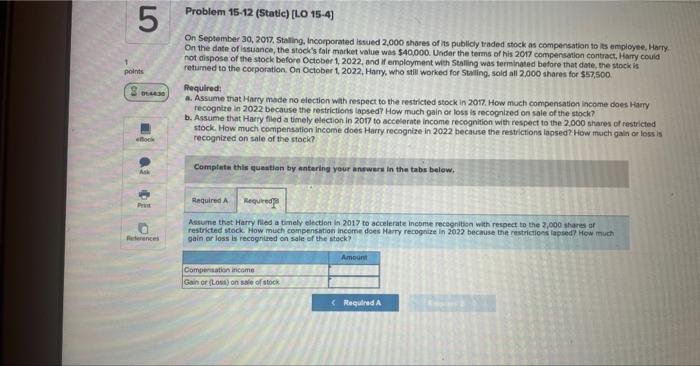

Question: #5 Problem 15-12 (Static) [LO 15-4] On September 30, 207, Salling. Incomporated issued 2,000 shares of its publichy traded stock as compensation to its enployee,

![#5 Problem 15-12 (Static) [LO 15-4] On September 30, 207, Salling. Incomporated](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e8acf43df5a_65966e8acf3c1316.jpg)

Problem 15-12 (Static) [LO 15-4] On September 30, 207, Salling. Incomporated issued 2,000 shares of its publichy traded stock as compensation to its enployee, Harry On the date of issuance, the stock's fair market value was $40,000. Under the terms of his 2017 compensation contract, Harmy couild not dispose of the stock before October 1, 2022, and if employment with Stalling was terninated before that date, the stock is retumed to the corporation, On October 1,2022, Harry, whe stil wocked for 5 talling, sold all 2,000 shares for $57,500. Required: a. Assiene that Harry made no election with respect to the restricted stock in 2017 . How much compensation income does Hasry recognize in 2022 because the restrictions lapsed? How much gain ar loss is recognited on sale of the stock? b. Assume that Harry flied a timely election in 2017 to accelerate income recognition with respect to the 2.000 shares of restricted stock. How much compensation income does Harry recognize in 2022 because the restrictions lapsed? How much gain or iass is recognized on sale of the stack? Complete this question by entering your answers in the tabs below. Assume that Harry made no election with respect to the nestricted stock in 2017 . How much cumpersation income does Harty recognire in 2022 because the restrictions tappedr How much gain or loss is recogntaes en sale of the stock? Problem 1512 (5tatic) [LO 15-4] On September 30, 20m, Staling, Incorporated istued 2,000 shares of its publicly traded stock as compensation to its employee, Harry. On the date of issuance, the stock's folr market value wes $40.000 Under the terms of his 2017 compersation contract, Hayry couid not dispose of the stock before October 1, 2022, and if employment with Sealling was terminated before that dote, the stock is retumed to the corporation. On October 1,2022, Hamy, who still worked for Staling. sold all 2,000 shares for $57,500. Pecpulredt a. Assume that Harcy mace no election wah respect to the restricted stock in 2017. How much compensation income does Hamy recognite in 2022 because the restrictions lapsed? How much gain or loss is recognized on sale of the stock? b. Assume that Haery filed a timely election in 2017 to accelerate income recegnition with respect to the 2.000 shares of restricted stock. How much compensytion income does Harry recognize in 2022 because the restrictions lapsed? How much gain or loss is recognized on sale of the stock? Compteti this queation by antering your answern in the tabs below. Assume thot Harry filied a timely election in 2017 to accelerate incomine recegnitisn with respect to the 2,000 share of restricted stock. How much compensation incorne does Harry recognize in 2022 because the restrictions lapsed How much gain or loss is recognised on sale of the stack

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts