Question: 5 pts D Question 26 This is the cap table for a startup AFTER two rounds of financing (After Series A and Series B) by

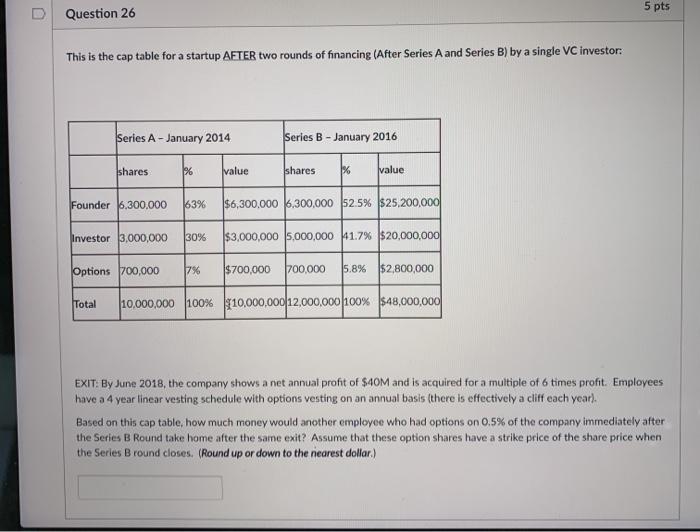

5 pts D Question 26 This is the cap table for a startup AFTER two rounds of financing (After Series A and Series B) by a single VC investor: Series A - January 2014 Series B - January 2016 shares % value shares % value Founder 6.300.000 63% $6,300,000 1,300,000 52.5% $25,200,000 Investor 3,000,000 30% $3,000,000 5,000,000 1.7% $20,000,000 Options 700,000 17% $700,000 700,000 $5.8% $2,800,000 Total 10,000,000 100% 110,000,000 12,000,000|100% $48,000,000 EXIT: By June 2018, the company shows a net annual profit of $40M and is acquired for a multiple of 6 times profit. Employees have a 4 year linear vesting schedule with options vesting on an annual basis (there is effectively a cliff each year). Based on this captable, how much money would another employee who had options on 0.5% of the company immediately after the Series B Round take home after the same exit? Assume that these option shares have a strike price of the share price when the Series Bround closes. (Round up or down to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts