Question: 5 points Save Answer Calculating 'Cash flows at the start' Dreamtime Jewellers Limited (DJL) is a small network of jewellery stores and DJL is considering

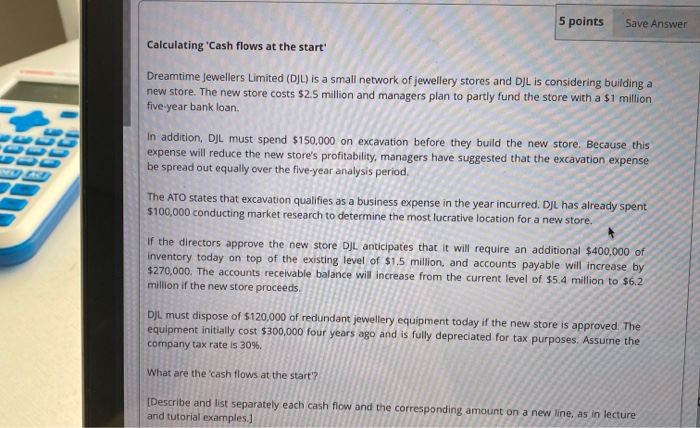

5 points Save Answer Calculating 'Cash flows at the start' Dreamtime Jewellers Limited (DJL) is a small network of jewellery stores and DJL is considering building a new store. The new store costs $2.5 million and managers plan to partly fund the store with a $1 million five-year bank loan In addition, DJL must spend $150,000 on excavation before they build the new store. Because this expense will reduce the new store's profitability, managers have suggested that the excavation expense be spread out equally over the five-year analysis period. The ATO states that excavation qualifies as a business expense in the year incurred: DJL has already spent $100,000 conducting market research to determine the most lucrative location for a new store, If the directors approve the new store DJL anticipates that it will require an additional $400,000 of inventory today on top of the existing level of $1.5 million, and accounts payable will increase by $270,000. The accounts receivable balance will increase from the current level of $5.4 million to $6.2 million if the new store proceeds. DJL must dispose of $120,000 of redundant jewellery equipment today if the new store is approved. The equipment initially cost $300,000 four years ago and is fully depreciated for tax purposes. Assume the company tax rate is 30%. What are the cash flows at the start? [Describe and list separately each cash flow and the corresponding amount on a new line, as in lecture and tutorial examples.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts