Question: 5. (Practice Set 4, part 2, #3) Big Oil Inc. owns a lease to extract crude oil from sea. It is considering the construction of

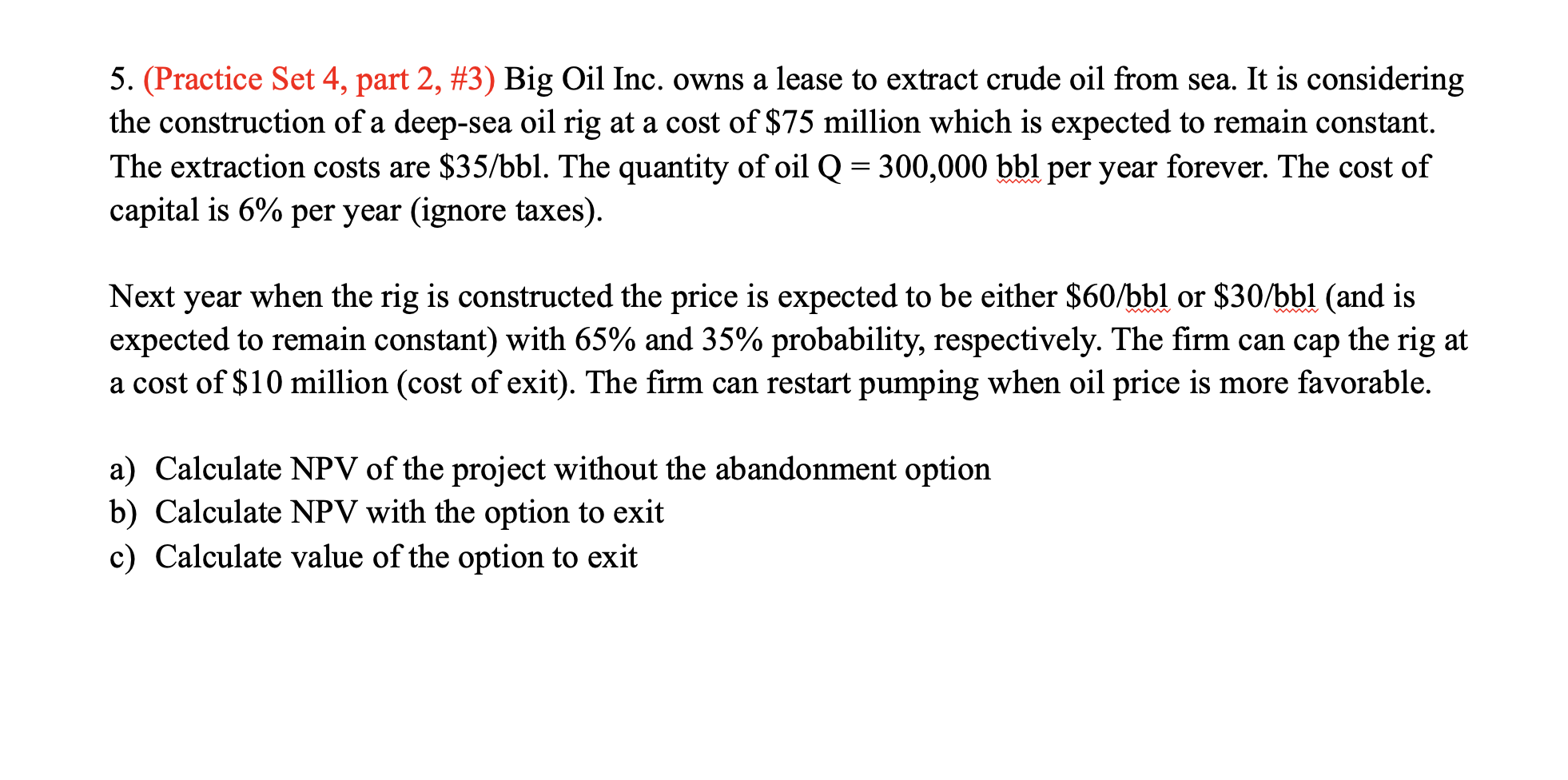

5. (Practice Set 4, part 2, #3) Big Oil Inc. owns a lease to extract crude oil from sea. It is considering the construction of a deep-sea oil rig at a cost of $75 million which is expected to remain constant. The extraction costs are $35/bbl. The quantity of oil Q = 300,000 bbl per year forever. The cost of capital is 6% per year (ignore taxes). Next year when the rig is constructed the price is expected to be either $60/bbl or $30/bbl (and is expected to remain constant) with 65% and 35% probability, respectively. The firm can cap the rig at a cost of $10 million (cost of exit). The firm can restart pumping when oil price is more favorable. a) Calculate NPV of the project without the abandonment option b) Calculate NPV with the option to exit c) Calculate value of the option to exit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts