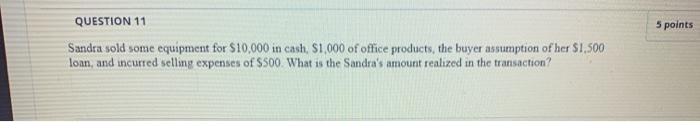

Question: 5 points QUESTION 11 Sandra sold some equipment for $10,000 in cash, $1.000 of office products, the buyer assumption of her $1.500 loan, and incurred

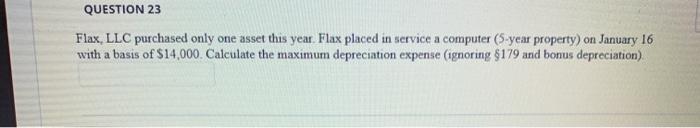

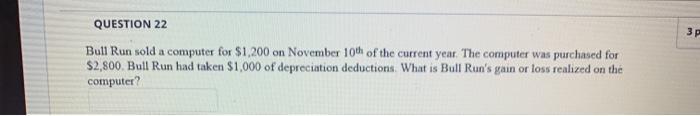

5 points QUESTION 11 Sandra sold some equipment for $10,000 in cash, $1.000 of office products, the buyer assumption of her $1.500 loan, and incurred selling expenses of $500 What is the Sandra's amount realized in the transaction? QUESTION 23 Flax, LLC purchased only one asset this year. Flax placed in service a computer (5-year property) on January 16 with a basis of $14,000. Calculate the maximum depreciation expense (ignoring $179 and bonus depreciation) 3 QUESTION 22 Bull Run sold a computer for $1,200 on November 107 of the current year. The computer was purchased for $2,800 Bull Run had taken $1,000 of depreciation deductions. What is Bull Run's gain or loss realized on the computer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts