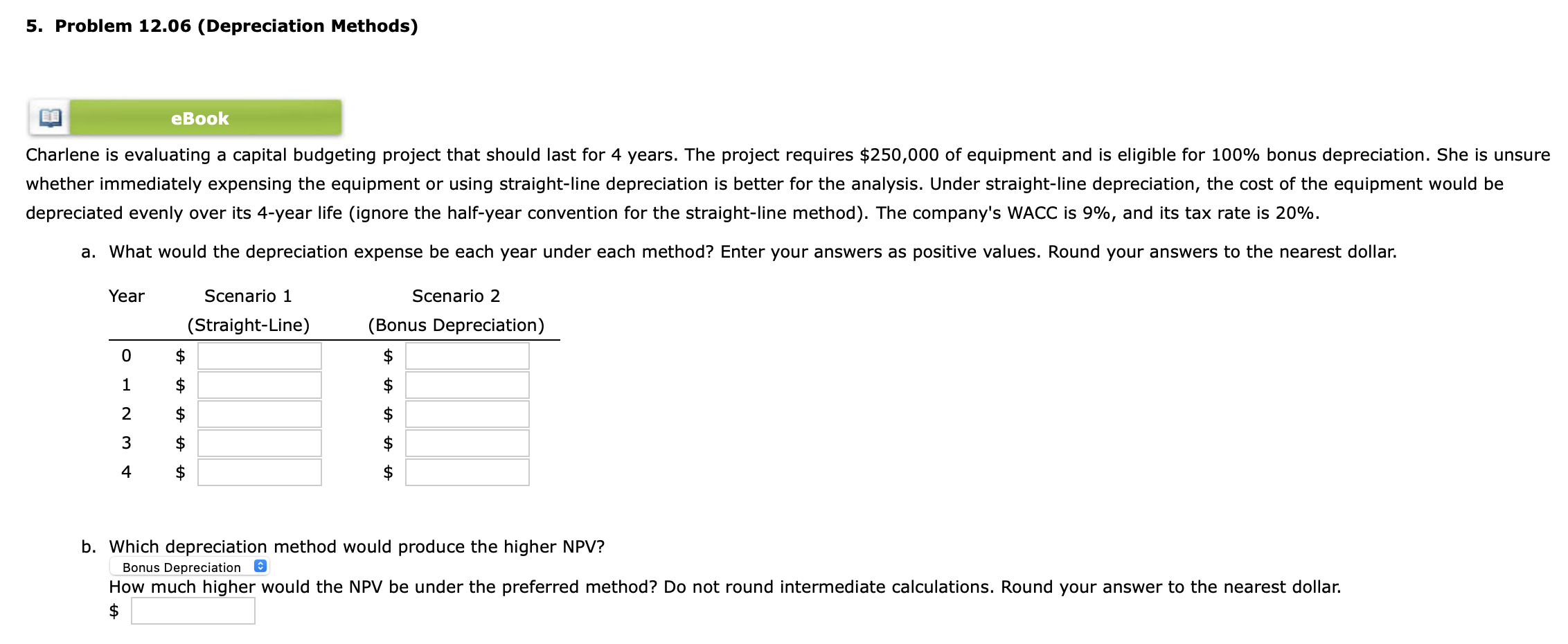

Question: 5. Problem 12.06 (Depreciation Methods) depreciated evenly over its 4-year life (ignore the half-year convention for the straight-line method). The company's WACC is 9%, and

5. Problem 12.06 (Depreciation Methods) depreciated evenly over its 4-year life (ignore the half-year convention for the straight-line method). The company's WACC is 9%, and its tax rate is 20%. b. Which depreciation method would produce the higher NPV? Bonus Depreciation How much higher would the NPV be under the preferred method? Do not round intermediate calculations. Round your answer to the nearest dollar. $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock