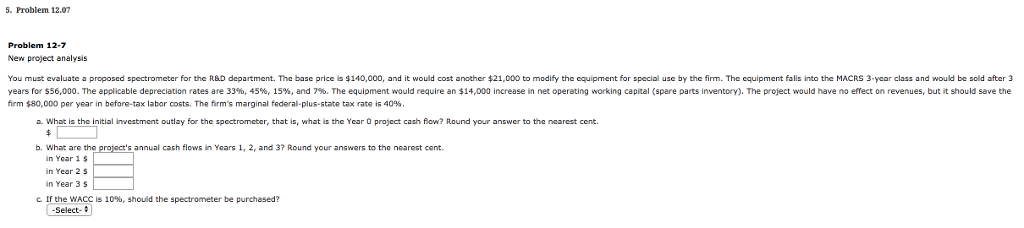

Question: 5. Problem 12.07 Problem 12-7 New project analysis another $21,000 t You must evaluate proposed spectrometer for the R&D department. The base price s140,000, and

5. Problem 12.07 Problem 12-7 New project analysis another $21,000 t You must evaluate proposed spectrometer for the R&D department. The base price s140,000, and it would cost another $21,000 to modify the equipment for special use by the firm. The equipment falls into the MACRS 3-year class and would be sold after 3 years fo S56,000. The applicable depreciation ates are 33 45% 15% and 79 The equipment would equire an 14,000 increase in net operating o king capital spare parts inventory The pro ect would have no effect on even es, but it should save the firm $80,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 40% parts inventory).The project wo would have no en3 ye a. What is the initial investment outlay for the spectrometer, that is, what is the Year 0 project cash flow? Round your answer to the nearest cent b. Whatare the annual cash flows in Years 1, 2, and 37 Round your answers to the nearest cent. in Year 1 in Year 2 s in Year 3 s If the WACC is 10%, should the spectrometer be purchased? Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts