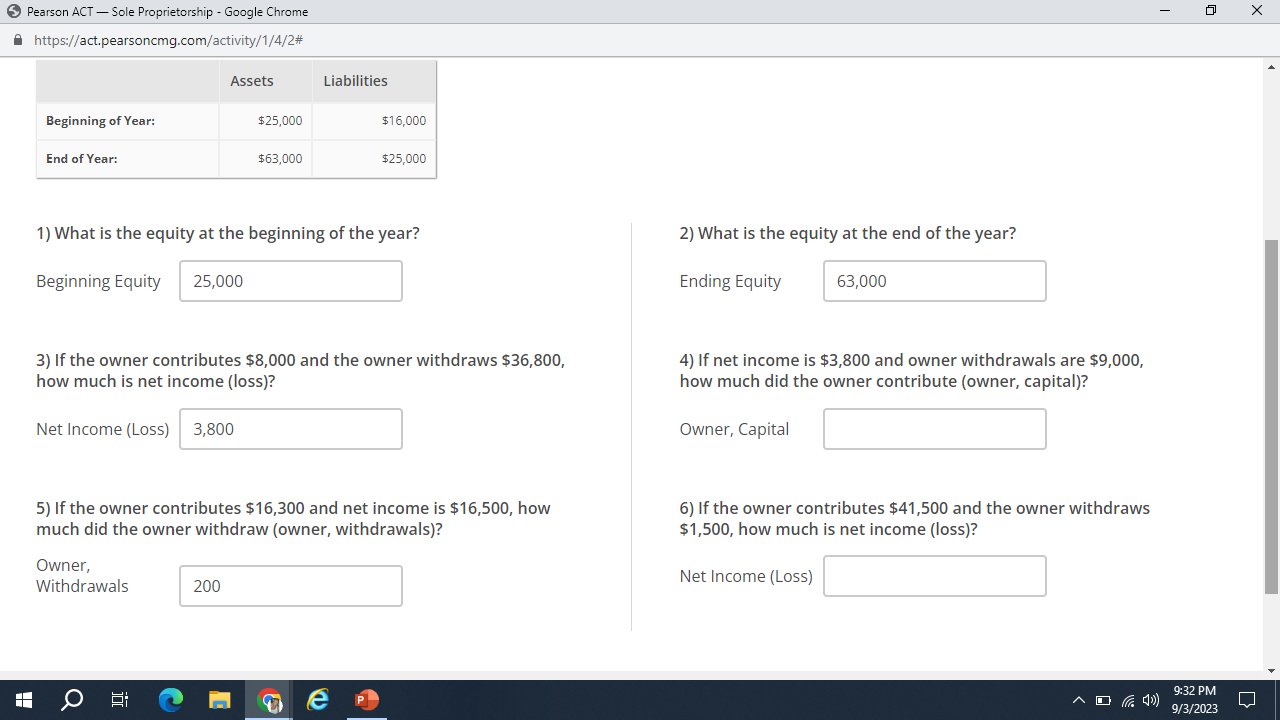

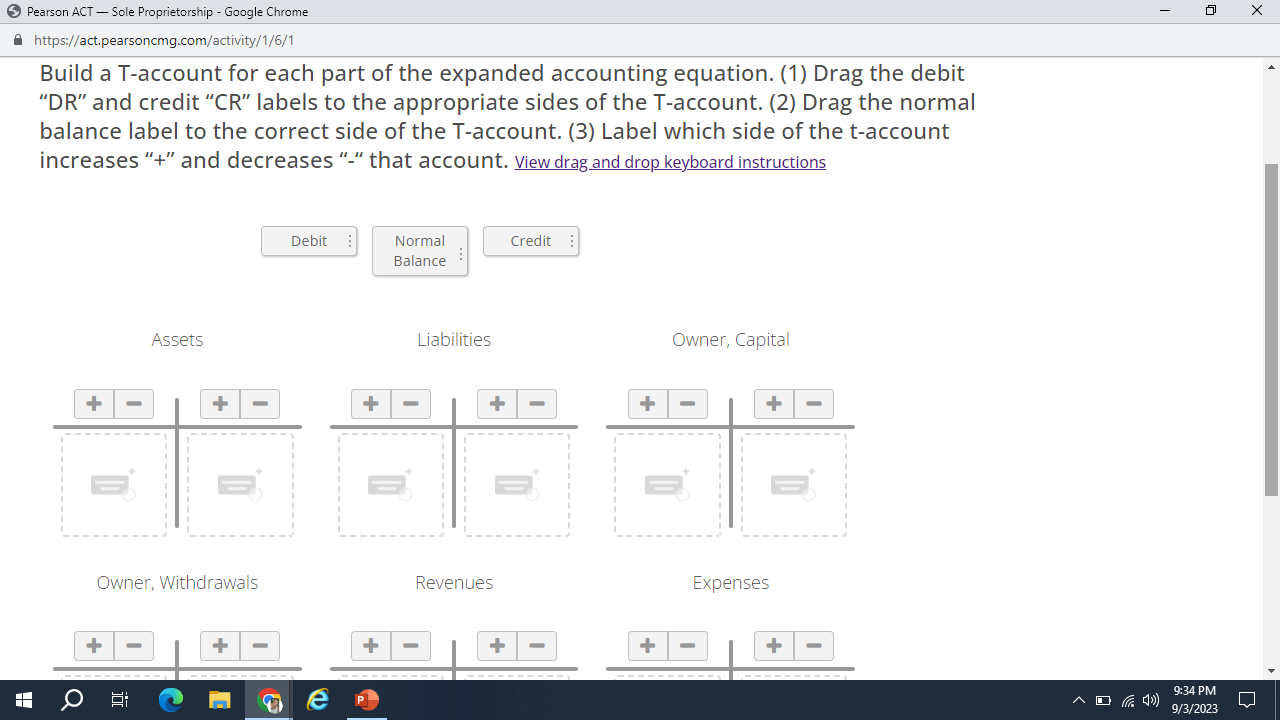

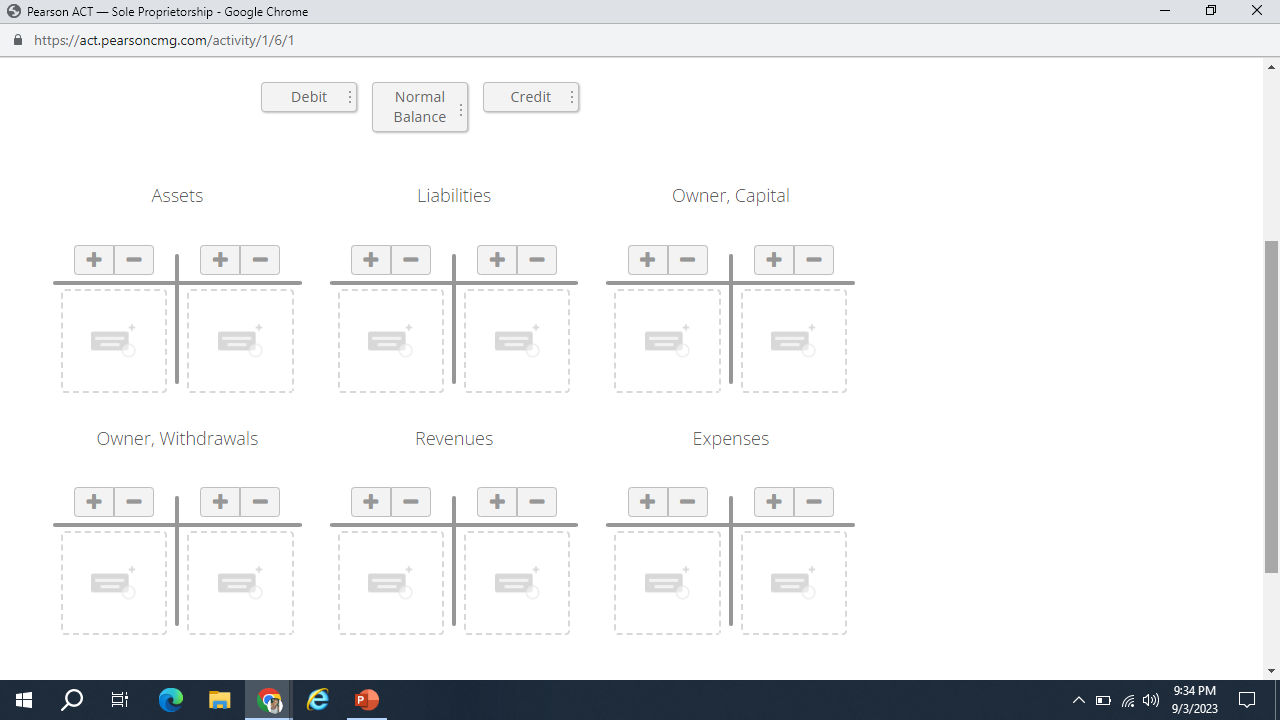

5 Pearson ACT - Sole Proprietorship - Google Chrome 0 X X A https://act.pearsoncmg.com/activity/1/4/1 Pea Accounting Cycle Tutorial Step 1: Account Balances OOO.OOO > AS 4 Balancing the Expanded Accounting Equation Glossary Re ? HINT Stu Activity 4.a - Balance the Expanded Accounting Equation Mu Enter the missing value to balance the equation. Assets = Liabilities + Owner, Capital - Owner, Withdrawals + Revenues - Expenses > ch Dy = 36,000 + 27,000 - 43,000 + 23,000 - 34,000 > Co Acd 46,200 = + 6,000 - 32,000 + 41,000 - 800 48,000 = 11,000 + - 1,000 + 48,000 - 40,000 O P 9:31 PM 9/3/2023Pearson ACT - Sole Proprietorship - Google Chrome X https://act.pearsoncmg.com/activity/1/4/2# Assets Liabilities Beginning of Year: $25,000 $16,000 End of Year: $63,000 $25,000 1) What is the equity at the beginning of the year? 2) What is the equity at the end of the year? Beginning Equity 25,000 Ending Equity 63,000 3) If the owner contributes $8,000 and the owner withdraws $36,800, 4) If net income is $3,800 and owner withdrawals are $9,000, how much is net income (loss)? how much did the owner contribute (owner, capital)? Net Income (Loss) 3,800 Owner, Capital 5) If the owner contributes $16,300 and net income is $16,500, how 6) If the owner contributes $41,500 and the owner withdraws much did the owner withdraw (owner, withdrawals)? $1,500, how much is net income (loss)? Owner, Withdrawals 200 Net Income (Loss) P 9:32 PM 9/3/2023Pearson ACT - Sole Proprietorship - Google Chrome X https://act.pearsoncmg.com/activity/1/6/1 Build a T-account for each part of the expanded accounting equation. (1) Drag the debit "DR" and credit "CR" labels to the appropriate sides of the T-account. (2) Drag the normal balance label to the correct side of the T-account. (3) Label which side of the t-account increases "+" and decreases "-" that account. View drag and drop keyboard instructions Debit Normal Credit . . . . . . Balance Assets Liabilities Owner, Capital + + Owner, Withdrawals Revenues Expenses O Eli e P 9:34 PM 9/3/2023Pearson ACT - Sole Proprietorship - Google Chrome X https://act.pearsoncmg.com/activity/1/6/1 Debit Normal Credit Balance Assets Liabilities Owner, Capital + + Owner, Withdrawals Revenues Expenses 9:34 PM P 9/3/2023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts