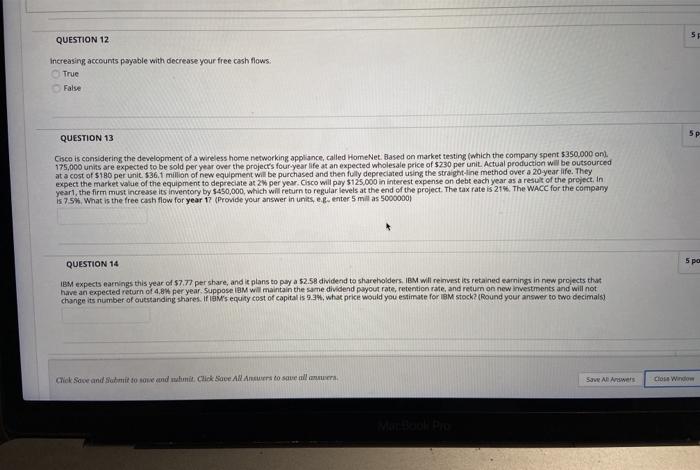

Question: 5 QUESTION 12 Increasing accounts payable with decrease your free cash flows. True False QUESTION 13 5P Cisco is considering the development of a wireless

5 QUESTION 12 Increasing accounts payable with decrease your free cash flows. True False QUESTION 13 5P Cisco is considering the development of a wireless home networking appliance, called HomeNet. Based on market testing (which the company spent $350,000 oni 175,000 units are expected to be sold per year over the project's four year life at an expected wholesale price of $230 per unit. Actual production will be outsourced at a cost of $180 per unit. $36.1 million of new equipment will be purchased and then fully depreciated using the straight-line method over a 20-year life. They expect the market value of the equipment to depreciate at 2 per year. Cisco will pay $125,000 in interest expense on debt each year as a result of the project. In year, the firm must increase its inventory by $450,000, which will return to regular levels at the end of the project. The tax rate is 21%. The WACC for the company is 75% What is the free cash flow for year 17 (Provide your answer in units, e..enter 5 millas 5000000) QUESTION 14 5 po IBM expects earnings this year of 57.77 per share, and it plans to pay a 52.58 dividend to shareholders. IBM will reinvestits retained earnings in new projects that have an expected return of 4.8 per year. Suppose IBM will maintain the same dividend payout rate, retention rate, and return on new investments and will not change its number of outstanding shares. M's equity cost of capital is 9.3, what price would you estimate for IBM stock? (Round your answer to two decimals) Chick Save and submit to one and whit. Click Save All Ancesto save me Sve Alwers Close Window

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts