Question: 5 Problem 2-1A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2 Karla Tanner opens a Web consulting business

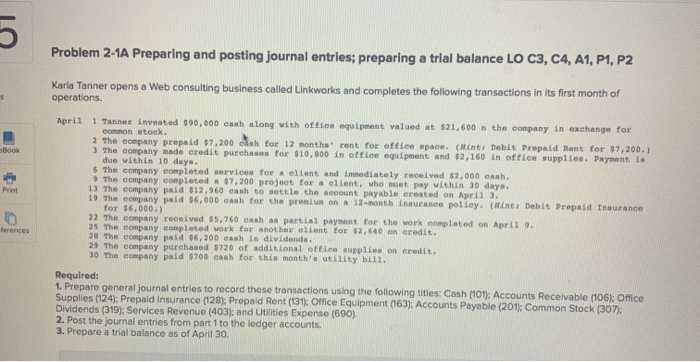

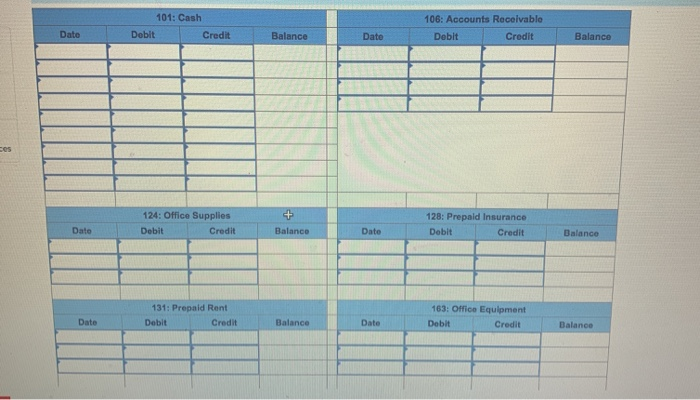

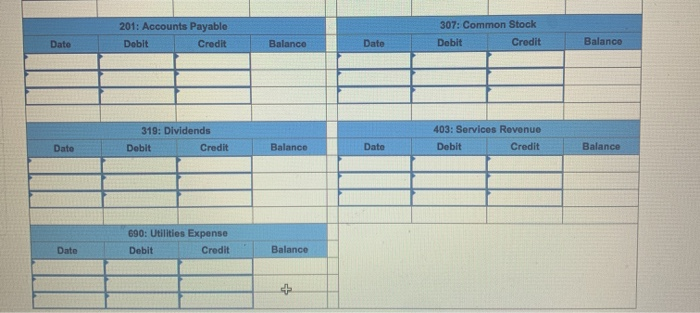

5 Problem 2-1A Preparing and posting journal entries; preparing a trial balance LO C3, C4, A1, P1, P2 Karla Tanner opens a Web consulting business called Linkworks and completes the following transactions in its first month of operations. April Book Print 1 Tanner invested $90,000 cash along with office equipment valued at $21,600 n the company in exchange for common stock 2. The company prepaid $7,200 ah for 12 months' rent for office space. (Hint: Debit Prepaid Rent for $7,200.) 3 The company made credit purchases for $10,800 in office equipment and $2,160 in office supplies. Payment is due within 10 days. 6. The company completed services for a client and immediately received $2,000 cash. The company completed a $7,200 project for a client, who must pay within 30 days. 13 The company paid $12,960 cash to settle the account payable created on April 3. 19 The company paid $6,000 cash for the prentun on a 12-month indurance policy. (int Debit Prepaid Insurance for $6,000.) 22 The company received $5,760 cash as partial payment for the work completed on April 9. 25 The company completed work for another client for $2,640 on credit. 28 The company paid $6,200 canh in dividends. 29 The company purchased $720 of additional office supplies on credit. 30 The company paid $700 cash for this month's stility bill. ferences Required: 1. Prepare general Journal entries to record these transactions using the following titles: Cash (101): Accounts Receivable (106): Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131): Office Equipment (163); Accounts Payable (201); Common Stock (307): Dividends (319)Services Revenue (403); and Utilities Expense (690). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of April 30. 101: Cash Dobit Credit 106: Accounts Receivable Debit Credit Date Balance Date Balance 124: Office Supplies Debit Credit 128: Prepaid Insurance Dobit Credit Date Balance Dato Balance 131: Prepaid Rent Debit Credit 163: Office Equipment Debit Credit Date Balance Date Balance 201: Accounts Payable Dobit Credit 307: Common Stock Debit Credit Date Balance Date Balanco 319: Dividends Debit Credit 403: Services Revenue Debit Credit Date Balance Date Balance 690: Utilities Expense Debit Credit Date Balance +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts